Economy

Fellow Freelancers: Don’t Marry Rich, Organize! Fellow Freelancers: Don’t Marry Rich, Organize!

The problem is systemic: Freelance life is underpaid. The solution must be systemic too.

The “Troublemakers” of the Labor Movement Gather in Chicago The “Troublemakers” of the Labor Movement Gather in Chicago

The Labor Notes conference explodes, with growing ranks of unionists, new organizers taking on goliaths like Amazon and Starbucks, and veterans invigorated by reform victories.

A Better Two-State Solution—Plus, the UAW’s Victory A Better Two-State Solution—Plus, the UAW’s Victory

Podcast / Start Making Sense / Apr 24, 2024 A Better Two-State Solution—Plus, the UAW’s Victory On this episode of Start Making Sense, May Pundak explains the vision of…

Start Making Sense / Podcast / Start Making Sense

Without Expanded DACA Protections, Undocumented Students Are Being Left Behind Without Expanded DACA Protections, Undocumented Students Are Being Left Behind

Around 80 percent of the nearly 120,000 undocumented students who graduated high school in 2023 don’t qualify for DACA.

Policy

The “Troublemakers” of the Labor Movement Gather in Chicago The “Troublemakers” of the Labor Movement Gather in Chicago

The Labor Notes conference explodes, with growing ranks of unionists, new organizers taking on goliaths like Amazon and Starbucks, and veterans invigorated by reform victories.

Here’s What a 21st-Century Rural New Deal Looks Like Here’s What a 21st-Century Rural New Deal Looks Like

A strategy for building a rural-urban working-class coalition.

Republicans Are No Friends to Working People Republicans Are No Friends to Working People

If you work for a living, or if you know and love people who do, there’s a lot on the line in this year’s election.

Labor

Fellow Freelancers: Don’t Marry Rich, Organize! Fellow Freelancers: Don’t Marry Rich, Organize!

The problem is systemic: Freelance life is underpaid. The solution must be systemic too.

The “Troublemakers” of the Labor Movement Gather in Chicago The “Troublemakers” of the Labor Movement Gather in Chicago

The Labor Notes conference explodes, with growing ranks of unionists, new organizers taking on goliaths like Amazon and Starbucks, and veterans invigorated by reform victories.

A Better Two-State Solution—Plus, the UAW’s Victory A Better Two-State Solution—Plus, the UAW’s Victory

Podcast / Start Making Sense / Apr 24, 2024 A Better Two-State Solution—Plus, the UAW’s Victory On this episode of Start Making Sense, May Pundak explains the vision of…

Start Making Sense / Podcast / Start Making Sense

As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off

Human Rights Watch just let go of 39 staffers. Workers are demanding executives take pay cuts instead

The Use of “Attention Capture” Technologies in Our Classrooms Has Created a Crisis The Use of “Attention Capture” Technologies in Our Classrooms Has Created a Crisis

We have a choice: We can allow Big Tech to solve the problem with invasive brain technology. Or we can let educators teach students how to pay attention.

The Score

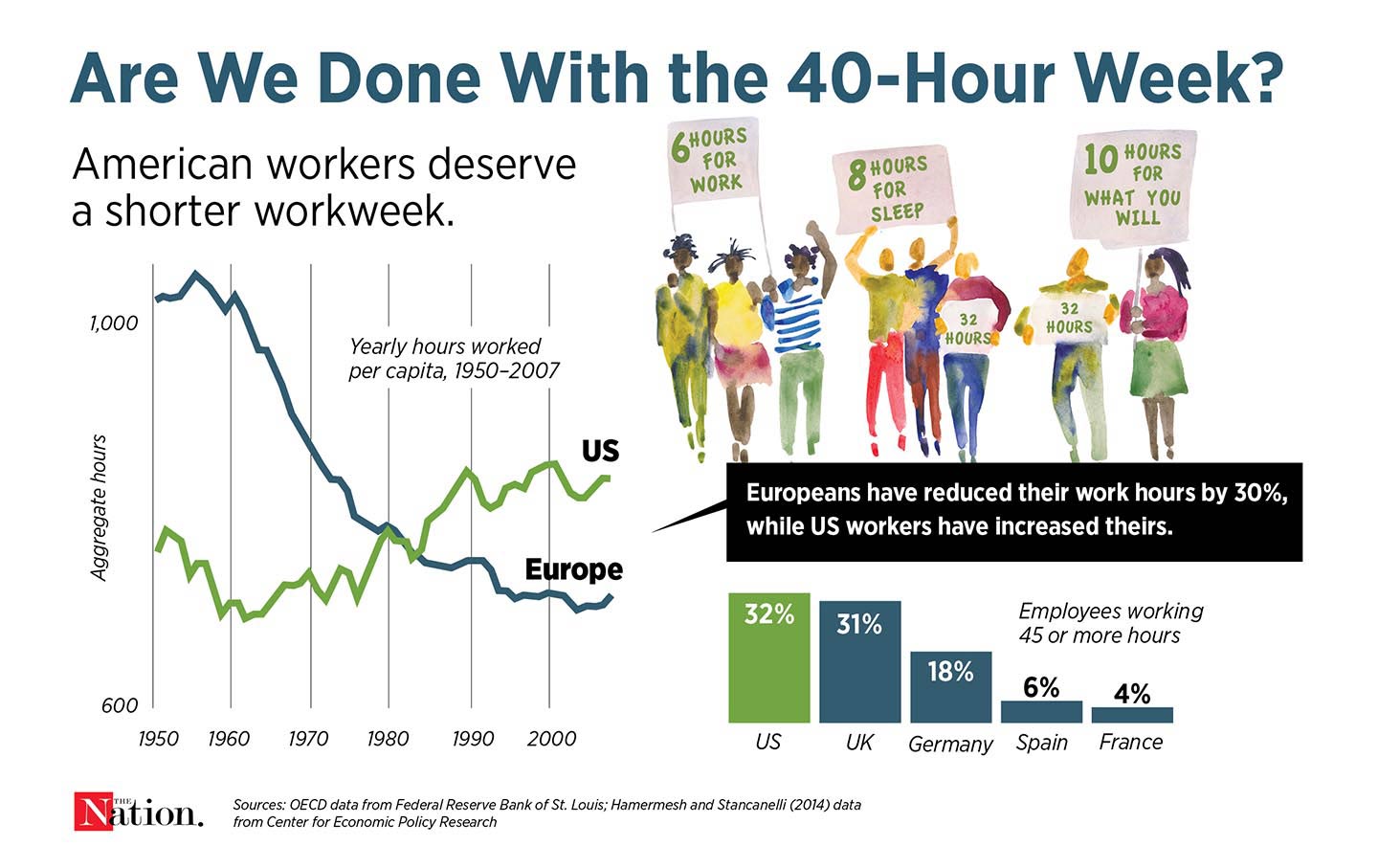

You Deserve a 4-Day Workweek You Deserve a 4-Day Workweek

It’s time for Americans to claw their lives back from work.

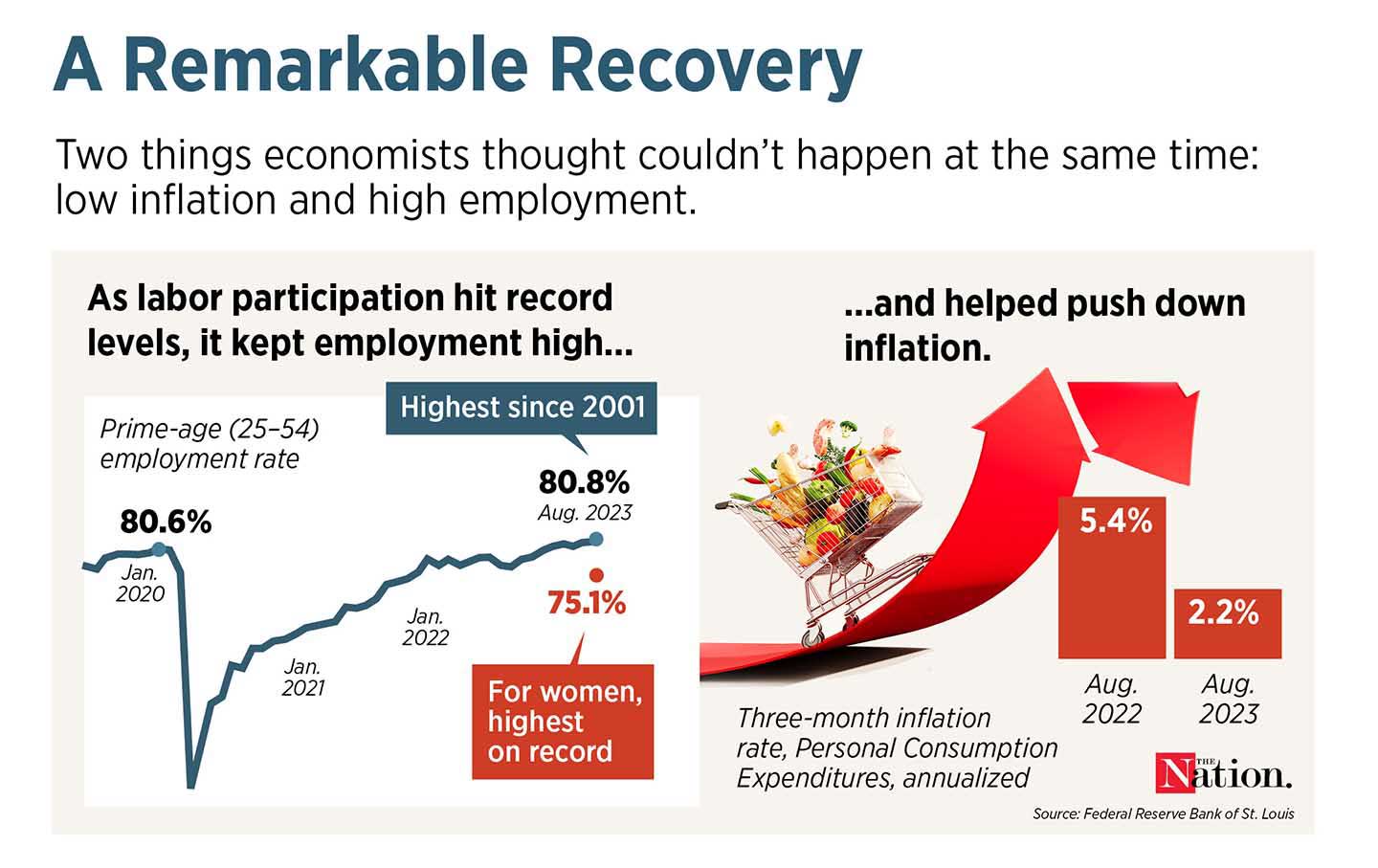

Too Many Economists Thought This Was Impossible Too Many Economists Thought This Was Impossible

The increase in the number of people working has helped tamp down inflation and has shown the importance of aiming for full employment.

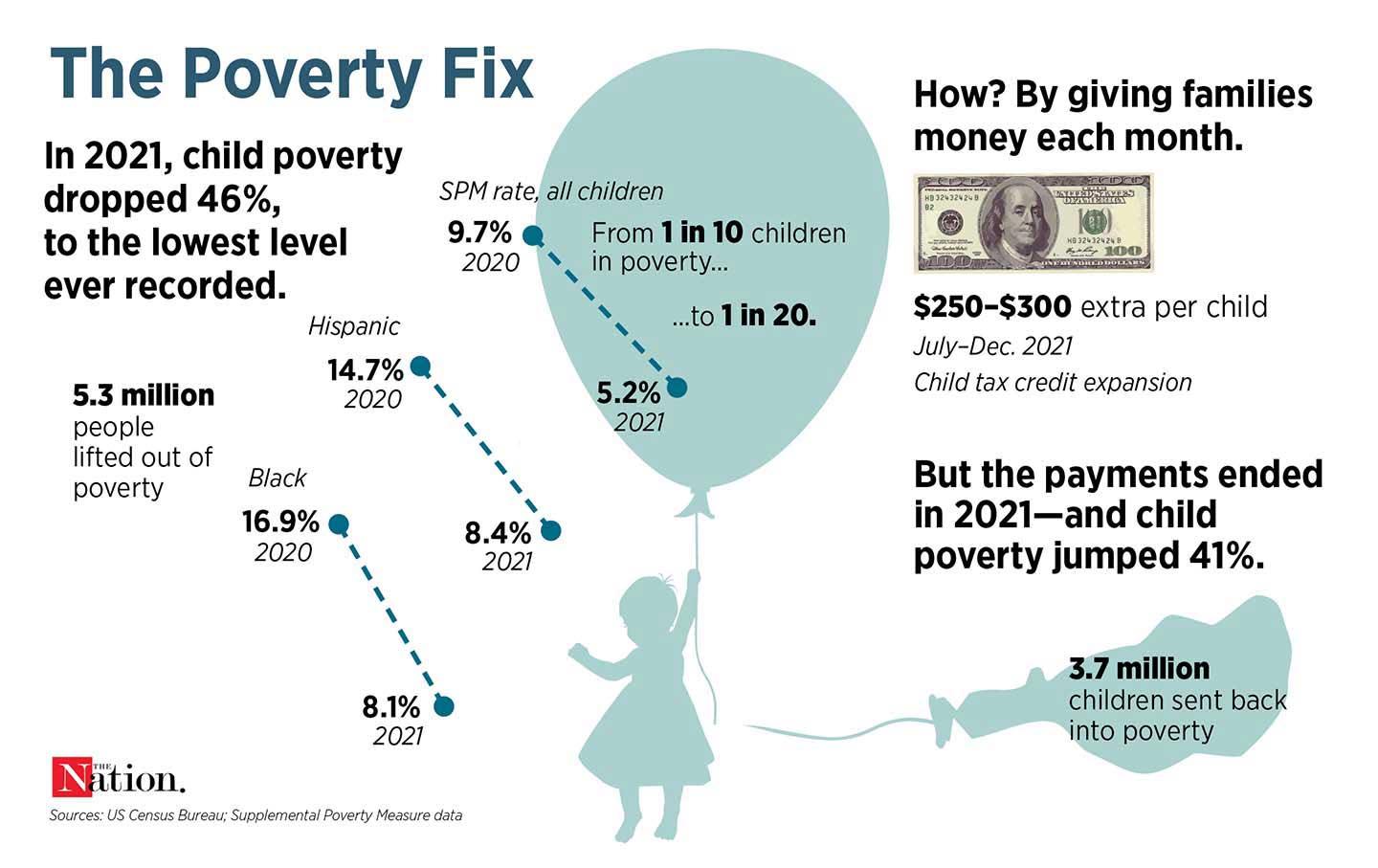

We Have the Solution to Child Poverty. Republicans Are Blocking It. We Have the Solution to Child Poverty. Republicans Are Blocking It.

The expansion of the child tax credits under the American Rescue Plan halved child poverty. When the policy ended, child poverty shot back up.

Latest in Economy

This Earth Day, It’s Time to Make Polluters Pay This Earth Day, It’s Time to Make Polluters Pay

The costs of climate change are falling on those least responsible. This year, we must ask our elected officials for more than just flimsy commitments to sustainability.

Apr 22, 2024 / StudentNation / Ilana Cohen

The EEOC Has Released New, Much-Needed Protections for Pregnant Workers The EEOC Has Released New, Much-Needed Protections for Pregnant Workers

The Pregnant Workers Fairness Act obligates employers to enable pregnant people to work safely and to grant them unpaid but job-protected leave for pregnancy-related absences.

Apr 15, 2024 / Bryce Covert

The Only Thing Worse Than Taking Rural Voters for Granted The Only Thing Worse Than Taking Rural Voters for Granted

… is dismissing them as out of reach for Democrats.

Apr 15, 2024 / Editorial / Erica Etelson and Anthony Flaccavento

O.J. Simpson Proved That With Enough Money You Can Get Away With Murder O.J. Simpson Proved That With Enough Money You Can Get Away With Murder

The accused killer won and lost in court depending on his bank account.

Apr 12, 2024 / Jeet Heer

These Americans Won’t Pay for the War on Gaza These Americans Won’t Pay for the War on Gaza

As the Biden administration continues to give weapons to Israel, thousands of people across the country are protesting by refusing to pay their taxes.

Apr 12, 2024 / Lucy Dean Stockton

Transatlantic Tragedy: “Grenfell” Moves from Britain’s National Theatre to a Brooklyn Stage Transatlantic Tragedy: “Grenfell” Moves from Britain’s National Theatre to a Brooklyn Stage

An interview with Gillian Slovo, whose new play about the survivors of the Grenfell Tower fire in London just opened in New York.

Apr 12, 2024 / Feature / D.D. Guttenplan