The much-reported recovery from the 2007–08 financial crisis has still left millions of Americans behind, squeezed between stagnant salaries and a rising cost of living. The depth of the country’s economic anxiety shows up in polling: A survey earlier this year found that respondents’ top economic concern was that it is “too tough for the middle class to make ends meet.”

Numbers like that make it clear that current policies are not doing enough to address the problem. But with advocates pressing for a new anti-poverty framework, and the recent electoral flux focusing the attention of politicians, a new wave of economic thought is influencing old-fashioned economic policy.

Take the Earned Income Tax Credit (EITC), which works by supplementing the incomes of low wage workers. Low-income taxpayers receive an income-based credit. The credit grows as income increases, up until a point where the benefit amount levels off and then begins to taper down. The size of the credit also increases for households with children. If you don’t have an income, you don’t get a credit. The intent is to simultaneously incentivize work while also providing the extra cash that low-income families need.

There is good empirical evidence that the EITC is effective at achieving its stated goals of increasing workforce participation and improving the cash flow and overall quality of life of low income families. Several congressional Democrats are seeking to build upon the strengths of the EITC and shore up its weaknesses, and have proposed expanded and modified versions of the EITC that increase the amount of the credit and number of people eligible to receive it.

The most intriguing of the recent batch of EITC bills is the EITC Modernization Act introduced last month by Representative Bonnie Watson Coleman (D-NJ). The EITC Modernization Act directly tackles many of the deficiencies of the current EITC—for example, benefits would include family caregivers and students, an important first step toward more universal programs. Watson Coleman’s bill also offers an option to receive the benefit monthly, helping even out spikes and dips in earnings that can be a real hardship on struggling families (a strain that can often push them to use payday loans and other predatory financial products). This also makes the benefit more visible to recipients, and thus more resistant to political attack.

In its current form, the EITC transfers some of the administrative burden onto its would-be beneficiaries, who must first be aware that they are eligible, and then must know how to claim the benefit on their tax returns. In an attempt to lessen the burden, Watson Coleman’s bill would increase funding for the Volunteer Income Tax Assistance program, which offers gratis professional tax-preparation services for people whose incomes are less than approximately $54,000.

Popular

"swipe left below to view more authors"Swipe →

Senator Kamala Harris (D-CA) also recently unveiled her take on EITC expansion. Called the LIFT (Livable Incomes for Families Today) the Middle Class Act, it would create a new tax credit that would offer cash payments to roughly 80 million working- and middle-class Americans. If you work, earn less than $100,000 a year, and you’re married or have children, you would receive up to $500 per month. Single workers who earn less than $50,000 per year would receive up to half that amount. Low-income students would also be eligible for the credit. The LIFT Act also phases in much more rapidly than the current EITC.

Last year, Senator Sherrod Brown (D-OH) and Representative Ro Khanna (D-CA) proposed an expanded EITC called the Grow American Incomes Now (GAIN) Act, which is similar to the LIFT act, although much more modest.

It is encouraging to see Democrats propose large-scale programs to benefit middle- and working-class families during a time of extreme income inequality and stagnant wage growth, and these proposals stand in stark contrast to Republican’s tax cuts for the wealthy and plans for austerity. However, the EITC—and the proposed expansions to it—still exclude non-working individuals, as well as some of the poorest families in the country, and this severely limits the ability of these programs to alleviate poverty.

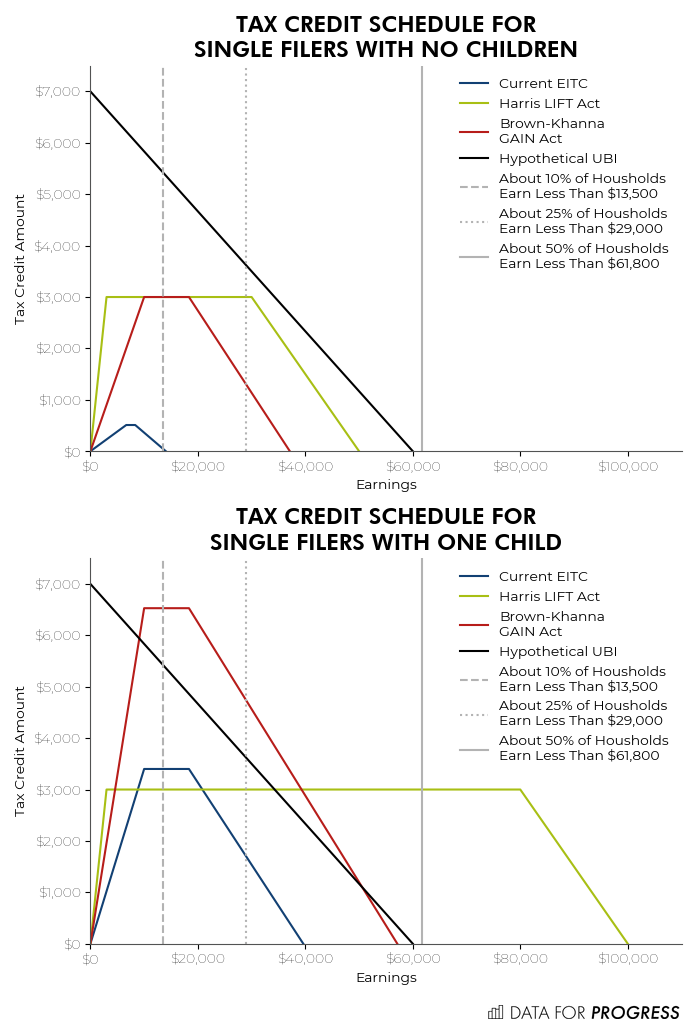

First, to get a better sense how the EITC works, the benefit schedule for a single filer with no children and a single filer with one child are shown below (there are further differences for married filers and people with more than one child, which are not shown). A hypothetical universal (or unconditional) basic income (UBI), which is an unconditional cash payment to every person, is also shown. This particular UBI program was recently proposed by Associate Professor of Economics at Harvard Max Kasy in a new Data for Progress Working Paper. In Kasy’s proposal, individuals with no income receive the highest net benefit, and as incomes increase, a larger portion of the UBI is taxed back, decreasing the net benefit.

The current EITC doesn’t give much benefit to people without children, and both the GAIN and LIFT acts offer substantially more. LIFT also extends the credit well above the median income for people with children. The faster phase-in of the GAIN and LIFT acts benefits those at the low end of the income distribution, but this still excludes those who do not have an income, and gives reduced benefits to some of the most needy families. A UBI, on the other hand, provides cash to working and non-working individuals alike, and the neediest families benefit most.

The EITC is currently the most progressive component of the US tax code, but is a subsidy of low wage work really the best way to get money to people who need it? Kasy argues that from an economic perspective, the answer is no.

There are a number of reasons why a UBI is preferable to an EITC. First, the EITC and other subsidies of low-wage work distort incentives because they cause people to work more than they otherwise would (there is an incentive to increase work to maximize EITC benefits). As people work more, this ultimately increases the amount of money the government needs to pay out. According to Kasy, this is less efficient than simply offering unconditional transfers to everyone (because benefits are tied to working). It also excludes non-working people from benefits, punishing people who are shut out of the labor force and keeping money away from the people who need it the most. In addition, offering benefits conditioned on work neglects the other problems that prevent people from working, such as child care or disability. If the goal is to increase work, there are more effective ways (such as a public-jobs guarantee) to do it that are far less cruel than impoverishing people shut out of the labor market.

Second, subsidizing low-wage work depresses wages by essentially allowing employers to pay less than a livable wage. This makes EITC-model benefits, at least in part, a money transfer to employers, rather than workers. Replacing subsidies of low-wage work with unconditional transfers (as with a UBI) would improve workers’ bargaining position and wages.

By its very nature, the EITC work requirement excludes from the benefits those who are unable to work or unable to find a job, which limits coverage in addition to distorting incentives. To get a sense of how the EITC work requirement affects coverage, Data for Progress collected data from the Current Population Survey, a monthly survey fielded by the Census (the data is averaged for January through August 2018). Breaking the numbers out by income and activity paints a much different picture than the simple monthly unemployment rate, which only includes those who are currently in the labor force.

About 48 percent of the population is employed, and a little under half of the population is neither working nor actively seeking a job, for various reasons. Among people who are members of households that earn less than $20,000 a year, only 27 percent are employed. While the unemployment rate for this group is higher than the overall population, most of the drop off in employment is due to the fact that this income group has disproportionately more retirees and disabled or ill individuals. Working their way out of poverty is simply not going to be an option for many people in this income group, even if a decent job were available to everyone.

Jobs are always politically salient, and full employment is an important policy goal, as this increases workers’ bargaining power and puts upward pressure on wages (some Democrats in Congress have called for a job guarantee, where the federal government funds direct community job creation to provide paid employment for anyone who wants it). However, it’s clear that policy platforms that focus solely on employment are limited in their ability to fight poverty, because they exclude many of the people who are enduring the most severe poverty.

While it is an incremental step relative to a UBI, Watson Coleman’s bill takes a direct approach to this problem by extending the EITC to non-working individuals who are caregivers or students, two groups that often face particularly trying economic conditions. Economic precarity is a risk factor for dropping out of school. A third of college students report that they don’t always have enough to eat, and a similar number say they don’t have consistent housing. This forces many college students to leave school without completing their degree, only to face an unforgiving job market and crushing student debt. Providing students with income while at school would allow them to take on less debt and better focus on their education.

Caregivers are excluded from the EITC on the technicality that the work they do is unpaid, meaning that under the current EITC rules, they cannot claim earnings that count toward the tax credit. However, caring for young, elderly, or ill relatives, along with domestic work, is crucial to a functioning society. In fact, a study by the AARP Public Policy Institute estimated that the economic value of unpaid care work was about $470 billion in 2013. That was more than the value of all paid home care and Medicaid spending in the same year.

In the United States (as with the rest of the world), this work is done by women far more often than it is by men, and because it is unpaid, this contributes to serious gender disparities in income. Caregiving incurs costs of its own, and in addition, 61 percent of the United States’ 40 million caregivers reported that their caregiving responsibilities required them to cut back on work, change jobs, or stop working entirely. Work requirements for cash transfers for caregivers deny assistance to many people who are simply unable to work, and Watson Coleman’s EITC expansion or a UBI could remedy this.

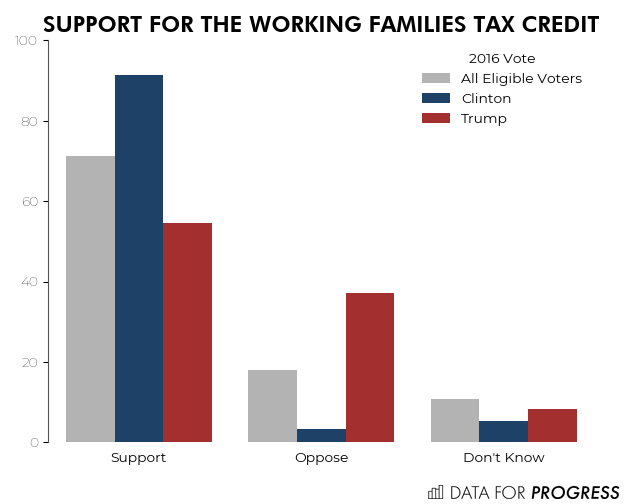

Policy arguments aside, a full universal-income initiative may still be a long way off. UBI is not yet a popular proposal among the electorate, although it has net positive support among people under 40. The more incremental steps of EITC expansion, along the lines of the proposals discussed here, however, are wildly popular. In September, YouGov conducted a poll, commissioned by the Economic Security Project and provided to Data for Progress, which asked about series of EITC reforms that the Economic Security Project calls the Working Families Tax Credit (WFTC). The WFTC is another variation on EITC expansion, one which would give up to a $2,000 credit to families making less than $75,000, with the credits offset by taxes on people making over $500,000. Students and caregivers would also be included.

This policy gets a resounding 72 percent support overall, with near-unanimous support among people who voted for Clinton in the 2016 election, and majority support among Trump voters. While many policies face a geographic penalty, where low support in rural areas leads to an unfavorable distribution of support throughout the states, that’s not a problem for expanding the EITC; net support for EITC expansion is positive in every state, with relatively small levels of state-to-state variability.

In addition, last July, Data for Progress polled each constituent part of the policy separately, that is, both the expansion of the tax cut and the expansion of refunds to benefit caregivers and students, and both proposals enjoyed substantial support. Even benefit expansion to caregivers and students—which conventionally could be viewed as politically risky—saw broad support, including among a majority of Republicans, two-to-one support among independents, and overwhelming support among Democrats.

Perhaps the biggest takeaway from these results is that, despite decades of racially charged rhetoric demonizing welfare recipients, the public is quite supportive of giving assistance to some people who are not officially (or traditionally) employed. It’s long past time for Democrats to address the fact that students and caregivers slip through the cracks in employment-based assistance programs. Expanding the EITC is a practical and feasible improvement to antipoverty programs in the United States, and should be debated along with complementary and alternative proposals such as student allowances and government-funded training and payments to people doing unpaid care work.