The Age of Public Austerity and Private Luxury

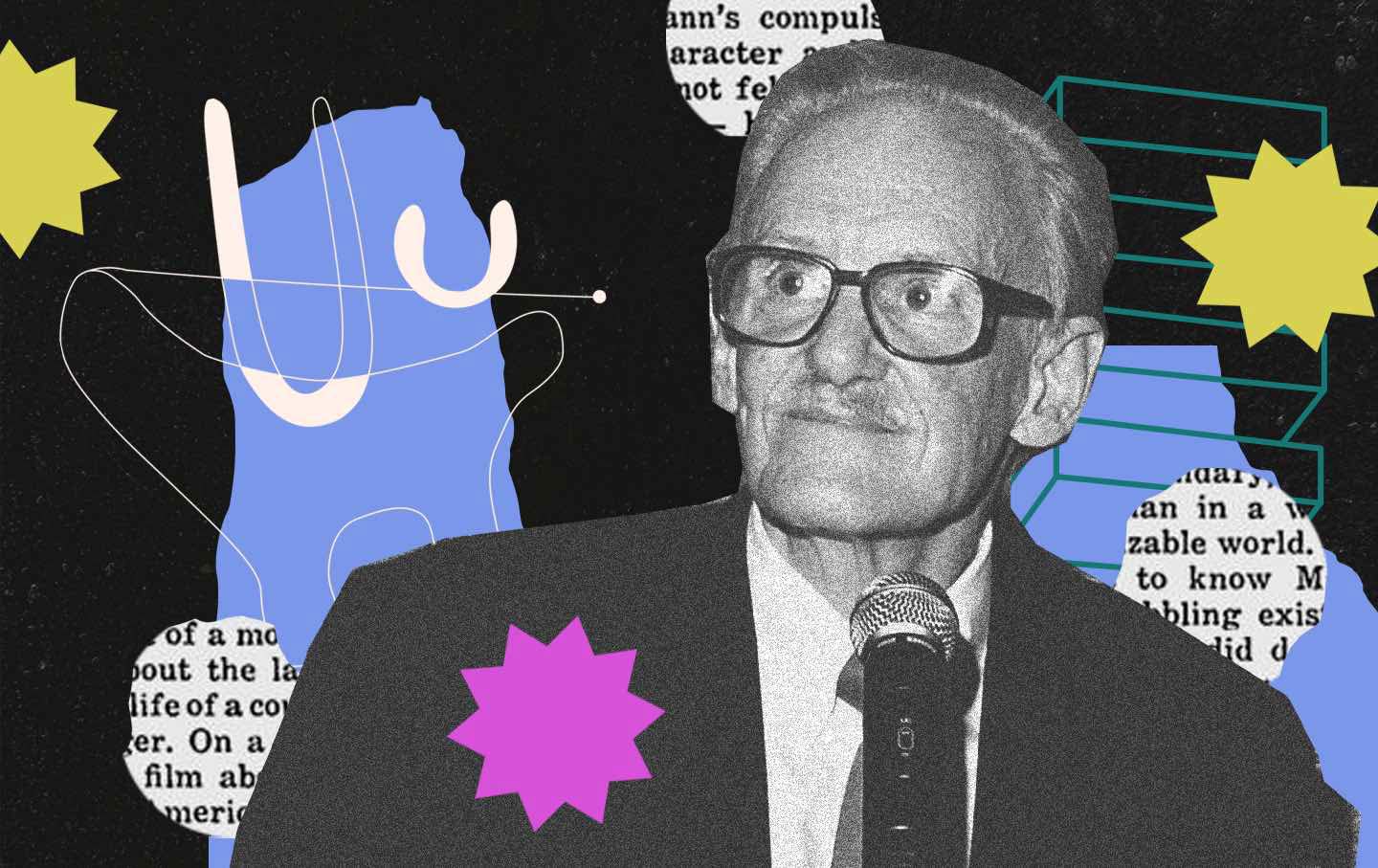

A conversation with Melinda Cooper about the recent history of neoliberalism and her new book Counterrevolution: Extravagance and Austerity in Public Finance.

Over the last decade, the history of neoliberalism has received a great deal of attention, from David Harvey’s Marxist interpretation in A Brief History of Neoliberalism to Quinn Slobodian’s Globalists, which sees neoliberalism arising from the ruins of Europe’s fallen empires. Many more books could be listed, but one of the most discussed and recently influential is Melinda Cooper’s Family Values (2017), which sought to show how the neoliberal economic discourse of the 1970s—with its demands for austerity, fiscal responsibility, and anti-inflation measures—came to be embraced by social conservatives such as the religious right, with its gospel of moral restraint, traditional family values, and the Protestant work ethic. Cooper sees this embrace as a reaction to the left progressive movements that emerged around the same time, such as the women’s and Black Power movements, and argues that the social conservatives played a crucial role in neoliberalism’s rise.

Cooper’s latest book, Counterrevolution: Extravagance and Austerity in Public Finance, might be considered a follow-up to Family Values. It frames the turn to neoliberalism in the 1980s as a kind of counterrevolution in public finance—via measures like budget balancing, tax breaks for the wealthy, central bank monetary policy, and the like—for the purpose of containing a left-wing public finance agenda. She calls this period a “counterrevolution” because it sought to undermine not merely the Keynesian welfare state but the leftist social forces that Keynesianism held in check. Insofar as Keynesianism enabled the government to subsidize public services, welfare, and wages, Cooper argues, it left the door open for a revolution in which workers could push for higher pay and politicians could push for redistributing wealth in order to win votes. In other words, “it was possible,” Cooper writes, “that the institutions of the social state would be seized from below, turning state dependents into agents of a new kind of social revolution.” Cooper believes that such social revolutionary forces were emerging by the late 1960s in the United States. The counterrevolution aimed to stymie these forces by implementing “budgetary mechanisms” that were introduced under technical economic rationales, but that were driven by the political aim of disempowering the poor and empowering the wealthy. The only way this counterrevolution can be overcome, Cooper argues, is for the left to “collectivize the process of money creation and public spending.” But how can it achieve this?

The Nation spoke with Cooper about the counterrevolution, the politics that motivate its economic practices, why the left has had such a difficult time overcoming it, and what it can do in the future. Our interview has been edited for length and clarity.

—Daniel Steinmetz-Jenkins and Kate Yoon

Daniel Steinmetz-Jenkins: Why don’t we start by discussing what you mean specifically by the “counterrevolution” that emerged in government spending and central bank monetary policy in the 1970s.

Melinda Cooper: My overarching argument is continuous with the one I developed in Family Values. I question the idea that the neoliberal counterrevolution of the early 1980s was a backlash against Keynesianism as such. Instead, I see it as a backlash against the leftist social movements of the late 1960s and ’70s, which were already engaged in a kind of immanent critique of actually existing Keynesianism.

What is new in this book is the focus on the fiscal and monetary dimensions of the long neoliberal counterrevolution. I am trying to map the various budgetary mechanisms that were deployed by neoliberals to rein in, blunt, or neutralize the promise of the left-wing social revolt. These mechanisms include tax and expenditure limitations on state and local governments; supermajority voting rules on taxation; the balanced budget ideal at the federal level; the central bank taboo against real wage inflation; and the benign neglect of asset price inflation. While these may look like highly technocratic and politically neutral instruments, they were used in very targeted ways to disenfranchise certain populations and empower others.

My basic argument is that neoliberals of different stripes managed to create a regime of extreme public spending austerity for those primarily dependent on wage income, while at the same time ushering in a regime of radical spending and monetary extravagance for financial asset owners. We tend to see only the austerity side of the equation—hence the illusion that this is all about the retreat of the state. But it’s hard to explain the extreme wealth concentration that has occurred in recent decades if we don’t also understand the multiple ways in which financial wealth is actively subsidized by the state.

Kate Yoon: Counterrevolution suggests that the real backlash to Keynesianism in the 1970s was not economic but political: “What the capitalist state had run up against,” you write, “were political limits to its own modus operandi, not absolute economic limits to fiscal and monetary policy.” How did demands to expand the beneficiaries of the Keynesian state beyond the white male worker lead to a counterrevolution?

MC: I insist on the difference between economic and political limits to fiscal and monetary policy because too many people defer to the idea that we collectively encountered real limits to economic redistribution in the 1970s. The prevailing diagnosis was that wage inflation and redistributive public spending were a recipe for economic disaster. This was a diagnosis shared by nascent neoliberals and many erstwhile Keynesians. It’s the key point we need to question if we are to keep open the counterfactual idea of historical and future alternatives. I suggest that the situation was catastrophic for the capitalist state, but not necessarily for a left communist alternative.

The conservative Austrian economist Joseph Schumpeter posited this distinction between economic and political limits to spending in the wake of World War I, when states were expanding their social budgets and communism was a real force to be reckoned with. For Schumpeter, the real limit to welfare state expansion was not some hypothetical tipping point of unsustainable government debt, but the rising political power of the working class.

In the 1940s, Michal Kalecki made a similar point from the left and simultaneously predicted the neoliberal backlash against the Keynesian welfare state in the 1970s. Kalecki was talking about the danger of full employment. Yet in the mid-1970s recession, something worse happened: The ranks of the unemployed increased with no apparent disciplinary effect on wages, thanks to the widespread availability of unemployment benefits. Kalecki anticipated that as soon as welfare state expansion undermined the work ethic, both industrialists and financial asset holders would withdraw their support from the Keynesian consensus. The supply-side economist Martin Feldstein basically spelled out the same diagnosis of the situation in the mid-1970s, which is why I call him the “Kalecki of the Master Class.”

These are all very concrete illustrations of the political limits to the Keynesian project of mediation between capital and labor. But Kalecki doesn’t dig any deeper than the immediate standoff between labor and capital, so he fails to understand the crucial role played by the family and the nation in the organization of the Keynesian consensus. Limits to citizenship and women’s labor are two ways in which Keynesianism is able to constrain the expansion of government spending and keep the labor share of national income in check. Kalecki’s diagnosis needs to be expanded: The 1970s witnessed an inflation of the social wage, not just the formal wage, and both movements were sustained by Fordism’s marginal workers—women, African Americans, and other racial minorities—as well as the Fordist working class.

DSJ: It is typically assumed that this counterrevolution was basically inevitable. You disagree. What viable alternative paths were available at the time?

MC: The counterrevolution is only inevitable if we accept the premise that there are hard economic limits to the collectivization of wealth. These economic “laws of nature” make communism seem not just dangerous but impossible. Economists of different stripes have different words for these laws. Among neoliberals, it’s the idea that real wage inflation is economically catastrophic and must be reined in by the deliberate creation of unemployment, the so-called non-accelerating inflation rate of unemployment (NAIRU). Among Keynesians, it is the idea that national income must be shared between capital and labor without compromising the increase in profits, a trade-off that can only be sustained by constant growth in the national product.

Both currents place a limit on the collectivization of wealth: They get worried when they see any increase in wages relative to profits or any redistribution of social wealth that compromises the value of financial assets. Keynesians, obviously, have more flexibility here, but only so long as they are able to sustain the continual growth in the national product. When growth founders or the labor share of national income is growing faster than the capital share, they resort to corporatist strategies in which trade unions and bosses agree to share the austerity via wage and price controls.

If you want to start imagining what a communist organization of money would look like, the first thing you need to do is to demystify the technical limits to the collectivization of wealth posited, in different ways, by neoliberals and Keynesians. This doesn’t mean that economic uncertainty or natural resource scarcity or the tediousness of essential work disappears as a result. What is eliminated is the immense waste of collective resources currently dedicated to shoring up corporate profits or private wealth.

Having said this, it is obvious that the creation of an economic alternative cannot only be a technical question. We might have a perfect blueprint for what a collective organization of wealth might look like, yet still lack the political resources for bringing it into being.

I would say that the confluence of labor and social militancy that occurred in the early 1970s came closest to realizing Kalecki’s (and Schumpeter’s) vision of a revolution in and against the social state. At least it came close enough in the sense that for a short period, profits and financial returns were under genuine threat from the expansion of the formal and the social wage. I insist on this point because I think it is important to locate counterfactuals in the otherwise deadening history of left-wing defeats.

Having said this, what is too close for comfort from the point of view of capital is still very far from a genuine social revolution. So if the initial conditions were there, it’s important to understand why things didn’t go any further. My narrative suggests that the dividing of workers against each other (private versus public sector) and against welfare recipients was fatal to the left during this period.

It’s also significant that few people on the left had a clear sense of how welfare state and public sector militancy might fit into a strategy of revolutionary social change. The exception here were people like Nikos Poulantzas or the anarcho-communist London/Edinburgh Weekend Return Group, who were interested in the possibilities of working “in and against” the late Keynesian social state. The political theorist and historian Katrina Forrester is working on a book about this at the moment, and she describes very clearly how British feminists at the time were demanding the redistribution of resources minus the discipline that typically came with it.

KY: In your account, conservatives—namely, the supply-siders and Virginia School neoliberals—converge in this counterrevolution despite their seemingly different views on public spending. That potential tension is highlighted in your book’s subtitle, “Extravagance and Austerity in Public Finance.” Could you describe what that difference was, and how the convergence between the two sides happened?

MC: Virginia School neoliberalism, especially as laid out in the constitutional philosophy of James M. Buchanan, offers a detailed conceptual justification and a policy blueprint for the implementation of austerity at all levels of government—local, state, and federal. Buchanan’s oeuvre is a masterwork in state theory that has been at least as influential in shaping government policy as Keynesianism was. Yet the breadth of Buchanan’s influence (and that of his students) has slipped under the radar. Close attention to Buchanan’s sources in the Southern Democratic tradition makes it easier to understand why neoliberal budgetary politics has been so forensic in its targeting of racial minorities. We need to move beyond explicit theories of race or scientific racism to understand the racial politics of local tax and spending limits or the federal Balanced Budget Amendment. As Republican strategist Lee Atwater observed, supposedly neutral budgetary and monetary mechanisms can play the role of racial segregation much more efficiently than outright racism.

While Virginia School neoliberals were naïvely committed to the idea that government deficits and debt finance were dangerous in and of themselves, supply-side economists were embedded in the world of Republican Treasury circles and bond markets and very much attuned to the new form of global hegemony assumed by the dollar in the 1980s. Robert Mundell was the first to recognize that the United States could become a global exporter of government debt and run a continual trade deficit as long as it could guarantee low inflation to financial investors. This opened up the tantalizing possibility that the US government could spend extravagantly on subsidies to financial asset holders (essentially in the form of targeted tax expenditures such as the capital-gains tax preference) and not be punished by global bond markets. However, as the 1978 flight from the dollar had demonstrated, global investors would flee the dollar anytime the government threatened to spend too extravagantly on welfare or allow wages to rise too fast.

Supply-siders were all in favor of extravagant government spending on financial asset holders, but they preached austerity when it came to mere wage earners or welfare beneficiaries. In this respect, their economics of extravagance ended up dovetailing with that of the Virginia School neoliberals, even when they had serious disagreements on the fundamentals.

KY: This convergence takes place in part through seemingly highly technical tools like accelerated depreciation schedules on fixed capital assets. Could you explain how accelerated depreciation schedules exemplified the extravagance of the supply-siders?

MC: I try to look at the various ways in which capital gains are promoted through the tax code. “Capital gains” is the tax accounting term for the appreciation of assets. The most obvious way of promoting wealth gains through asset price appreciation is through the use of capital-gains tax preferences. The campaign to reduce the capital-gains tax was a central plank of supply-side economic thinking from the mid-1970s to the present.

However, there are various other tax preferences that do the same thing but go by different names. When it comes to the world of private investment, by which I mean private equity funds, venture capital and hedge funds, the so-called carried-interest exemption allows general partners to claim roughly 20 percent of returns on any investment as capital income rather than labor income. Thus, their (often already) very large investment returns are taxed at the much lower capital-gains rate.

Another tax mechanism that has come to operate as an equivalent to the capital-gains preference is the accelerated depreciation schedule. Depreciation schedules were originally designed to help industrialists make long-term investments in fixed capital assets such as buildings, machinery, and equipment. The classic depreciation schedule was organized as a “straight line”—that is, the tax write-offs that could be claimed on a given investment were spread out over the presumptive life of the asset. Given that these were physical assets necessary to the enterprise of industrial production, the tax code made allowance for the fact that these things tend to wear down and lose value with time and will eventually need to be replaced. When supply-siders diagnosed the declining investment rates of industrial capitalists in the 1970s, they recommended the introduction of so-called accelerated depreciation schedules. If capitalists could write off the costs of an investment earlier, it was thought, they could be lured out of their risk aversion and incentivized to innovate again. An upfront tax reprieve is more valuable than one that is stretched out over many years, because it can be used to fund further investments from the start.

All this might have made sense if industrialists had any intention of continuing business as usual. But when Ronald Reagan introduced accelerated depreciation schedules in the early 1980s, they were used primarily by real estate developers like Donald Trump, who were investing in real estate as a financial asset rather than a factor of production. Under an industrial regime of accumulation, the value of commercial real estate was largely determined by the production units it housed, and as physical assets, these tended to depreciate in value over time. By contrast, the value of a hotel or office block in 1980s New York had more to do with market appraisal than productive output, and even a crumbling building might be appreciating in value by the year. This created the situation where a real estate developer could purchase a property purely on credit and claim upfront depreciation allowances on the investment, even when the value of the property was appreciating, not depreciating. A real estate developer could claim tax write-offs on the mortgage interest and depreciation for a few years and then sell off the property at an extraordinary profit. This profit, in turn, would be taxed at the preferential capital-gains rate.

Donald Trump was a connoisseur of accelerated depreciation.

DSJ: What role does the religious right of the 1970s play in all this, especially since your previous book, Family Values, seems to suggest a rather large one?

MC: The final chapter of the new book is devoted entirely to the religious far right and its understanding of the relationship between the politics of reproduction and the national debt. It seems to me that this is an increasingly important element in the fiscal and monetary politics of the Republican right, but one that is almost systematically ignored by left analysts. At the height of the Tea Party’s power in the 2010s, Republican congressmen repeatedly explained their opposition to raising the debt ceiling as a way of defending the unborn. It was hard for anyone not steeped in religious teaching to hear this for what it was, or to imagine that decisions around the budget might genuinely be motivated by Christian millenarianism.

Yet religious conservatives have long seen the issues of abortion and the national debt as inseparable, and this premise is key to understanding their politics of fiscal obstructionism. Beginning in the 1970s, Catholic and evangelical conservatives came to see the adoption of floating exchange rates, the legalization of abortion, and the growth in US government debt as closely interconnected symptoms of national breakdown. Religious conservatives have a direct line to the sexual unconscious of economic life, so while more mainstream neoliberals might worry about ballooning welfare budgets and wage-push inflation, and more mainstream conservatives might lament the breakdown of the family and the number of unmarried women on welfare, religious conservatives go straight to the heart of the matter: the loss of male sexual control over women. As they see it, the fiscal and monetary future of the nation rests on the subordination of women to the future life of the fetus. As a consequence, they came to understand limits to government indebtedness as a way of limiting abortion, and vice versa.

What I try to show throughout the book, but especially in this chapter, is that the politics of austerity goes far beyond the bread-and-butter issues we normally associate it with. Long before they had any judicial success in fighting against Roe v. Wade, religious conservatives spent many years trying to limit women’s access to abortion and birth control via fiscal means.

DSJ: How does the counterrevolution connect to Donald Trump’s rise? Do you, for instance, agree with the stance taken by Wendy Brown, who frames Trump as emerging out of the “ruins of neoliberalism”? Or is there something built into the counterrevolution itself that is inherently compatible with America First nationalism?

MC: My focus on the long history of supply-side economics makes it hard to sustain the idea that Donald Trump is not a neoliberal. His 2017 tax legislation was in many ways a deliberate revival of Reagan’s income-tax reforms of 1981, only with much more generous subsidies to the real estate sector.

Having said this, I don’t think economic liberalism as such ever works alone; it always works in alliance with some species of conservatism. This may be the communitarian/neoliberal alliance of a Third Way Democrat like Bill Clinton, or the neoconservative neoliberalism of George W. Bush.

In today’s Republican Party, we have something that looks like a neoliberal/paleoconservative alliance, and this brings complexities of its own. Paleoconservatism has clear connections to the white supremacist and theocratic far right; as a movement, it defines itself in opposition to neoconservatism, which it sees as too secular, too liberal, too internationalist, and too Jewish.

However, the kinds of economic alliances made by paleoconservatives have been quite diverse. On the one hand, paleoconservatives have often teamed up with radical libertarians such as Murray Rothbard, people who are inspired by the Austrian School neoliberalism of Ludwig von Mises. Libertarians are radical exponents of free trade without being internationalists. They are enemies of centralized federal power, thanks to their nostalgia for Southern secessionism. They want to abolish the Federal Reserve and the Internal Revenue Service. In government, however, they find ways of making the Fed work for the wealthy (see the former Ayn Rand devotee Alan Greenspan).

On the other hand, you have an arch-paleoconservative like Pat Buchanan, who I would see as a neo-Hamiltonian economic nationalist rather than a libertarian—the “America First” mantra comes straight from him. This is very different from a neoliberal free-trade position, and a lot of people seem to be excited about this. There is a widespread assumption, even in some quarters of the left, that national protectionism and mercantilism automatically translate into better conditions for workers. But this was never part of Pat Buchanan’s America First agenda, which really only offered up tariffs and tough border politics as a way of supposedly protecting workers, while otherwise promoting an extremely regressive tax system. I see two publications—American Compass and American Affairs—as contemporary exponents of an anti-neoliberal paleoconservatism. Admittedly, it’s a somewhat aspirational position at the moment, given that the global monetary system as it is currently configured locks the United States into the role of net importer.

I would say the contemporary Republican Party draws on all of these influences, Trump more haphazardly than others. In his first election campaign, Trump seemed to embody the kind of paleoconservative national protectionist policies espoused by Pat Buchanan or Steve Bannon—and certainly on the issue of trade with China, he followed through on this.

JD Vance sounds like he espouses an anti-neoliberal national protectionist position too, but then again he is one of several Republican right operators who are funded by the ultra-libertarian Peter Thiel. What unites these people is their affiliation to far-right paleoconservatism and their immersion in the world of private investment. This underwrites a deeply patrimonial, autarchic, and atavistic outlook that is sometimes dressed up in the garb of a more progressive anti-corporate agenda.

DSJ: What about the Biden administration?

MC: As is well known, Biden kept nearly all of Trump’s tariffs on Chinese imports and introduced some more of his own. Yet he also combined this with an explicit industrial policy. This turned out to be more ambitious in its conception than in its implementation, but it was obviously informed to some degree by the Democrats’ left flank and its vision of an equitable green-energy transition. I do see this as a significant political shift. The conundrum for the left is that the pivot is motivated as much by looming geopolitical tensions as by social movement pressure from below or heterodox policy expertise from within. In some ways, it looks like we are seeing a return to the kind of “supply-side liberalism” practiced by Democrats during the Cold War, where industrial policy is pursued via targeted tax expenditures and the left is trapped in a vise between its own fiscal ambitions and those of the security state.