The Freedom Flotilla Is Sailing Into Its Most Dangerous Waters Yet The Freedom Flotilla Is Sailing Into Its Most Dangerous Waters Yet

The humanitarian convoy is trying to deliver vital aid to Gaza at a time when the stakes—and the risks—could not be higher.

The Crackdown on Campus Protests Is Happening Everywhere The Crackdown on Campus Protests Is Happening Everywhere

Across the US, pro-Palestine students have faced repression, suspension, and arrest. We asked more than a dozen students to share how their schools have restricted the right to pr…

The Supreme Court’s 5 Male Justices Are Fully in the Tank for Trump The Supreme Court’s 5 Male Justices Are Fully in the Tank for Trump

During the former president’s immunity hearing, Roberts & Co. made clear that they’re going to do everything they can to delay Trump’s criminal reckoning.

Nikki Haley’s Zombie Campaign Is Drawing Swing-State Republicans Away from Trump Nikki Haley’s Zombie Campaign Is Drawing Swing-State Republicans Away from Trump

Haley is not campaigning, but she just won almost 158,000 GOP primary votes in the critical state of Pennsylvania. Democrats think they can swing many of them to Biden.

Latest

A Biden War Funding Package, Mass Graves in Gaza, and a New Cold War Update A Biden War Funding Package, Mass Graves in Gaza, and a New Cold War Update

Apr 26, 2024 / American Prestige / Daniel Bessner and Derek Davison

The Reactionary Justices Won’t Stop Until Abortions Are Illegal Everywhere The Reactionary Justices Won’t Stop Until Abortions Are Illegal Everywhere

Apr 26, 2024 / Jeet Heer

How the US Media Failed to Tell the Story of the Occupation of Palestine How the US Media Failed to Tell the Story of the Occupation of Palestine

Apr 26, 2024 / Dave Zirin

Republicans Are in Damage Control Mode Over Abortion Republicans Are in Damage Control Mode Over Abortion

Apr 26, 2024 / Sasha Abramsky

The Covid Revisionists Are Endangering Us All The Covid Revisionists Are Endangering Us All

Apr 25, 2024 / Gregg Gonsalves

Fellow Freelancers: Don’t Marry Rich, Organize! Fellow Freelancers: Don’t Marry Rich, Organize!

Apr 25, 2024 / Amy Littlefield

Nation Voices

“swipe left below to view more authors”Swipe →Israel-Gaza War

“The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza “The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza

The extraordinary story of a 14-year-old, her mother, and what happened when the Israeli military came to destroy their house.

Genocide in Real Time Genocide in Real Time

As an American, I share the deep sorrow over my country’s complicity in this horrific crime against humanity.

Israel’s Attacks on Gaza Are Not “Mistakes.” They’re Crimes. Israel’s Attacks on Gaza Are Not “Mistakes.” They’re Crimes.

The political and media class is doing what it always does with the US and its allies: trying to frame deliberate atrocities as tragic mishaps.

Popular

“swipe left below to view more authors”Swipe →-

The Supreme Court’s 5 Male Justices Are Fully in the Tank for Trump The Supreme Court’s 5 Male Justices Are Fully in the Tank for Trump

-

“The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza “The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza

-

How the US Media Failed to Tell the Story of the Occupation of Palestine How the US Media Failed to Tell the Story of the Occupation of Palestine

-

The Crackdown on Campus Protests Is Happening Everywhere The Crackdown on Campus Protests Is Happening Everywhere

From the Archive

December 12, 2016: Black Life and Death in the Age of Obama Black Life and Death in the Age of Obama

His presidency saw new opportunities for black Americans—as well as the resurgence of white supremacy.

Politics

Summer Lee Proves That “Opposing Genocide Is Good Politics and Good Policy” Summer Lee Proves That “Opposing Genocide Is Good Politics and Good Policy”

Last week, the Pennsylvania representative voted against unconditional military aid for Israel. This week, she won what was supposed to be a tough primary by an overwhelming margi…

Is Donald Trump on Drugs? If Not, He Should Be. Is Donald Trump on Drugs? If Not, He Should Be.

His true addiction explains the president’s doziness.

The House Foreign Aid Bills Have Put a Target on Mike Johnson’s Back The House Foreign Aid Bills Have Put a Target on Mike Johnson’s Back

After a vote in favor of sending $95 billion to Ukraine, Israel, and Taiwan passed, far right Republicans are threatening a motion to vacate the speaker of the house.

Books & the Arts

Want to Fight Mass Incarceration? Start With Your Local Jail Want to Fight Mass Incarceration? Start With Your Local Jail

A new collection of essays from academics and activists devoted to prison abolition focuses on the quiet but rapid expansion of the carceral system in small towns and municipaliti…

Is Comedy Really an Art? Is Comedy Really an Art?

A history of comedy’s last three decades of pop culture dominance argues that it is among the consequential American art forms.

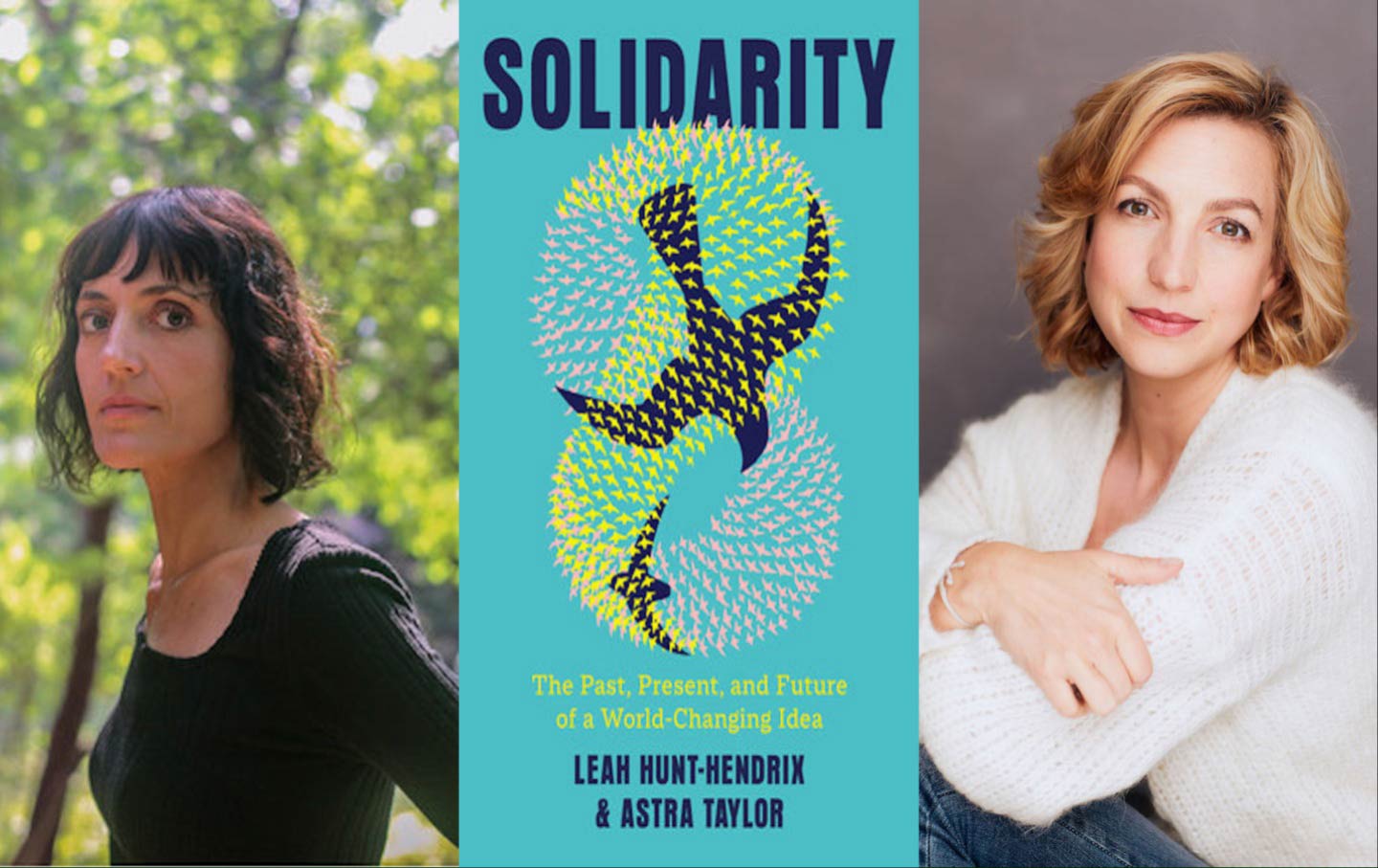

Talking “Solidarity” With Astra Taylor and Leah Hunt-Hendrix Talking “Solidarity” With Astra Taylor and Leah Hunt-Hendrix

A conversation with the activists and writers about their wide-ranging history of the politics of the common good and togetherness.

Features

“swipe left below to view more features”Swipe →Latest Podcasts

The Nation produces various podcasts, including Contempt of Court with Elie Mystal, Start Making Sense with Jon Wiener, Time of Monsters with Jeet Heer, and Edge of Sports with Dave Zirin.

SubscribeA Biden War Funding Package, Mass Graves in Gaza, and a New Cold War Update A Biden War Funding Package, Mass Graves in Gaza, and a New Cold War Update

Podcast / American Prestige

The Religious Foundations of Transhumanism The Religious Foundations of Transhumanism

Podcast / Tech Won’t Save Us

A Better Two-State Solution—Plus, the UAW’s Victory A Better Two-State Solution—Plus, the UAW’s Victory

Podcast / Start Making Sense