KAREN CALDICOTT

KAREN CALDICOTT

This article is adapted from Jeff Madrick’s The Case for Big Government (Princeton).

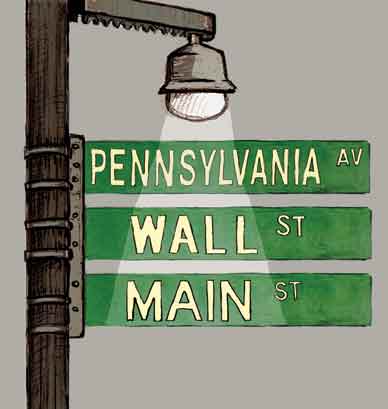

The financial crisis jeopardizing living standards around the world is the direct result of the antigovernment attitudes that began to spread in the United States as far back as the 1970s and reached their height in the George W. Bush administration. It had become conventional wisdom that high levels of taxes, government spending and regulation–in sum, big government–inevitably undermine a nation’s prosperity. The claims, embraced enthusiastically by business, apparently also struck a deep intuitive chord among Americans. The dangers of big government had become so obvious to so many over the past thirty years that they hardly seemed to require demonstration any longer, even among many Democrats. Government was widely seen as the problem and rarely the solution, a sharp reversal of attitudes that prevailed for the first two-thirds of that century. Cutting taxes was the main rallying cry, but deregulation was its close cousin. Starting in the 1980s, with Ronald Reagan’s presidency in particular but extended by George H.W. Bush, Bill Clinton and George W. Bush–as well as Alan Greenspan, the ideological Federal Reserve chair who won far more credibility than he deserved–the government reduced its regulatory oversight radically over the course of a generation.

President Clinton proudly announced the new position in 1996. “The era of big government is over,” he said with fanfare in his State of the Union address, the year of his presidential re-election bid. He successfully raised taxes on better-off Americans in 1993 but with the express purpose of reducing the federal deficit, not developing new social programs. In the ensuing years, considerable regulatory damage was done. Even after severe financial storms in the late ’90s in Asia and Russia and at hedge funds in New York, neither the Republicans nor the Democrats asked for new regulatory authority or requirements for disclosure of more information. Now even Greenspan acknowledges serious errors of judgment. No one knows the extent of the liabilities of financial firms today because of the lack of federal oversight of financial derivatives. The Clinton administration signed off on the end of the Glass-Steagall legislation, which had separated in law and spirit commercial and investment banking, and Clinton’s Treasury secretary prevented the Commodities Futures Trading Commission from actively regulating derivatives.

Popular

"swipe left below to view more authors"Swipe →

But it was the George W. Bush administration that took up the Reagan banner with energy and vindictive delight. Bush engineered enormous tax cuts, but the loosening of regulations was also integral to his philosophy. In 2004, for example, the Securities and Exchange Commission undid restrictions on how much investment banks could borrow, even as they made enormous profits. In return, the banks volunteered to open their books to the SEC, though this option was never aggressively pursued. Bush’s appointee as SEC chair, Christopher Cox, formerly a conservative Congressman, enforced the program with the deliberate Bush-style laxity that has characterized the administration’s management of the Food and Drug Administration, the Environmental Protection Agency, the Federal Aviation Administration and, of course, the Federal Emergency Management Agency, which so tragically mangled the Hurricane Katrina rescue efforts. Cox has admitted that the voluntary program did not work and has urged comprehensive securities regulation at last.

All of this is part of a mythology about the dangerous consequences of big government that does not and never did stand up to economic evidence. According to the best mainstream economic research, big-government and high-tax nations simply do not grow any more slowly than nations with proportionally lower levels of government spending and taxes. They do not have lower levels of productivity. The lack of any statistical relationship between taxes and economic prosperity suggests government must often be doing something right.

After all, the fastest growth of social programs in history– the rise of the so-called welfare state–took place in the rich Western nations and Japan over the three decades after 1950. Over that same period, which included the sharp rise in oil prices in the ’70s, the economies of these same countries experienced rapid growth. Today, no government of a Western nation spends less than 10 percent of gross domestic product (GDP), and many spend much more, on its poor, unhealthy and aged–what economists call social transfers–and all are immensely wealthy by historical standards. In addition to spending on social transfers, they also spend significantly on education and infrastructure, and they all remain vibrant democracies as well.

Because most of these high-tax economies do well, much of that tax money evidently must be spent constructively, on programs that inspire a sense of confidence and promote good health, education and efficient transportation. There may well be moderate disincentives to invest and work, but many of the programs are intelligently oriented to minimize these. For example, even high levels of unemployment insurance, a particular bête noire of conservatives, can remove less productive workers from the labor force and minimize any damaging consequences from shirking work.

Intelligent regulations, in turn, enable markets to work better by making information more available and reducing abuse and corruption. Regulations can save a lot of money over time, even if they cost more in the short run, as the current experience painfully shows. The evidence does not deter opponents of government. Many critics argued, for example, that Sweden’s welfare state had gone too far in the 1980s–taxes were too high and wages too generous. Incomes compared with those of the rest of the wealthy countries were no longer near the top of the tables. Adjustments were made in Sweden, including tax cuts, and conditions improved. But Sweden did not cut taxes or social spending nearly to US levels, or even to those of Britain. To the contrary, social transfers remained a very high proportion of national income, roughly 30 percent of GDP, not including education expenditures. The United States expends only about 13 percent of GDP on such social transfers (Social Security, Medicare, unemployment insurance, housing and poverty).

Yet with such high levels of social transfers, the growth rate of GDP per person in Sweden from the mid-1990s was as high through the mid-2000s as the growth rate of the United States or most European nations–many of which equaled America’s GDP growth rate per capita during this period (which included the Clinton boom years).

The average compensation for manufacturing workers in Sweden is about equal to that of America. (To make the wages comparable in this example, they are adjusted for what is called purchasing power parity–the amount of goods and services the wage actually buys.) Sweden’s productivity, which many economists argue is inevitably damaged by high levels of social transfers, has not fallen off the table. It is about 87 percent of America’s level. Although America’s productivity is 15 percent higher than the average of nations in the Organization for Economic Co-operation and Development (OECD)–the two dozen or so richest nations in the world–it is lower than or at best equal to that of a half-dozen nations with much higher taxes and rates of social spending. Roughly half the OECD countries pay higher or equivalent wages to workers in manufacturing, and almost all provide more benefits than do US companies.

Let us now look at how the changing size of American government has affected US prosperity in recent years. In a 2002 foreword to a new edition of his popular 1962 book Capitalism and Freedom, Milton Friedman wrote that America had at last recognized the damage done by big government. He apparently had the Clinton boom of the late ’90s in mind. But during the Clinton boom, which Friedman implied had to do with less government, tax receipts rose to 20 percent of GDP, much higher than at any time since the final years of World War II. Federal spending–though it grew more slowly under Clinton, largely because of the peace dividend following the cold war and the slower growth of healthcare costs–remained at higher levels than those in the early 1970s, when Friedman was arguing that government was much too big and was bound to stimulate inflation. In the early ’70s, at that level of government spending, inflation was rising rapidly; in the late 1990s, it was falling.

Some still argue, of course, that the 1981 income tax cuts under Reagan produced the Clinton boom. Given that they occurred fifteen years earlier, the claim is farfetched on the face of it. Reagan did not even cut taxes overall. While income taxes were cut, which conservative economists argue should have provided wonderful incentives for economic growth, payroll taxes for Social Security and Medicare were markedly increased. Total taxes as a proportion of GDP were about the same in Reagan’s last year in office as they were in three of the four years of Jimmy Carter’s presidency.

What Reagan did was undermine the impact of regulations, largely failing to enforce or implement many of them. Despite the lower income tax rate and persistent deregulation, productivity growth rates (adjusted for the ups and downs of the business cycle) did not improve under Reagan or his successor, George H.W. Bush. The productivity takeoff began in 1996, not long after the Clinton income tax increase. Harvard economist Martin Feldstein, Republican House leader Dick Armey and others predicted that the tax increase would have the opposite effect.

How did the wealthiest nation in history come to believe for a generation, even when it was prosperous in the late 1990s, that it was not wealthy enough to provide what was needed in a more complex and global society?

In the past, when America required canals, railroads and highways, it financed them. When it needed better and broader education, it provided it. When it needed sewer and sanitation systems, and vaccines to prevent widespread disease, it created them. When unemployment became a fact of industrial life, it insured workers against it. When America was at its best, it did not look back and say, We never did this before so we can’t do it now. Ultimately it did what was necessary.

Part of the nation’s new agenda must be to rid itself of the deep-seated pessimism that it does not acknowledge. Promising a new “morning in America,” Reagan ironically ushered in the age of limits he accused Carter of creating. With Reagan, slow wage growth and high levels of unemployment became accepted. Today’s coming deep recession is a consequence.

America has no free and high-quality daycare or pre-K institutions to nourish and comfort two-worker families, and work and family are undermined as a consequence. College has become far more expensive, and attendance is bifurcated by class: the privileged go to the best colleges, and good jobs are increasingly available only to those who attend the best colleges. Transportation infrastructure has been notoriously neglected. It is decaying and has not been adequately modernized to meet energy-efficient standards or global competition. America has not responded to a new world of high energy costs and global warming. The country has a healthcare system that is out of control, providing inadequate quality at very high prices–specializing in high-technology medicine at the expense of better overall care. And its financial system has run amok. Speculation and financial panic reminiscent of the harsh 1800s has been the result. Most important, average incomes have been flat or only slightly higher for a generation; for men, that has been true since the early 1970s. In the 2000s, compensation for men and women has fallen. As we enter a recession, wages are about to fall sharply.

These facts amount to about as conclusive a proof as history ever provides that the ideology applied in this generation has failed. This was Reagan’s Trojan horse, disguised as optimism. He sent in a plan to reduce help to most Americans under the guise of an ideology of personal responsibility that would ultimately make everyone better off; instead it largely helped an increasingly privileged upper tier. From the economic evidence, history and the performance of other nations, we know the following: if federal, state and local governments absorb another 4 or 5 percent of GDP in America, it will not inhibit growth or undermine entrepreneurial spirit, productivity or prosperity if the spending is well channeled. Government absorbs much more of national income in other nations whose prosperity is the equivalent of or perhaps superior to America’s. If government programs are managed well, they will enhance productivity. A rise in government spending of 5 percent of GDP will raise approximately $750 billion a year for federal, state and local governments to provide protection to workers, finance social programs, maintain an adequate regulatory presence and significantly raise the level of investment in transportation, energy, education and healthcare. Once we emerge from this recession–and only after that–part and perhaps all of this $750 billion can be paid for with higher taxes.

Let’s try to keep the discussion more politically practical, however. If we lower our sights to an additional 3 percent of GDP for new government programs, the nation would have more than $450 billion a year with which to work. Four hundred fifty billion dollars a year could make Social Security entirely solvent by current estimates, with no further reductions in benefits; provide universal pre-K education to America’s 3- to 5-year-olds; and leave enough money to pay two years of tuition for all college students. Thirty billion dollars a year could go a long way toward repairing and updating transportation infrastructure and making it far more energy efficient. Some competent scientists argue that we could transfer the nation from fossil fuel to solar energy for only a little more than that a year.

What seem to many Americans like pragmatic limitations on spending, the proper role of government or responsible fiscal management will very likely someday be seen for what they truly are: a reflection of deep pessimism, the rise in power of vested interests seeking tax cuts and special benefits, and a tragic forgoing of responsibility. Boldness of government does not mean that the right choices will always be made. The Iraq War serves as a supreme and tragic reminder of government activism gone awry. But liberals make errors too, and once a government program has started, it is indeed hard to close down.

This should not be a deterrence. We tolerate wrong choices and a lot of waste in business in order not to suppress its “animal spirits.” And it is hard to shut down businesses as well. Consider the multiple bailouts on Wall Street right now, and also the recent loans to automakers. But the government has been bailing out financial and other firms for many years: Chrysler in the 1970s, Continental Illinois and the savings and loan associations in the 1980s, the creditors of Long-Term Capital Management in the 1990s and so on. Such examples understate the breadth of government bailouts. When the Federal Reserve rapidly loosened monetary policies in 1972, 1987, 1998 and 2001, it did so to bail out the excesses of business as well.

With an annual GDP of $15 trillion, the United States has the resources and capabilities to recapture its energies and optimism. Government can and must be a full partner to business in economic development and a senior partner in the equitable distribution of benefits and true practical freedoms. What history and contemporary examples teach us is that the nation has the capacity to regulate, tax and invest adequately in public goods without undermining the entrepreneurial capacity and material prosperity of the nation.

Granted, attitudes have momentarily turned in favor of financial regulation and government bailouts. But is the attitudinal conversion merely skin-deep? Not only must the nation stem the draining of capital from the financial system; it must also stimulate the economy to raise it from steep and painful recession. Solving the financial crisis will not be enough, and deepening recession will lead to more financial emergencies as homeowners default on more mortgages and even businesses start to default on their debt.

The re-regulation of Wall Street will be a pressing challenge to the newly elected President Obama. But the main challenge will be to provide the stimulus the economy needs to avoid tragedy while investing in America’s healthcare, education, broadband, green-energy technology and transportation–the assets it needs to compete in a more competitive world. We shall see whether we will renounce the bad habit of ideology in favor of the pragmatism America always exhibits in its best moments.