Rise of the Crypto Keepers

The promoters of scam currency spent more money than any other group in 2024. They’re now realizing a massive return on investment in Donald Trump’s White House.

On February 11, 2025, Representative Sean Casten, an Illinois Democrat who sits on the House Financial Services Committee, questioned crypto industry executives at a public hearing about the dangers of the president of the United States launching a memecoin. These crypto tokens are also known as “shitcoins” since they’re widely considered worthless, a tool for pump-and-dump schemes. Because the rules of congressional decorum had not accommodated themselves to the vulgar conventions of 21st-century financial technologies, Casten had to phrase his question carefully.

“It’s hard to talk about memecoins with the language that the industry uses to talk about them,” Casten said. “We’ll refer to them as ‘fecal coins’ for the purposes of this hearing. Is it safe to say from your smiles that you generally share the view of the industry that this is not something that has any innate value?”

“Yes,” an industry representative replied.

“The president of the United States issued something that has no innate value,” Casten said, before going on to talk about how retail traders may have lost billions speculating on the $TRUMP fecal coin.

On social media, crypto boosters were less interested in Casten’s charge that the president was swindling Americans than they were galvanized into transforming Casten’s cheeky euphemism into the very sort of worthless financial instrument it sought to describe. Less than two hours later, someone had created a memecoin under the ticker symbol $FECAL and started an X account and Telegram group to pump the token, exhorting speculators to buy. $FECAL’s value never rose above $0.00007, but about $6 million worth of the made-up coin was traded that day before it sputtered toward irrelevance. It was the kind of shitcoin pump-and-dump that happens hundreds of times a day, but this one was connected to the words and actions of a congressman. Its logo had Casten’s face on it.

The $FECAL episode was a small but telling sign of how crypto, despite being a relative flop commercially, has infiltrated American politics. Once the memecoin appeared, Casten’s unremarkable comment turned into an opportunity for graft and self-dealing, however ludicrously conceived and executed. Casten recognized as much. If he weren’t a known critic of the crypto lobby, Casten said, the token might have provoked some suspicion—that, say, the congressman was in on the grift. “You should be asking me hard questions about that, right?” he said in an interview. “It’s insane.”

If no part of society is immune from the all-powerful hand of the market, the same might now be said of crypto. Never has so much power, authority, and attention been afforded to such an economically unproductive industry. Never has so much energy and human potential been wasted chasing illusory profits in a business that relies on Ponzi economics. And never have politicians had so many opportunities for clandestine personal enrichment, in a parallel financial system that they’ve largely let run amok.

The cryptocurrency industry is about as old as the iPhone, yet it has accomplished very little, devouring hundreds of billions of real dollars to prop up a technology that still lacks much of a rationale to be introduced as legal currency. Through multiple bubbles, crypto has failed to scale beyond a base of hardcore believers and retail speculators who keep the casino running. It’s created more heartache than shared prosperity. It’s better known for its growing list of fraudulent companies than for its successful ones. In the United States, there are two publicly traded crypto exchanges: Coinbase and Bakkt. Coinbase is a major Trump supporter, while the Trump family has been reportedly negotiating to acquire Bakkt—partially owned by Trump ally and Small Business Administration director Kelly Loeffler—for its own crypto portfolio. Yet the industry is at the peak of its political influence.

Crypto has been successful in two areas: as a tool for crime—money-laundering, sanctions evasion, investment scams—and in its conquest of the American political scene. The two achievements seem deeply intertwined. In the 2024 political campaign cycle, crypto was the biggest donor by industry, raising more than $197 million. The crypto industry won nearly every race it got behind, and some of its leaders later claimed responsibility for helping to return Representative Jamaal Bowman, Representative Katie Porter, and Senator Sherrod Brown, all progressive Democrats, to the private sector.

Crypto supporters often claim that we are on the brink of a financial revolution—if only the government would get out of the way and allow these heroic financial innovators to do their thing. Now the industry will get its chance. With both houses of Congress under Republican control and an orange-pilled Trump in the White House, crypto is on the verge of getting the bespoke regulatory and legal regime it’s long demanded. Congress is now considering legislation to boost the market for stablecoins (crypto tokens that are pegged to the dollar, sometimes backed by unaudited overseas holdings parked in sketchy banks). Under the supervision of venture capitalist turned crypto and AI czar David Sacks, the federal government is even going to start stockpiling digital tokens as a strategic asset.

That will be a problem for the rest of us, who will have to deal with the collective disaster likely to be wrought by the bursting of another crypto bubble. This time, skeptics worry about crypto’s inroads into mainstream finance, where crypto is now on corporate balance sheets, in public employees’ retirement accounts, and fueling highly leveraged bets. Another digital-asset crash could spur a wider economic calamity. With the Republicans in charge and a divided Democratic opposition forsaking its traditional mandate of consumer protection, it seems we will have no choice but to suffer a gratuitous economic downturn engineered by a make-believe medium of exchange.

Donald Trump once called Bitcoin a scam, but under the tutelage of his sons and venture-capitalist donors, he changed his mind. Starting several crypto businesses over the past year, he embraced this century’s hottest get-rich-quick scheme with a fulsomeness that surprised even some true believers. (The inauguration weekend launch of the $TRUMP shitcoin was treated by some MAGA crypto figures as a little unseemly—they had seen this movie before.) The Republican Party had already gotten there, with Senators Cynthia Lummis of Wyoming and Ted Cruz of Texas and House majority whip Tom Emmer of Minnesota serving as the industry’s most devoted partisans. With Trump on board, crypto is poised to become fully woven into US economic and industrial policy.

The Republicans had a few like-minded Democratic colleagues, notably Senator Kirsten Gillibrand and Representative Ritchie Torres of New York and Representative Ro Khanna of California. But overall, liberals were divided on crypto. Some didn’t understand it; some thought there must be “something” there, a real innovation to cultivate; a few were in the industry’s pocket; and others feared the industry’s growing clout.

Recently, while attempting to whip fellow House Democrats to vote against a Republican resolution to overturn a Biden-era rule that classified some crypto entities as brokers with IRS reporting requirements, Casten found himself fighting against his colleagues’ apprehension of an industry that could easily flood their opponents with cash donations.

“I didn’t find a single Democrat who disagreed with me that this CRA [Congressional Review Act vote] was terrible policy,” Casten said. “No one pushed back on it. But I heard a lot of them saying, ‘Look, you know I’m in a vulnerable seat. I don’t want to have a bunch of crypto money’” donated to their opponent. “That’s really scary.”

With its disregard for institutions and their precious norms, crypto ended up being a perfect cultural fit for Trump and MAGA. Even in the grubby, cutthroat political arena, crypto didn’t operate like most industries. Its leading executives blasted regulators on social media and filed lawsuits in support of crypto developers accused of money-laundering, such as Tornado Cash, a “cryptocurrency mixer” that was responsible for laundering more than $7 billion and was on the Office of Foreign Asset Control’s sanctions list—that is, until a three-judge appellate panel sided with Tornado Cash users in a Coinbase-funded lawsuit. The crypto VC firm Paradigm donated $1.25 million to assist in the criminal defense of one of Tornado Cash’s founders.

Claiming that they were fighting for their industry’s life, crypto leaders attacked Democratic politicians and regulators with trollish vehemence. The vocal cadre of single-issue crypto voters followed suit. Like the ride-hailing and meal-delivery start-ups before them, crypto companies used their apps to rally users against their local representatives’ supposedly regressive policies, portraying themselves as populist insurgents cornered by a corrupt establishment.

“We had enforcement folks who were personally attacked by the industry for having been associated with crypto cases,” said Corey Frayer, who was a senior adviser to former Securities and Exchange Commission (SEC) chair Gary Gensler—crypto’s chief antagonist—during the Biden administration. “Credible threats coming through. People’s personal information being doxed, posted online. That’s not the kind of thing you see from the traditional financial services industry, as confrontational as those cases or those interactions can be. That’s just unheard of.”

After Trump won the 2024 election with overwhelming backing from the industry, crypto executives began exerting their newfound influence. Coinbase CEO Brian Armstrong, a regular presence on Capitol Hill in the months leading up to the election, said that his company wouldn’t work with any law firm that hired former SEC lawyers. “It’s an ethics violation in my book to try and unlawfully kill an industry while refusing to publish clear rules,” Armstrong wrote on X.

In February, the SEC reportedly closed its investigation into Gemini, the crypto company run by the Winklevoss twins, best known as the failed social media rivals to Mark Zuckerberg’s Facebook empire. Gemini had also been sued by New York Attorney General Letitia James in a $3 billion fraud case. Tyler Winklevoss demanded that the SEC should name, shame, and fire staffers who worked on crypto enforcement and reimburse their company three times its legal costs. “This will start to make amends for the damage you have done to us, our industry, and America,” Winklevoss wrote.

Under Trump, the SEC is set to be led by Paul Atkins, a crypto industry consultant. The SEC’s top litigator was transferred to the agency’s IT department, as career staff are being punished for implementing the policies of a previous administration and as the agency races to drop lawsuits and pause enforcement actions.

Although it hasn’t been very successful economically, crypto punches above its weight culturally, tapping into long-standing conservative shibboleths. “Much of the economic and political thought on which Bitcoin is based emerges directly from ideas that travel the gamut from the sometimes-extreme Chicago School economics of Milton Friedman to the explicit extremism of Federal Reserve conspiracy theorists,” wrote David Golumbia in The Politics of Bitcoin: Software as Right-Wing Extremism. “Bitcoin and the blockchain technology on which it rests satisfy needs that make sense only in the context of right-wing politics.”

Unlike their counterparts on Wall Street, these financial executives aren’t interested in the stability of the state. They’d rather see it destroyed, if not do the job themselves. Creating private money, issued by Silicon Valley start-ups, pseudonymous scammers, and shell companies based in island tax shelters, is by its nature a broadside against the sovereignty of the state and its governing authority over the money supply. Frequently calling fiat money—US dollars—the “real Ponzi scheme,” crypto partisans inhabit a different ideological arena, one that puts them in automatic conflict with the liberal regulatory state.

The crypto industry’s blunt disregard for government bureaucrats and regulations builds on a right-wing tradition of calling for the government to be shrunk by any means, its capacity hollowed out. This hard-right libertarian worldview is now being put into destructive practice with Elon Musk’s DOGE project, which has allowed the world’s richest man to launch an administrative coup in the name of rooting out waste and fraud. Like Musk, crypto perpetuates the very corruption it claims to be excising.

Cobbled together from a pastiche of right-wing philosophy and American economic jingoism, crypto’s turns of phrase have seeped into the substrate of Republican discourse. “The freedom to transact”—the principal liberty from which all other liberties and rights flow, according to the prevailing ideology—is now invoked by politicians like Arkansas Republican Representative French Hill as a key economic right that can be secured only with better access to crypto. After being accused of counterfeiting and destabilizing the dollar and of enabling global cybercrime, stablecoin issuers like Tether began talking about how their products would “extend dollar hegemony.” The idea has been taken up by Trump and his top officials. “As President Trump has directed, we are going to keep the U.S. the dominant reserve currency in the world, and we will use stablecoins to do that,” said Scott Bessent, his treasury secretary.

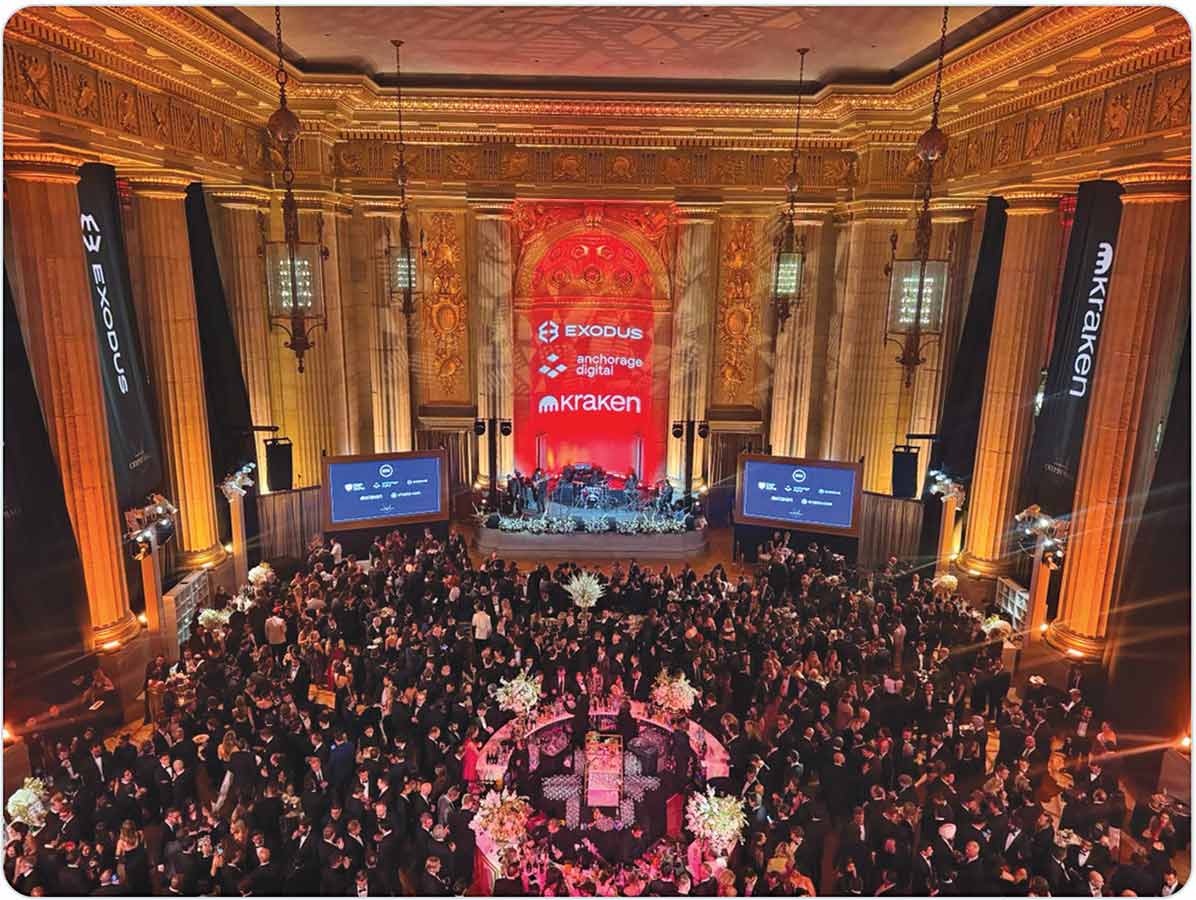

The right’s ready absorption of crypto-speak reveals how the industry has effected the same neat trick of political positioning that Trump has: Crypto boosters laud themselves as countercultural political actors, clawing away the deadwood of incumbent institutions while soaking up the establishment prestige that comes with massive campaign contributions—an uptick in Beltway status that’s also made them heavily dependent on the political favors and patronage of Republican elites. There’s a reason, after all, that one of the hottest tickets of Trump’s inaugural weekend was the lavishly funded Crypto Ball.

The industry’s Janus-faced self-image also helps explain a policy agenda that’s all over the map. Crypto leaders may fancy themselves revolutionary upstarts who are challenging the existing Wall Street–led, SEC-supervised economic order—but they would also very much like access to mainstream finance’s products, lines of credit, and institutional investors. Crypto boosters claim that they will offer a hedge against the dollar in a new multipolar global trading regime—but they will also somehow prolong the dollar’s standing as the world’s reserve currency. These whiplash-inducing swerves in policy thinking aren’t meant to be taken much more seriously than the latest shitcoin offerings—like those ploys, they just supply an alibi for investors looking to cut and run the moment that token prices start dropping.

Although its roots are in right-wing libertarian and cypherpunk thought, crypto wasn’t always a right-wing political phenomenon. During the first Trump administration, tech-friendly Democrats embraced the industry and its dubious promise of financial empowerment and innovation. In the 2022 midterms, just before his crypto empire imploded, Sam Bankman-Fried, the now-imprisoned fraudster who founded the FTX crypto exchange, made more than $100 million in political donations; he floated the possibility of spending $1 billion in the 2024 races. At the same time, his colleague Ryan Salame led a dark-money campaign targeting Republican politicians while Bankman-Fried met privately with GOP leaders like Senator Mitch McConnell. Bankman-Fried was the face of crypto’s public campaign to legitimize itself—to bring the casinos onshore into a friendly legal environment permitting more money to enter the system. Until FTX’s collapse and the exposure of what a federal prosecutor described as the largest campaign finance crime in history, many Democrats were all too glad to go along. For years, Democratic politicians and career civil servants gamely tried to work with the crypto industry, only to encounter repeated intransigence from crypto barons. The industry argued that it required “regulatory clarity.” In its view, crypto was novel and unsuited to the current legal and regulatory framework, but Gensler’s SEC—and the broader Biden administration—maintained that existing laws were capacious and flexible enough to regulate crypto. It was the crypto companies who refused to comply with existing securities and banking laws and claimed they needed new rules to accommodate them.

This dynamic played out publicly in crypto’s dealings with the SEC. Gensler invited crypto companies—along with financial firms considering moving into crypto—to come in and register with the agency under existing securities regulations. Perhaps some minor rule disputes could be worked out, regulators thought. The initiative was dead in the water: A procession of companies came in to talk, but none of them registered with the SEC—their business models wouldn’t allow it.

“Going through that process over and over and over, even when it wasn’t stated explicitly, it became pretty clear what the conflict was. We don’t want to separate these businesses out into the traditional set of intermediaries that operate at arm’s length, because the conflicts of interest are what made the industry profitable,” said Frayer, the former SEC adviser. He was referring to the varied roles—market maker, clearinghouse, broker-dealer—that were divided up in traditional financial markets but that in crypto tended to exist under one roof. This “concentrated business structure,” as Frayer called it, wasn’t allowed in US capital markets, but it seemed to be key to crypto’s plans.

Casten had similar experiences, seeing an industry determined to pursue its self-interest without accommodating itself to the rules of public markets. “I’m still waiting for the first person from the crypto industry to come to my office and say, ‘We absolutely want something where it is not easier to launder money than it would be with regular dollars; it is not easier to destabilize the financial system than it is with regular dollars; it is not easier to defraud investors than it is with other securities and commodities,’” he said. “No one from the industry has yet offered that up. And I find myself left saying, ‘OK, then is there a legal use case for this stuff where you can make money?’ Because it doesn’t seem like anybody is advocating for one.”

Casting the Biden administration as the ultimate oppressor, the crypto industry seemed beyond negotiation or compromise. Any attempts at regulation or enforcement—or at what the industry derisively calls “regulation by enforcement”—were treated as existential threats. The SEC was accused of selectively going after certain crypto companies; in reality, the agency was husbanding limited resources against a mandate to protect capital markets that were far larger than crypto’s market cap of less than $3 trillion.

“As we did make informal requests from certain crypto-native firms, we got letters from Congress saying, ‘How dare you look at these? They’re outside your jurisdiction,’” Frayer recalled, referring obliquely to actions by GOP House majority whip Tom Emmer. “And then after FTX crashed, we got letters saying, ‘Where were you? Why didn’t you show up before this crash happened?’”

Popular

“swipe left below to view more authors”Swipe →Given its chronic intransigence in the face of regulatory bodies, crypto hasn’t operated like other powerful industries or interest groups. “Generally, there’s this very good-faith back-and-forth between the staff and the industry, because even when there’s different differences of opinion, there’s a desire to get this stuff right, a desire to maintain the integrity of the markets, because that works to everybody’s benefit,” Frayer said. “Crypto was not interested in preserving that norm.”

By the time the 2024 political campaign revved into gear, Bankman-Fried was a convicted felon and the crypto bubble had burst. But starting last year, even as consumer interest remained tepid, digital-asset prices began to recover, and crypto companies essentially rebooted their political influence campaign, this time focusing on Republicans. Led by Coinbase, the venture capital firm Andreessen Horowitz, the trading firm Jump, and others, crypto companies began pouring millions of dollars into Republican-aligned super PACs. Attracted by the stench of legalized corruption, lobbyists materialized, creating crypto trade organizations and messaging campaigns. The political energy and donations coalesced around Republicans who preached about the evils of government from the floor of Congress. And Democrats became the enemy.

Surrounded by all manner of crypto touters, Trump swept to victory on a tide of crypto cash and a promise to industry leaders that they would get whatever they wanted. After all, he was now one of them—the Constitution’s emoluments clause seems to have been rendered a quaint legal artifact—so what was good for the crypto industry should be good for Donald Trump. The president stocked his administration with crypto industry executives, VCs, and reactionary tech moguls. Steve Witkoff, the real estate billionaire and longtime friend of Trump, is both the president’s Middle East envoy and one of the forces behind World Liberty Financial, the crypto company that has raked in hundreds of millions of dollars for the Trump family. In his capacity as a government official, Witkoff helped negotiate a prisoner swap with Russia that brought home the imprisoned American Marc Fogel in exchange for Alexander Vinnik, who was serving a 20-year sentence for laundering $4 billion through BTC-e, a Russian crypto exchange.

Trump has promised to establish a government crypto reserve compiled from the stockpile of Bitcoin seized from criminal proceeds as well as the handful of tokens, like Solana, that have Trumpworld connections. “They’re going to make a lot of money for the country,” Trump said as he signed an executive order authorizing the new crypto reserve. “So is David,” he added, pointing to his crypto and AI czar David Sacks.

Trump claimed that the government will hold on to its Bitcoin—in line with the coiner’s philosophy to never sell—but the overall intention seemed, per the standard crypto business model, to extract maximum market returns and let the devil take the hindmost. Sacks has said that the federal government lost out on $17 billion in capital gains by selling 195,000 Bitcoin over the years. The federal government is on its way to becoming a participant in crypto markets, bailing out Trump’s venture capital donors while providing a price floor for politically favored tokens. Trump’s plan for a digital-asset stockpile states that “the Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies impose no incremental costs on American taxpayers.”

While Sacks may have the crypto czar title, the most crypto-aligned figure in the administration is arguably Howard Lutnick, the brash Wall Street executive who led Cantor Fitzgerald before he was appointed as Trump’s secretary of commerce. In recent years, Cantor Fitzgerald has become the de facto US banker for Tether, the crypto industry’s most important and most controversial company. Tether makes the $1 stablecoin called USDT, which is crypto’s most widely traded token. It’s frequently described as the chip used at all the crypto casinos. A majority of crypto transactions are done in Tether, especially in the lightly regulated sphere of decentralized finance. Tether is also widely used for money laundering, sanctions evasion, and terrorist financing, and in cybercrimes such as “pig butchering” schemes—romance and investment scams that involve pitches to buy crypto tokens and send them overseas.

The alleged sins of Tether have already generated a small library’s worth of court proceedings. Imagine an offshore Federal Reserve–slash–shadow bank with vast reach and an impossibly checkered cast of characters behind it that once included child actor and accused pedophile turned cryptocurrency mogul Brock Pierce. Besides its association with illicit finance, one of the main concerns about Tether is its financial reserves, which have never been audited. Tether has more than $143 billion worth of USDT tokens in circulation and should have a corresponding $143 billion in real dollars and dollar equivalents in the bank. But the company has been caught obfuscating its finances and has admitted in court filings to printing tokens without dollar backing—essentially, minting money out of nothing. (The farcically named GENIUS Act, the bill regulating stablecoins that’s currently being debated in the Senate, calls for stablecoin issuers to have fully dollar-backed, audited reserves, which could be a problem for Tether.) Tether is also deeply involved in the kind of highly leveraged lending business that in 2022 helped take down Bankman-Fried, a Tether business partner, and the wider consumer crypto market.

Hounded by investigators, Tether has faced banking issues throughout its history. In recent years, the company claims, it has poured its money into Treasury bonds—dollar-like instruments that are considered safe and are easy to get in and out of. With $113 billion worth of Treasuries, Tether claims to be one of the largest holders of US debt, landing somewhere between the governments of Mexico and South Korea. Cantor Fitzgerald manages Tether’s Treasury holdings, even though Letitia James has banned Tether from doing business in New York, where Cantor is headquartered. Lutnick’s firm also bought 5 percent of Tether and announced a multibillion-dollar Bitcoin-backed lending program with the company. The commerce secretary, in short, is closely affiliated with a company whose product is a linchpin of criminal money-laundering networks. Last fall, as Lutnick took meetings on Capitol Hill, his willingness to veer into personal crypto business alarmed Republican interlocutors, who duly issued anonymous complaints to Politico. Lutnick’s crypto-shilling may have doomed his bid for treasury secretary, which he lost to the more polished hedge funder Scott Bessent.

Even as crypto’s money and public allegiance shifted toward Republicans, Democrats failed to develop a coherent crypto policy or electoral strategy. Elected officials didn’t adequately understand what crypto was and the unique political threat it posed—or, as Casten noted, they were cowed by the industry’s bankroll.

Others found that, in contrast to its shambolic would-be opposition in Congress, the crypto industry was well-organized and armed with a battery of talking points approved by its political allies on the right. “You get a really one-sided kind of engagement from the industry,” said Representative Ben Waxman, a member of the Pennsylvania Legislature, who introduced a bill last year requiring cryptocurrency lenders to better collateralize and segregate funds—two issues that contributed to the bursting of the crypto bubble in 2022. “Most of the people we had testify in my hearing, they were opposed to my bill,” he said. (At Waxman’s request, I testified in favor of his bill—which resembled similar policies in place in other financial markets—before a state legislative subcommittee.) The bill was never brought up for a floor vote.

Now Democrats are trying to parse proposed stablecoin legislation that would make it easier for large corporations, like Amazon and Walmart, to issue their own digital money. It’s another desperate front in America’s slide toward plutocracy, and Democrats—the few who are willing to fight head-on—are losing that war.

“The same individuals that are promoting crypto as a tool for financial liberation—and trying to get Democrats to vote for something because it would be good for their consumers—are actively part of the effort to dismantle the Consumer Financial Protection Bureau to defang banking regulators,” said Mark Hays, the associate director for cryptocurrency and financial technology at Americans for Financial Reform.

“I don’t think Democrats, both rank and file and leadership, truly understand that,” Hays said. It wasn’t just about protecting consumers from financial predation, he explained: “It’s about protecting democracy and democratic institutions.”

Casten said that he tried but was unable to get what he called basic protections added to the latest bill under consideration, which he said will create “stablecoins that are not stable.” The Senate’s GENIUS Act was no better. “If your goal is to launder money, these bills are set up really well to do it,” Casten said, lamenting “how stupidly partisan this has become.”

Casten added that his colleagues were more worried about preserving their seats than about the health of the economy or their oversight responsibility. “You realize that there is going to be a massive financial crisis driven by crypto,” he told them while trying to whip votes against the resolution to overturn the IRS broker reporting requirement for crypto companies. “And everybody’s going to look back and say, ‘Who allowed this to happen?’”

Casten’s pleas went unheeded, as 76 Democrats voted with their Republican colleagues. Just as it did in the Senate, the measure passed with bipartisan support—and our shitcoiner in chief signed it into law in April. Crypto may not produce anything, but it gets results.