The EU’s Secret to Slashing Emissions

Europe proves that putting a price on carbon can dramatically transform fossil fuel–based economies.

A man demonstrates in front of the school where a dialogue event with citizens is taking place about the future of lignite mining in Erkelenz, a midsize town in the state of North Rhine–Westphalia in Germany on March 11, 2023. He holds the number 1.5, signifying a global goal to limit Earth’s warming.

(Marius Becker / Picture Alliance via Getty Images)The EU’s carbon pricing system is the cornerstone of the European Green Deal, the bloc’s sprawling climate program that aims to cut greenhouse gas emissions by 57 percent (below 1990 levels) by 2030. Europe’s emissions trading system, known as EU ETS, is largely—though not solely—responsible for Europe’s slashing the carbon footprint of the sectors under the ETS by 38 percent since 2005, the year the market came to life. Because of its success, the bloc has ramped up its 2030 reductions target for the third time in eight years. The EU ETS, the world’s first transborder carbon pricing mechanism, has grown to cover more industries and sectors, and raised revenue to expedite decarbonization. Last year, it brought in a record $42 billion.

Benjamin Görlach of the Ecologic Institute, a Berlin-based think tank, told me that the low cost of renewables has put pressure on coal generation, “but the rapid retreat of coal in Europe since 2018 is unthinkable without carbon pricing,” which, he said, echoing the opinion of many experts, is the “easiest, quickest, and cheapest” way to reduce emissions.

How it works

In a nutshell, the EU ETS, like all similar mechanisms, puts a price on carbon emissions to force polluters to conserve energy or switch to lower-carbon alternatives, or both. The EU ETS is a market-based “cap-and-trade” scheme—the template for which, oddly, was designed in the United States in the 1980s to drive leaded gasoline off the market, which it did.

The EU ETS’s leverage stems from its emissions price per metric ton, which is determined according to supply and demand on the European Energy Exchange in Leipzig, Germany. It works like this: The overall quantity of emissions is “capped” by EU legislation, setting a limit to maximum emissions in line with climate objectives. It distributes a certain quantity of emissions allowances to polluters—freebies. These enable companies to emit an amount of greenhouse gases each year, but every year fewer allowances are handed out. In 2013, for example, Europe’s manufacturing industry received 80 percent of its allowances for free. By 2020, that had dwindled to 30 percent, and by 2030, it will receive none.

Within the cap, companies sell or buy allowances as their emissions’ totals require. If the freebies do not cover their emissions, they must purchase more on the exchange—a disincentive to emit as well as a source of income for the EU’s energy transition. If they have a surplus, they can flog them for a profit—a perk that can be invested in green technology. If emitters fail to furnish the requisite allowances, they are subject to a per ton fine and still owe the missing allowances. The shrinking cap ensures that total emissions fall in line with the set targets.

The emitters that the EU ETS currently encompasses are the top-line climate offenders: About 11,000 energy-intensive factories and power plants, 350 airlines, and, as of 2024, 2,200 shipping companies, too. They are responsible for about 45 percent of EU emissions. The brilliance of the EU ETS is that it exerts pressure on enterprises to cut emissions in the most cost-effective manner—lowest-hanging fruit first. The burning of coal, the dirtiest (and thus most highly priced) fuel, gets pushed out first as companies strive to lower their emissions through, say, clean power sources, which thanks to the carbon price has become that much cheaper than coal. The ball is in the emitters’ court, Görlach said: “Rather than states micromanaging the transition with a bevy of detailed regulations for specific technologies and sectors, the polluters themselves choose which options are deployed where, how, and when. Of course, they’re going to go for the cheapest first.”

“The EU ETS rewards the most efficient companies and penalizes the laggards,” explained Stefan Otto Krehbiel of the Danish Energy Agency, a state-funded institute. “An ETS is a gift for regulators and governments, because once it is set up properly, it reaches its target on autopilot,” he said, noting that EU authorities do update it regularly. “And the private sector can work with it, because it’s transparent, predictable, and operates according to market logic.”

Under EU ETS, emissions become a cost just like labor or raw materials. Since industry and energy producers know in advance how much emissions they need to shed to remain within the cap, they make plans accordingly. During the course of the 2020s, for example, the overall number of emission allowances is scheduled to drop at an increasing rate (currently 2.2 percent) that will reach 4.4 percent a year by 2030. As allowances become more scarce and thus costly, the companies are also well served to make long-term plans to limit emissions.

Popular

“swipe left below to view more authors”Swipe →Education of an ETS

The EU ETS may be the gold standard for carbon pricing today, but it got off to an inauspicious start, wallowing for over a decade in surplus allowances that resulted in a per allowance price so low that it failed to act as a disincentive. But over time, it put increasing pressure on more and more companies to reduce their emissions. The sectors that the EU ETS covers, for example, expanded significantly: adding aviation in 2012; petrochemicals, aluminum, and ammonia in 2013; and most recently shipping. In 2027, Europe’s transportation and buildings will be subjected to emissions pricing, which will expand carbon-market coverage to roughly three-quarters of the EU’s emissions. The EU ETS began as the world’s largest transnational emissions network, and it later added Iceland, Liechtenstein, and Norway to its ranks—while dropping the UK after Brexit. The EU ETS adjusted allowance supply so that the price of an emission allowance for a metric ton of CO2 emissions went from about €4 in 2008 to a high over €100 last year, and the expectation is that prices will continue to climb as the cap squeezes downward.

Moreover, the EU ETS has offspring within Europe and around the world. Germany, Poland, Portugal, Austria, and others within the EU have their own national markets or carbon taxes that complement the EU ETS. The UK, until 2021 when it left the EU ETS, instituted its own market with a per ton price much higher than the EU’s. The result was that in handful of years, the UK orchestrated a near-complete phaseout of coal from its electricity supply—a first among industrial countries.

Alternatives: regulation and subsidy

An important lesson, according to Jakob Graichen, a senior researcher at the Oeko Institute, a climate think tank, is that carbon pricing alone cannot do the job of full-scale decarbonization. It cannot, he warned, summon the capital necessary to invest in energy savings or to help develop innovative, expensive breakthrough technologies. “Carbon markets have to be complemented with other tools, like regulation, subsidies, and R&D,” Graichen said, citing the 2000 Renewable Energy Act, which established price supports—ultimately a kind of indirect subsidy—for renewable energies not yet competitive on their own on the market. It was a big reason the share of renewables in electricity consumption in Germany soared from around 6 percent in 2000 to around 60 percent today.

The US case

The United States, on the other hand, is trying to reach climate goals without a nationwide carbon market. US politicians seem to have concluded that carbon pricing simply isn’t sellable to US voters. The Biden administration is thus staking nearly everything on regulation and subsidies, most prominently the Inflation Reduction Act (IRA), which is the nation’s de facto climate program. Its aim is to boost renewables and other clean-energy tech to such an extent—over $500 billion across a decade—that fossil fuel will no longer make economic sense. But by itself, the IRA is not likely be enough to expel coal-fired generation from the market completely—indeed, as it wasn’t in Germany either. There, coal began retreating fast only when the cap tightened and a higher allowance price kicked in.

While a national market may be a political nonstarter in the US, 12 states on its western and northeastern coasts are covered by pricing systems. The two largest are the Regional Greenhouse Gas Initiative (RGGI) on the Eastern Seaboard and California’s statewide cap-and-trade mechanism. Both can claim moderate success in raising funds for decarbonization in helping tamp down emissions.

But the RGGI, started in 2010, covers just 14 percent of the Northeast’s emissions, almost exclusively fossil fuel electricity-generating plants; it has so far raised $7 billion for energy efficiency and clean energy projects. Although these states have cut power-sector emissions by 30 percent since 2020, experts say this is largely due to lower-priced fossil gas replacing coal. The California market is much larger, covering 75 percent of the state’s total emissions, and it raised more than three times as much decarbonization money than the RGGI. But like with the RGGI, it is hard to attribute the state’s emissions’ plunge to the ETS.

The US systems’ fair-enough track records (and the much more impressive European model) makes a case for an expansion of the carbon markets to other US states and other sectors, too. In fact, a modest upscaling could be imminent: Pennsylvania may well join the RGGI and Washington State could merge with the California system. The Environmental Defense Fund wants the RGGI to finally reflect the US commitment to at least halve its emissions by 2030 (compared to 2005). EDF, which argues that a 2030 target even as high as 80 percent is possible in the RGGI states, maintains that screwing down the cap in the electricity sector is key to get there: “Especially relative to transportation and industry, electricity tends to be cheaper to decarbonize, so states can get much of their near-term emissions reductions from the power sector while waiting for technology in other areas to mature.”

While putting a price on greenhouse gases increases wholesale electricity prices, it doesn’t necessarily lead to a greater consumer outlay for energy. According to the Natural Resources Defense Council, the RGGI-funded energy-efficiency measures and cost-saving renewable energy projects have saved consumers more than $1 billion on energy bills so far “and will eventually save more than $13 billion on energy over the lifetime of RGGI-funded measures.”

Two further reforms that the EU ETS is instituting would make sense in the United States if its carbon markets become more robust. One is a tax on imports from countries—in the case of the regional US systems, both other countries and states—that do not themselves tax emissions. The term “carbon leakage” refers to business lost by companies or sectors because they are subject to carbon pricing while their competition is not. The EU will begin in 2026 levying a compensation levy on carbon-intensive products, such as steel, cement, and some electricity, imported to the EU.

Another incentive is a “climate bonus,” which in Canada is labeled a “carbon tax rebate.” These are annual payouts to citizens to offset the higher prices people are paying because of carbon markets. In Germany, the introduction of rebates similar to Austria’s and Switzerland’s are under discussion. In Austria, the climate bonus is paid to the entire population, including children. The amount in pilot year 2023 was between 110 and 220 euros per person—the calculation of the full cost of carbon pricing to consumers will climb, as costs do.

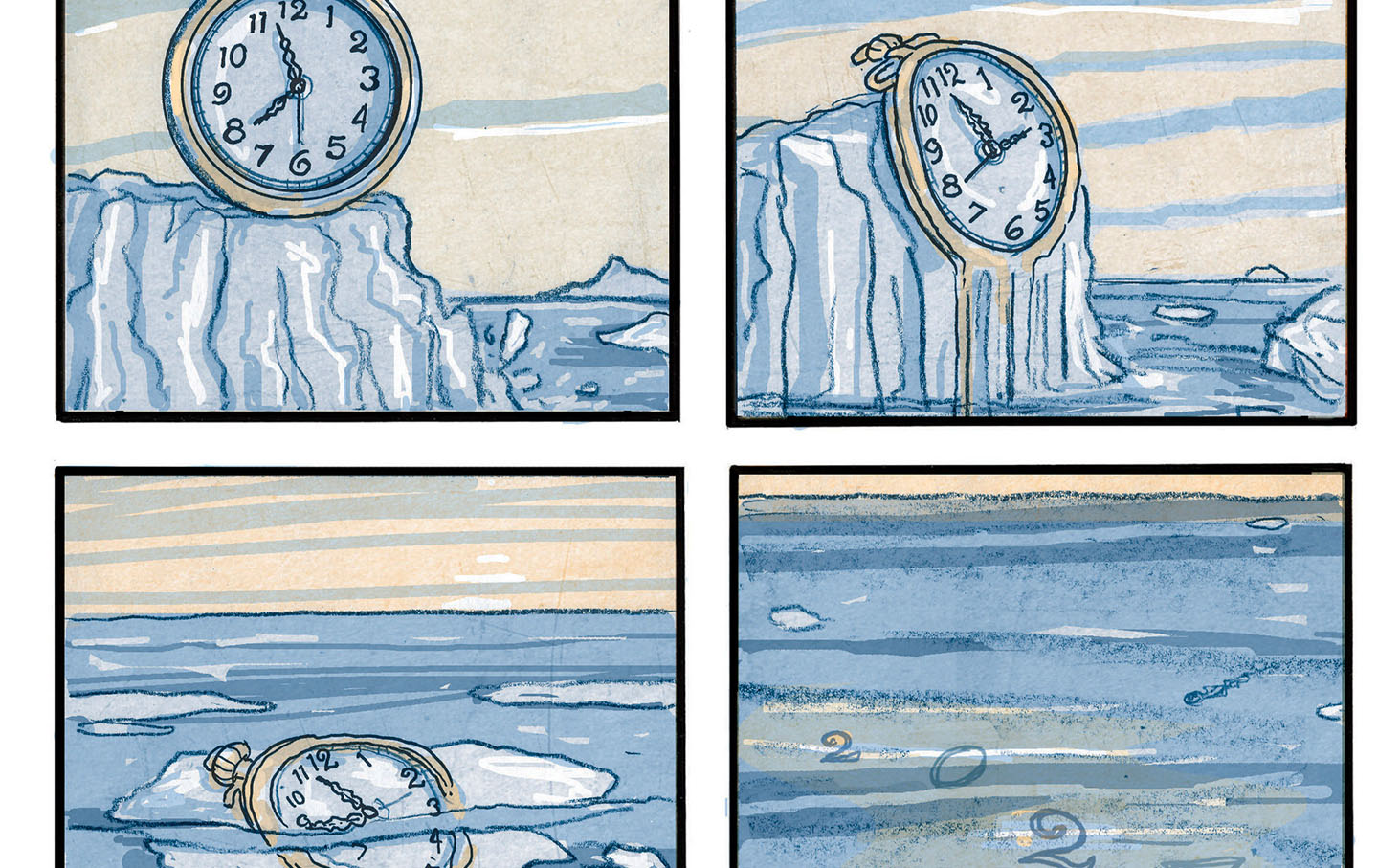

The EU ETS has much to boast about, but experts and environmental groups agree that it is not enough to keep global temperature increase below 1.5 degrees. Still, carbon-market mechanisms need to be a part of making that happen. We need to accelerate their expansion along with implementing accompanying policies for a just transition.