We Have the Solution to Child Poverty. Republicans Are Blocking It.

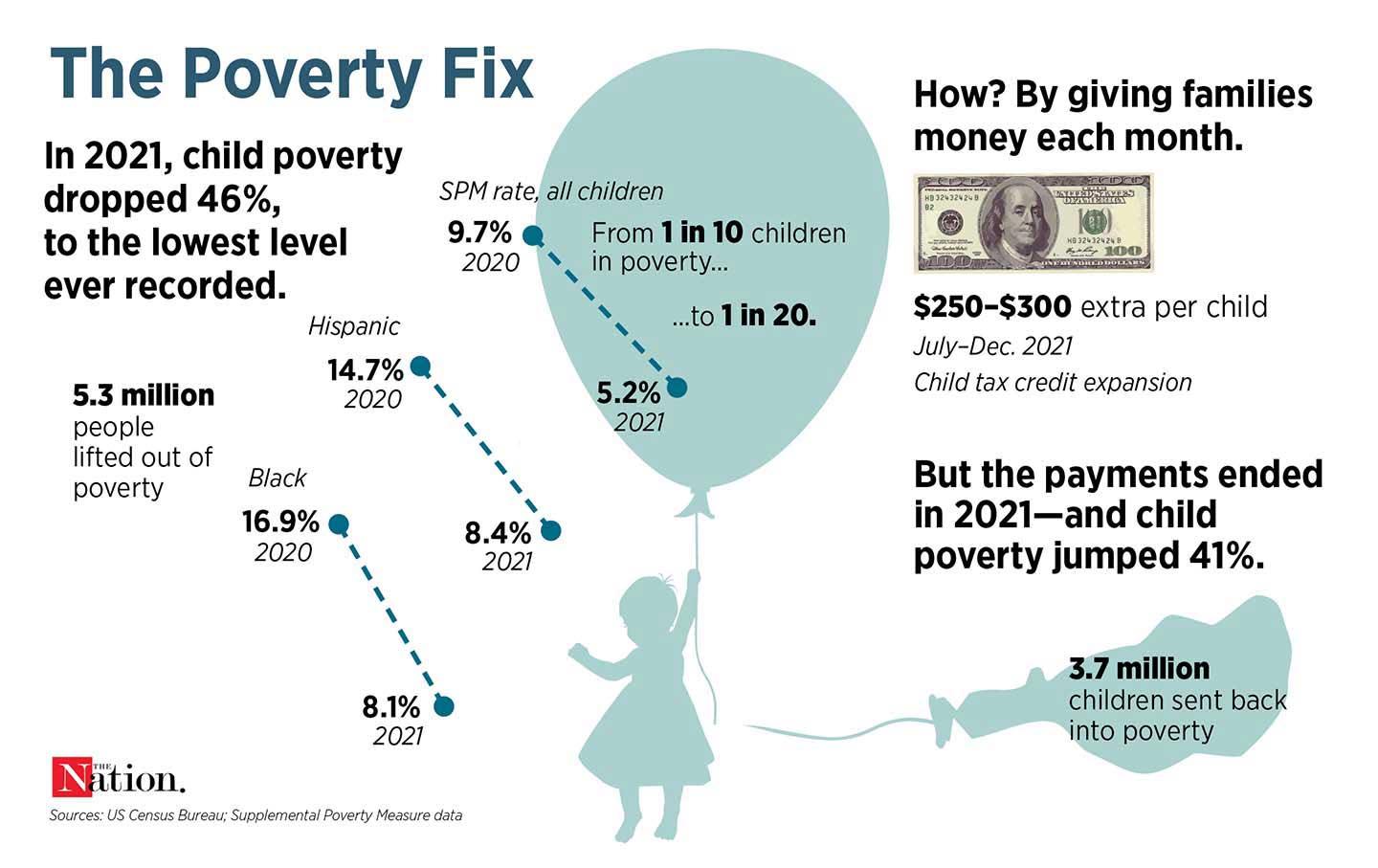

The expansion of the child tax credits under the American Rescue Plan halved child poverty. When the policy ended, child poverty shot back up.

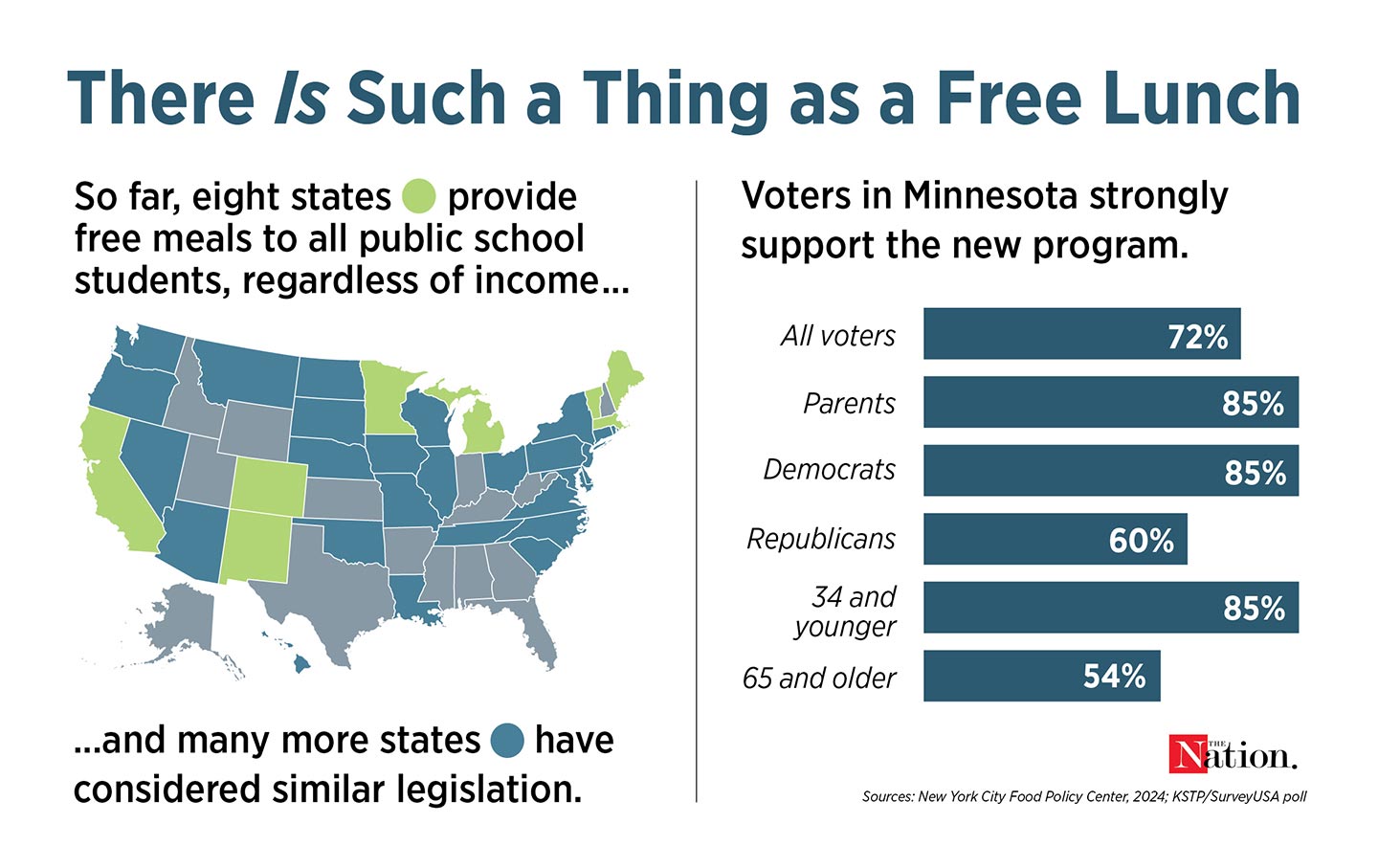

This year, 11 states either created a state-level child tax credit or beefed up an existing one. Minnesota led the pack. It didn’t just establish a new, permanent credit; it now boasts the country’s most generous one, offering families who earn less than $35,000 as much as $1,750 a year for each child under the age of 17.

These states are enacting a policy that has been an irrefutable success. In 2021, the country embarked on a remarkable, if short-lived, experiment in addressing child poverty. Democrats included a bigger federal child tax credit, to be paid out monthly to all low-income families, in the American Rescue Plan. President Joe Biden signed the legislation into law in March 2021, and starting in July of that year, eligible families received up to $300 a month for each child under the age of 6 and up to $250 for older ones.

The payments immediately reduced hunger and hardship. After checks went out, hunger among households with children dropped from 11 percent of families to 8 percent—and it didn’t change for childless ones. By August, hunger had fallen by 25 percent; families had less food insecurity and fewer medical hardships and were better able to afford their bills. It also allowed more families to remain housed and to stop doubling up in homes. The payments helped reduce the number of babies with low birth weights and increased maternal health. They also improved recipients’ mental health.

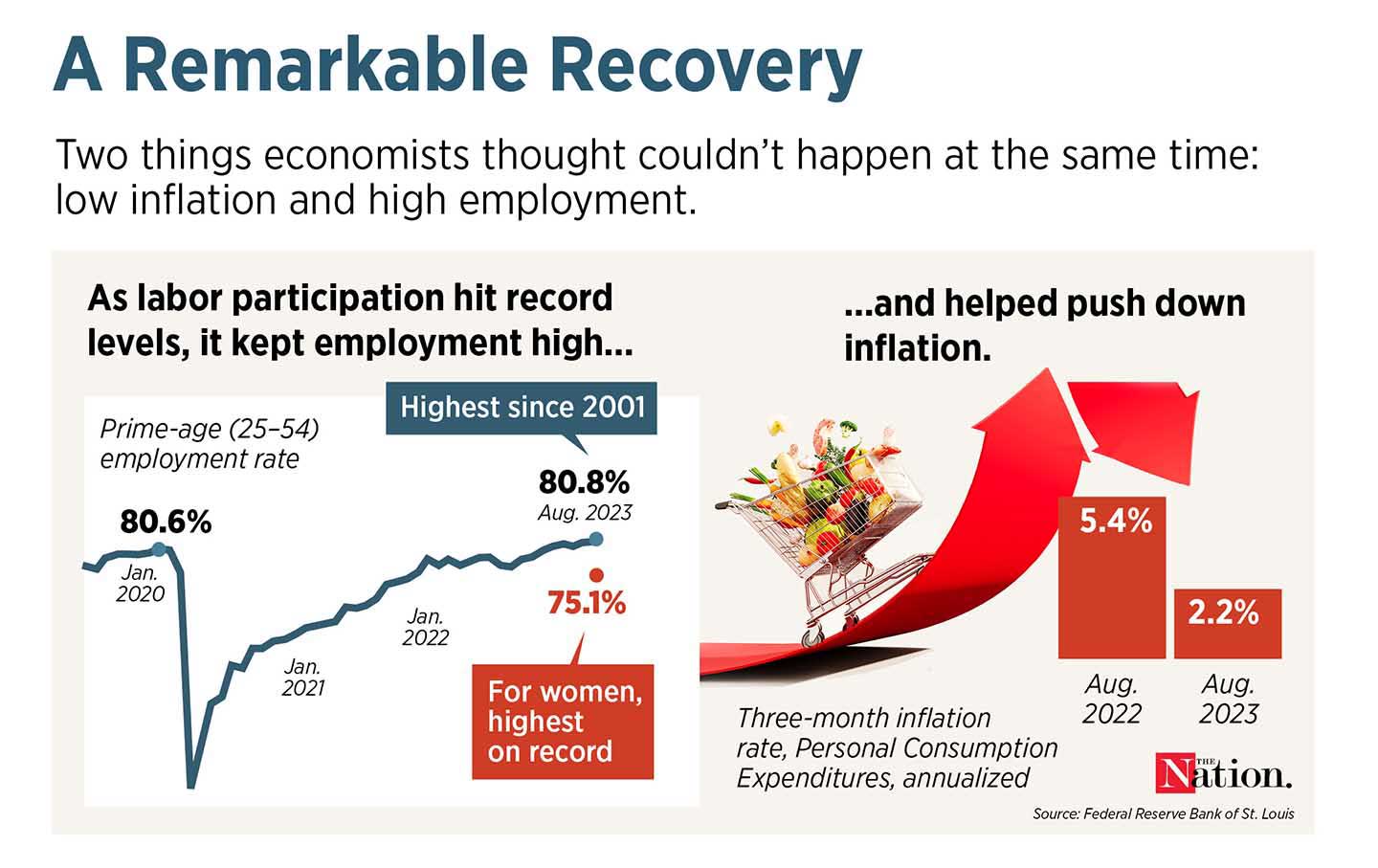

By the time the last payment was issued in December 2021, the money was keeping 3.7 million children out of poverty, a 30 percent reduction in the monthly child poverty rate. When government benefits like the child tax credit payments are taken into account, child poverty fell in 2021 to the lowest level on record, dropping 46 percent from the year before even as the pandemic roiled the economy. The payments drove the decline: They lifted 5.3 million people out of poverty. The effects were even more dramatic for children of color: The payments brought the families of nearly 2 million Black and Hispanic children above the poverty line.

Some economists worried that families would hoard or misspend the money, reducing the economic impact of the policy. Instead, they spent it on food, housing, and other things for their children like education.

The payments also ginned up fears that lazy parents would stop working thanks to the influx of government largesse. The alarm was unfounded: A number of studies looked at the question and concluded that the credits did not have an impact on how much or whether people worked. In fact, one study found that the checks actually allowed some parents to work more. They may have been able to afford a new outfit for interviews or gas to get to work.

Tragically, the country allowed this wildly successful experiment to end. The expansions to the child tax credit were designed to last only through the end of 2021, under the assumption that Congress would extend them if they worked. But lawmakers haven’t reinstated them, and the monthly payments have disappeared.

The positive outcomes ended just as quickly as the checks did. The child poverty rate jumped 41 percent in January 2022, reaching its highest rate since the end of 2020. Hunger rose 25 percent, and more families struggled to afford the necessities. One survey found that a third of former recipients were eating less and a quarter were skipping meals. “I don’t know how I will pay my bills,” one parent said. “I’m going to cut out on certain meals,” another said.

Not everyone in Congress has lost sight of what could have been. In June, Representatives Rosa DeLauro, Suzan DelBene, and Ritchie Torres reintroduced the American Family Act to make the expanded version of the child tax credit permanent. But Republicans haven’t gotten on board. They stood in unison to prevent Democrats from passing it in 2022. The bill has more than 200 cosponsors, all Democrats. Even the few Republicans who want to increase the child tax credit insist on adding work requirements that would exclude the poorest families. Our radical experiment in reducing child poverty worked spectacularly well. But with one party opposed, it stands little chance of becoming a lasting reality.