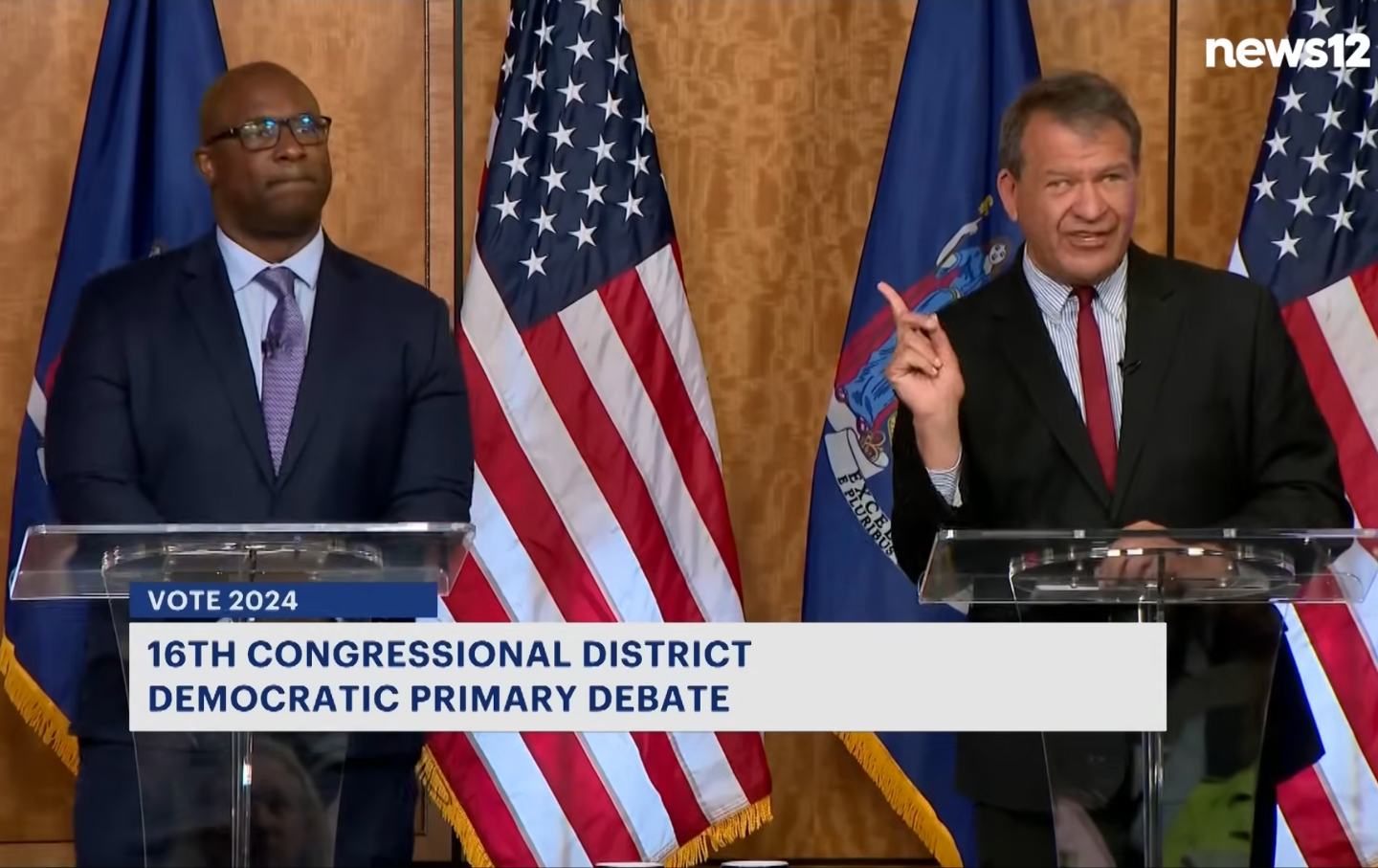

The Other Huge Difference Between Jamaal Bowman and George Latimer

Yes, they disagree on Gaza. But the Democratic primary rivals are also far apart when it comes to taxing billionaires and multinational corporations.

Media coverage of Tuesday’s Democratic primary battle between US Rep. Jamaal Bowman—the progressive New York incumbent facing a stiff challenge and a tidal wave of negative ad spending from establishment favorite Westchester County Executive George Latimer and his supporters— has focused primarily on the difference between the two candidates on the issue of Gaza. That’s understandable since Bowman is an ardent advocate for a cease-fire who argues that Israel’s assault on Palestinian civilians should be recognized as genocidal, while Latimer, with massive funding from political action committees and donors associated with the American Israel Public Affairs Committee, defends the actions of Prime Minister Benjamin Netanyahu and his government.

But that’s not the only major distinction between the two candidates in a race where several recent polls have given the advantage to the heavily-funded challenger.

Last week, Bowman joined US Senators Bernie Sanders, I-Vermont, and Ed Markey, D-Massachusetts, in announcing plans to introduce legislation that would impose a 95 percent excess profits tax on what the sponsors decried as “excessive corporate greed.” Modeled on the taxes implemented by the US government during World War I, World War II, and the Korean War to prevent war profiteering, as well as a windfall profits tax that was imposed on oil and gas companies as recently as the 1980s, the legislation could, according to its supporters, raise an estimated $300 billion in one year from ten of the nation’s largest corporations.

There’s no question where Bowman stands on this issue. As he says:

Since the pandemic, corporations have remained incredibly selfish in their business practices, squeezing their consumers who rely on them for essential goods and services, including gas, food, prescription drugs, banking and more. As corporations continue to make massive profits off the backs of rank-and-file workers, wages aren’t keeping pace. As a result the American people are struggling to keep up with the rising costs of living. Congress must do its part to check corporate greed before it completely robs people in America of their ability to live a life in pursuit of liberty, justice and happiness. As billionaires and corporations continue to get richer while the average person struggles to afford gas, food and utility costs–we must begin to hold those responsible to account and take the necessary steps to build an economy that works for everyone, not just the wealthy few.

Bowman has embraced this kind of progressive economic populism throughout his tenure in Congress. In 2022, he co-sponsored the “Babies Over Billionaires Act,” a plan that the congressman said was designed to “center the needs of people who account for most of the American population, instead of roughly 700 billionaires who have swindled us all.” His office explained, “This bill will require ultra-wealthy taxpayers with over $100 million in assets to pay their fair share by taxing the value of their investment gains annually similar to how we treat wages. This tax will disproportionately impact the roughly 700 billionaires in the country and could potentially raise over $1 trillion over 10 years.”

Contrast Bowman’s enthusiasm for holding the wealthy and profiteering corporations to account with Latimer’s message to the editors of one of the largest newspapers in New York’s 16th congressional district: “I am not signing on to raising taxes.”

A report on the session explained:

Latimer was asked about reversing or shrinking the tax cuts for top income brackets and businesses that Republicans enacted over Democratic opposition in 2017. Congress must revisit the tax code next year when parts of the 2017 law expire, and Biden has proposed hiking taxes again on businesses and the wealthy. Latimer shied away from that position. He said he wants to end the law’s $10,000 limit on state and local tax deductions but would look for ways other than tax increases to offset it.

What’s notable in this analysis is that, while many Democrats would like to reform aspects of the Trump tax plan that place undo burdens on working-class and middle-class families, Latimer is signaling that he is not in agreement with Biden’s plans to address revenue gaps with tax hikes on corporations and the billionaire class.

As the New York Working Families Party, which has backed Bowman, points out, “The Trump tax cuts were a windfall for the ultra-rich and an insult to working families. George Latimer is not just out of step with President Biden, but the vast majority of voters who are tired of seeing billionaires pay a lower tax rate than teachers and nurses.” Noting that many of the top donors to groups that are backing Latimer in the primary have histories of backing conservative Republicans, Justice Democrats, another group that is backing Bowman, says, “George Latimer is running a campaign for and by his Republican billionaire donors—at the expense of everyday people in #NY16.”

Bowman, for his part, is making the point that he agrees with President Biden’s proposals to tax the rich and multinational corporations, a message that should resonate in the Democratic-leaning district. But he’s having a hard time being heard in the face of a campaign that has seen record spending — at least $24 million so far, with most of the money going to attack the incumbent and support Latimer. Ironically, a big part of the anti-Bowman campaign rests on the idea that he, not Latimer, is out of step with Biden, despite Latimer’s rejection of a core component of Biden’s economic policy.

In a race that Bowman says pits “the many versus the money,” the incumbent’s closing message is a rebuke to the billionaire class, which he warns is “spending millions to try and buy our district.”

Sanders, who campaigned with Bowman on the weekend before the primary is, if anything, even blunter. “Jamaal understands that there’s something wrong when we are giving massive tax breaks to billionaires at the same time that we have people all over the country sleeping out on the streets,” says Sanders. “His opponent disagrees.”