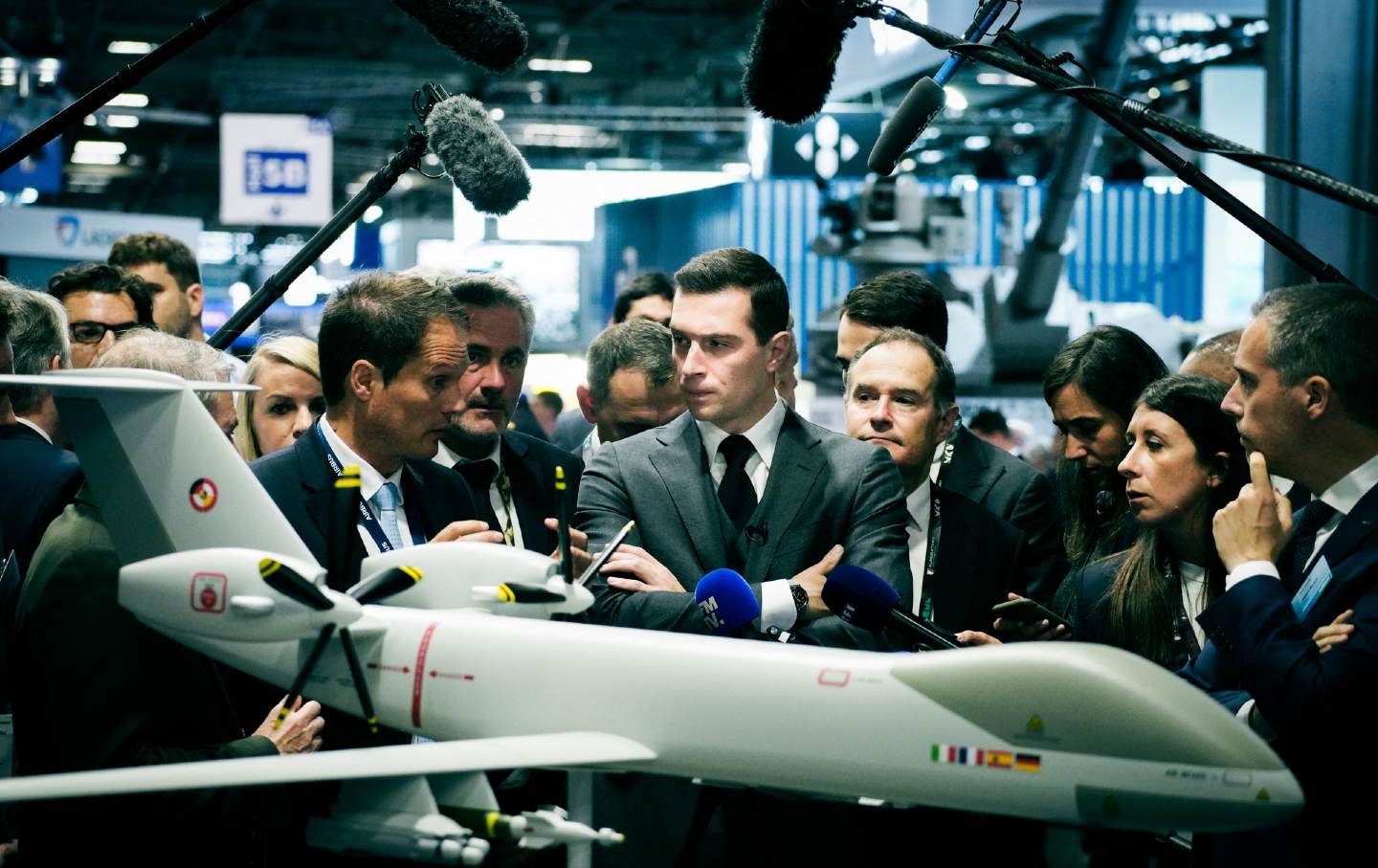

Meet the Global Arms Sellers

A dispatch from the largest weapons expo outside of Paris.

Between June 17 and June 21, the who’s-who in the global weapons industry flocked to the biannual Eurosatory expo just north of Paris. Billed as the largest trade fair of its kind, Eurosatory attracts over 60,000 attendees, including upwards of 250 national delegations and some 2,000 firms, organizations, and contractors to the sprawling Villepinte convention center. It’s the place where people who make military-grade guns hang out with people who buy them—whether that’s Rheinmetall’s main battle tank, the Leopard, or the Caesar motorized artillery ordinance from KNDS France. The small-arms category has the market’s full spread of assault rifles, snipers, and handguns and any military or adjacent accessory imaginable. Armored vehicles come in their standard-issue paint coat or draped in alternative camouflage for deserts and snowy woodlands. There are tele-controlled micro-vehicles, howitzers, mortars, armor piercing shells, and state-of-the-art surveillance and electronic warfare technology.

The MICA missile is produced by MBDA, a European consortium co-owned by Airbus, Britain’s BAE Systems, and Italian manufacturer Leonardo. A short-range “fire-and-forget” missile—it carries its own homing device, making it autonomous post-launch—the MICA delivers a 12-kilogram payload in a 20-kilometer radius. Versatile, and with all-weather capabilities, it can be fired from a naval vessel for sea-to-air missions, or delivered from the multipurpose Rafale jet, the marquee product of the French defense industry, by Dassault Aviation. Next to the missile podium, however, was the MICA’s ground-based vertical-launching (VL) system: a hulking truck called a Tactical Operations Center, or TOC, equipped with radars and multiple launch cylinders. It’s the VL-MICA that will be deployed for the 2024 Paris Olympics, fending off any aerial threats to the summer games.

Little actual dealmaking takes place at Eurosatory, which seems mostly about nurturing ties and scoping out potential interest. Yet when one MBDA sales rep said the MICA has “the biggest warhead on the market,” the delegation from the Congolese military seemed impressed. It was probably sales talk: The market for air defense technology ranges from shoulder-launched projectiles and jet-mounted missiles to behemoth anti-ballistic systems.

You can judge a company’s place in the industry pecking order by the size of their stand, with the largest and best-connected firms welcoming visitors to sprawling pavilions. The French group Thales is a European leader in high-grade electrical systems, security-oriented artificial intelligence, and surveillance technologies. A Thales radar, for example, can be mounted on MBDA’s VL-MICA; or their anti-submarine sonar systems on Lockheed Martin naval helicopters.

The investigative outlet Disclose revealed last week that Thales has continued to supply electronic components to Israeli drone manufacturers, including the Hermes 900, which was used in the bombing of Gaza. Thales’s most recent delivery was scheduled for late May 2024, with the approval of the French state, which holds a quarter stake in the company. The French government did order that Israeli firms be banned from this year’s Eurosatory, before a tribunal issued a stay on June 18. Until an Amnesty International complaint had them removed, models of cluster munitions were on full display by a Korean contractor. France is a signatory to the convention banning the weapon.

But details like these seemed to be on few minds at Eurosatory. Outside Thales’s invite-only exposition hall, a French officer in full regalia handed off the Qatari delegation to the firm’s representatives. “As-salamu alaykum,” or “Peace be upon you,” the execs said in their best Arabic.

For all the backslapping at this year’s expo, the global arms industry is currently engaged in what Aymeric Elluin, an arms control expert at Amnesty International, calls a “full-fledged economic war.” According to the latest data from the Stockholm International Peace Research Institute (SIPRI), global military spending grew by 6.8 percent in 2023 to hit $2.4 trillion—the largest global increase since 2009 and the ninth year of consecutive expansion. But the changing nature of military doctrine—a new vogue for great-power conflict versus an earlier trend for “asymmetric” warfare—is shaking up the race for market share.

Last year saw average spending increases across all five geographical regions measured by SIPRI (also a first since 2009). Although several subregions posted small declines, the world’s hot spots and usual suspects carried the average: US spending rose to hit $916 billion, still larger than the sum of the nine other countries in the top 10. In Asia and Oceania, Chinese growth also swelled the data, rising by 6 percent year over year. In a race to catch up, Japan’s military budget ballooned by 11 percent, the largest rise since 1972. After Africa, which saw the largest regional year-over-year growth, expanding by 22 percent, Europe came in second, with military spending growing by 10 percent as states rush to compensate for a post–Cold War stagnation in procurements and investments. The Middle East also saw a 9 percent rise, with Israel increasing its military spending by 24 percent, mostly since October 7.

Orders are coming in so fast in fact that firms are struggling to keep up. As the Financial Times reported on June 16, the industry has not been hiring at such a pace since the end of the Cold War. Despite the surge in demand, average revenue for SIPRI’s top-100 index of military suppliers bizarrely declined in 2023, like in 2022—mostly on account of depressed revenues facing some US and European suppliers, in part caused by inflation and supply-chain bottlenecks.

But the shift is also due to changes in the marketplace benefiting companies further down the technological food chain. The increase in what SIPRI calls “high-intensity” and “major armed” conflicts means that some of the big drivers of growth are in low-grade hardware like small arms, artillery, and munitions. This shift has destabilized an industry that had geared itself in recent decades toward specialized and ultra-sophisticated technology.

“It’s a little unclear who’s going to win out,” says William Hartung, a researcher at the Quincy Institute, of the recent shifts in the arms industry. “There’s one element that says, ‘To confront China we need swarms of drones and AI-driven weapons and a new generation of tech stuff out of Silicon Valley.’ But then people point to Ukraine and say, ‘This is a bread-and-butter war built on artillery.’… There’s a bit of competition between these two elements of the industry.”

These tensions have been particularly acute in Europe. “Europeans are confronted with two anxieties right now,” says Elluin. “To respond to the Russian war effort, European industries are not scaled and configured to produce as many munitions as required.” With continental manufacturers unable to respond to demand this past winter, and hesitant to dip further into strained national stocks, European states had to put forward the money to acquire shells for Ukraine from non-EU suppliers. This is amplifying a second fear facing the bloc’s arms industry, namely a relative lack of scale, especially compared with persistent domination of US firms who even before exports can count on a generous foundation from Pentagon acquisitions. Meanwhile, competitors from countries like Turkey and South Korea are consolidating a foothold in the global market.

Europe’s concerns are also symptomatic of strategic disagreements within the bloc. Some EU states are eager to use defense procurements—Poland’s tranche of F-35s are nearing completion at Lockheed Martin’s Texas assembly line—as a means of enticing the United States to stay committed to European defense. “In Europe now, there’s a little bit of a bias towards buying US,” said Hartung. “I used to know an arms lobbyist who said, ‘When you buy an American weapon, you’re not just buying a weapon, you’re buying a relationship with America.’”

US commercial success has frustrated French President Emmanuel Macron’s call for EU “strategic autonomy,” which in large part boils down to the idea that EU states should buy their own weapons, thereby sustaining an industrial base and a web of suppliers capable of providing for the full range of a modern military’s needs. “There’s a real anxiety on this subject,” said Elluin. “The idea is that if we’re less competitive than the Americans, we’ll lose our capacity to be independent because we’ll be less able to make sales and retain the market share to then be able to equip our own armies at a relatively low cost.”

In short, Macron’s case for “strategic autonomy” is not just about sage geopolitical strategy, and it’s little surprise that the Eurosatory fair takes place near Paris. France has the largest defense industry in Europe. In 2023, the country again held the second spot in arms exports after the United States—the result both of a Russian retreat from the market and of France’s own increasingly aggressive export policy, designed to provide the cushion for a strategic national industry that would be hard to sustain by France’s defense needs alone. According to SIPRI, French exports expanded by 47 percent between 2019 and 2023 relative to the preceding four yours.

Protracted war means combat testing, which firms are recycling back as research and, ultimately, new products. The Paris-based Safran is a key aeronautics manufacturer, namely of helicopter and airplane engines. They’re currently being phased out, but its CFM56 line of engines—coproduced with General Electric—was for decades the hegemonic turbofan jet engine on the market, supplying Boeings and Airbuses alike.

Popular

“swipe left below to view more authors”Swipe →But the firm most showed off its drones at Eurosatory, including its new addition to the market: the Lanner. “Low-cost and robust” and “combat proven”—the Safran representative used the Ukraine War–era triptych for drone marketing—the Lanner combines tactical surveillance, electronic warfare capabilities like data scrambling and spoofing, and lethal munitions. The Lanner can also carry the Safran group’s kamikaze drone, the Warbler, thereby greatly increasing the range of a warhead that if launched from a grounded catapult can hit targets only as far as five kilometers away.

But it’s not just from Ukraine that Safran has been getting its know-how. The firm’s ties with Israeli arms makers have brought demonstrators to the Safran headquarters in recent months. In 2010, as the group moved to strengthen its position in the drone market, it partnered with Elbit—Israel’s largest drone manufacturer, and producer of the Hermes 900. In 2021, Safran likewise signed a deal with the Israeli-state-owned group Rafael to fuse Safran’s MOSKITI TI optical technology with Rafael’s FIRE WEAVER digital battlefield mapping system. As the companies claimed in their initial press release, “The pairing of MOSKITO TI and FIRE WEAVER allows all tactical commanders and soldiers to see the same, integrated battlefield image. Moreover, any target can be detected, acquired, and neutralized with pinpoint precision and optimal efficiency.”

The genocide in Gaza has shown that the distinction between “asymmetric” and great-power war was always tenuous. But as far as the industry is concerned, a rising tide lifts all boats. Until it washes everything away.