Biden Should Channel His Inner FDR and Soak the Rich

Roosevelt welcomed the hatred of the plutocrats—and won a landslide. Biden should take note.

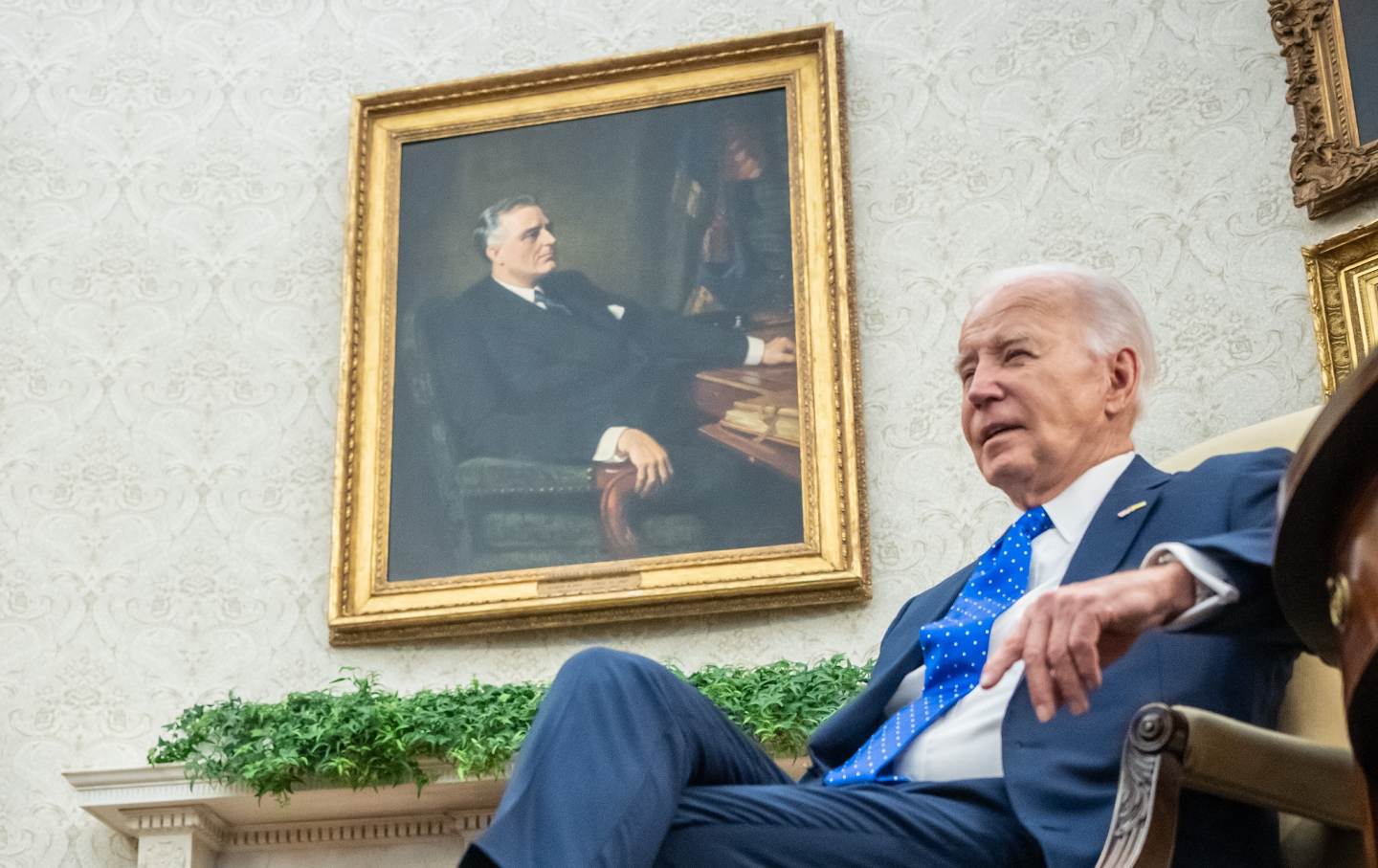

President Joe Biden during a bilateral meeting in the Oval Office on February 9, 2024.

(Michael Kappeler / Picture Alliance via Getty Images)As he prepared to seek a second presidential term in 1936, Franklin Delano Roosevelt introduced the Revenue Act of 1935, a plan to fund the New Deal by taxing the rich. The progressive tax plan came to be known as FDR’s “Wealth Tax,” because it went after up to 75 percent of the income of Americans who were making more than $1 million a year at a time when the great mass of Americans struggled to get by during the lingering Great Depression.

Millionaires and their apologists decried Roosevelt’s “Soak the Rich” strategy. But the president signed the measure into law and campaigned on it in 1936. That was the election during which FDR famously told a crowd at Madison Square Garden that, during his first term:

We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering.

They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.

Never before in all our history have these forces been so united against one candidate as they stand today. They are unanimous in their hate for me—and I welcome their hatred.

The millionaire class of his day did, indeed, hate FDR for his determination to tax them. But the voters loved the idea.

Three days after the “I welcome their hatred” address, Roosevelt was reelected with more than 60 percent of the popular vote and 98 percent of the Electoral College. He won every state in the nation except Maine and Vermont. The landslide secured not just a place in the record books but also an epic mandate to govern with the boldness that the moment demanded.

There were more factors in that sweeping victory than the wealth tax. But Roosevelt and his allies had no doubt that it helped to frame the message for an election that gave Democrats and left-wing Farmer-Laborites, Progressives, and independents who generally aligned with the president’s party more than three-quarters of the seats in the Senate and House.

Now, 88 years later, Joe Biden is running for reelection with a budget plan that includes his own “Wealth Tax.”

Under Biden’s proposed budget for Fiscal Year 2025, which was unveiled on Monday, billionaires would be required to pay at least 25 percent of their income in taxes because, as the White House puts it:

Billionaires make their money in ways that are often taxed at lower rates than ordinary wage income, or sometimes not taxed at all, thanks to giant loopholes and tax preferences that disproportionately benefit the wealthiest taxpayers. As a result, many of these wealthy Americans are able pay an average income tax rate of just 8 percent on their full incomes—a lower rate than many firefighters or teachers. To finally address this glaring inequity, the President’s Budget includes a 25 percent minimum tax on the wealthiest 0.01 percent, those with wealth of more than $100 million.

In addition, the Biden plan restores the top tax rate for the wealthiest Americans to 39.6 percent. When Republicans led by former President Donald Trump lowered that rate to 37 percent in 2017, they created a circumstance where, the White House explains, “This [Republican] rate cut alone is giving a couple with $2 million in annual taxable income a tax cut of more than $30,000 each year.”

Needless to say, the Biden plan, though more modest than Roosevelt’s, is likely to be unpopular with the billionaire class, and its GOP allies in the current Congress. House Speaker Mike Johnson (R-La.) has already dismissed Biden’s budget, which also includes plans to make billion-dollar corporations pay their fair share, as “a road map to accelerate America’s decline.”

So Biden won’t get to implement a “soak the rich” agenda before the election, as FDR did. But he’ll still get the hatred. And he should still embrace it.

Johnson and the rest of the House Republican leadership team announced Monday, “The price tag of President Biden’s proposed budget is yet another glaring reminder of this Administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility.”

As it turns out, Biden is the fiscally responsible candidate. His plan puts the tax burden where it belongs, raises needed revenue, and outlines an agenda for strengthening Social Security, Medicare, and Medicaid. Trump, on the other hand, responded on Monday to a CNBC question about Social Security and Medicare by saying, “There is a lot you can do in terms of entitlements in terms of cutting and in terms of also the theft and the bad management of entitlements, tremendous bad management of entitlements.”

A Business Insider report on the Republican former president’s statement began, “Donald Trump on Monday handed President Joe Biden a gift while calling in to CNBC.”

Biden accepted the gift gratefully, telling a New Hampshire crowd, “Even this morning, Donald Trump said cuts to Social Security and Medicare are on the table again. I’m never going to allow that to happen.”

So the battle lines are drawn, and Biden’s got the advantage, if he leans into it. He should channel his inner FDR, welcome the hatred of the billionaire class, laugh off Johnson’s feeble complaints, and unapologetically announce that, if he wins reelection and gets a Congress he can work with, he will tax, tax, tax the rich.

Popular

“swipe left below to view more authors”Swipe →There’s no risk and everything to gain politically. According to a Navigator Research poll from last month, 79 percent of registered voters favor higher taxes on billionaires and corporations. Only 16 percent are opposed. Democrats favor wealth taxes on billionaires by a 94-2 margin, independents by a 78-15 margin, Republicans by a 63-30 margin.

“Taxing the rich is extremely popular,” says Amy Hanauer, the executive director of the Institute on Taxation and Economic Policy. “It’s both good policy and good politics.”

FDR knew that. And so, it appears, does Joe Biden.

Thank you for reading The Nation!

We hope you enjoyed the story you just read, just one of the many incisive, deeply-reported articles we publish daily. Now more than ever, we need fearless journalism that shifts the needle on important issues, uncovers malfeasance and corruption, and uplifts voices and perspectives that often go unheard in mainstream media.

Throughout this critical election year and a time of media austerity and renewed campus activism and rising labor organizing, independent journalism that gets to the heart of the matter is more critical than ever before. Donate right now and help us hold the powerful accountable, shine a light on issues that would otherwise be swept under the rug, and build a more just and equitable future.

For nearly 160 years, The Nation has stood for truth, justice, and moral clarity. As a reader-supported publication, we are not beholden to the whims of advertisers or a corporate owner. But it does take financial resources to report on stories that may take weeks or months to properly investigate, thoroughly edit and fact-check articles, and get our stories into the hands of readers.

Donate today and stand with us for a better future. Thank you for being a supporter of independent journalism.

Thank you for your generosity.

More from The Nation

The Student Protesters Are Demonstrating Their Bravery, Not Antisemitism The Student Protesters Are Demonstrating Their Bravery, Not Antisemitism

The real threat to American Jews comes not from students but from the MAGA Republicans who are shouting about antisemitism the loudest.

Famine as Weapon of Mass Destruction Famine as Weapon of Mass Destruction

Gaza now.Visit World Central Kitchen, International Rescue Committee, Save the Children, and Doctors Without Borders to help.

The Supreme Court Rules That Cops Can Steal Your Stuff—as They Always Have The Supreme Court Rules That Cops Can Steal Your Stuff—as They Always Have

By a 6-3 vote, the conservative justices decided that there is no need for the state to provide a preliminary hearing in civil forfeiture cases.

Protests Rise and Opinions Divide Protests Rise and Opinions Divide

Do calls to free Palestine = antisemitism?

Antisemitism, Then and Now: A Guide for the Perplexed Antisemitism, Then and Now: A Guide for the Perplexed

President Biden’s remarks at the Holocaust Memorial Museum’s Days of Remembrance betrayed a total misunderstanding of what antisemitism actually is—and how it must be resisted.

A New Jewishness Is Being Born Before Our Eyes A New Jewishness Is Being Born Before Our Eyes

The future of our people is being written on campuses and in the streets. Thousands of Jews of all ages are creating something better than what we inherited.