Senator Menendez Is Just the Latest Sucker to Fall for Fool’s Gold

While most celebrity goldbugs are on the far right—the list includes Steve Bannon, Glenn Beck, Candace Owens, Ron Paul, and Jordan Peterson—Democrats are not immune from the strange charms of this economic delusion.

Senator Menendez Is Just the Latest Sucker to Fall for Fool’s Gold

While most celebrity goldbugs are on the far right—Steve Bannon, Glenn Beck, Candace Owens, Ron Paul…—Democrats are not immune from the strange charms of this economic delusion.

When Steve Bannon isn’t trying to get Donald Trump back into the White House, he’s busy hawking gold. But then the two projects are essentially the same: nostalgic sales pitches to anxious seniors who rely on exciting, apocalyptic right-wing nightmares on a regular basis. Since June 2020, Bannon’s podcast has been sponsored by Birch Gold, a nifty arrangement that unites politics and financial interest. The merger of pseudo-journalism and salesmanship could be seen in a March 2021 episode in which Bannon talked to a Birch Gold spokesman, Phillip Patrick. Bannon warned of the “coming inferno” that was ready to ignite because of Joe Biden’s alleged mismanagement of the economy, with high spending and deficits inevitably leading not just to inflation but to the possible end of the US dollar as the world’s reserve currency. In a typical Bannon move, the former Trump adviser even echoed some arguments that have traction on the left, notably the idea that the BRICS countries (Brazil, Russia, India, China, and South Africa) are on the cusp of shaking off US financial dominance. All of this doom and gloom is not just designed to rally GOP voters for a Trump-Biden rematch; it’s also a sales pitch for gold, a product Bannon touts in commercials and even in a 2022 booklet, the ominously titled The End of the Dollar Empire.

In mainstream journalism, this merging of punditry and product placement would be considered an ethical lapse. Even Fox News, a network not famous for being scrupulous about media ethics, became concerned in 2009 when its then-host Glenn Beck, who was being sponsored by Goldline (a company Beck praised as “the people I trust”), made a hard-sell argument for buying gold. Beck told his viewers that to survive Barack Obama’s evil regime, they needed the protection of the “Three G’s”: God, gold, and guns. Fox pushed Goldline to clarify that Beck, who had been described on Goldline’s website as a “paid spokesman,” wasn’t in fact directly given money for his advocacy.

Bannon and Beck are not alone in having murky ties to gold boosterism—or as critics of the shiny metal call it, goldbuggery. In July 2023, The Washington Post reported on the controversy surrounding a company called Lear Capital, which sells gold coins as a retirement investment, often to elderly clients. According to the newspaper, “While the legitimacy of the gold retirement investment industry is the subject of numerous lawsuits—including allegations of fraud by federal and state regulators against Lear and other companies—its advertising has become a mainstay of right-wing media.” Ads for Lear are a staple on Fox News, among other right-wing venues.

As Axios reported in 2021, “With inflation rising and Congress pumping out massive spending bills, conservative media have focused renewed attention on financial issues—and lent significant airtime to some of the very companies underwriting their shows.” Axios cited the conservative journalist Ben Shapiro as well as Bannon as having ties to Birch Gold. A fuller list of Birch Gold endorsers reads like the guest list for a Donald Trump birthday bash: Ron Paul, Candace Owens, Dinesh D’Souza, Michael Savage, Jordan Peterson, Ben Carson, and many more.

These MAGA metal peddlers have the ears not just of the credulous consumers of right-wing media but also of many politicians, especially in red states. In recent years there’s been a flurry of state-level activity, with Virginia, Tennessee, Missouri, Ohio, and Arkansas removing the sales tax on gold and silver coins, bars, and rounds, partly on the argument that these metal objects are currency. Wyoming has passed a bill authorizing the state treasury to have a stock of gold and silver and also allowing the state to be paid in those metals in certain circumstances. A lawmaker in Tennessee is pushing for the creation of an in-state bullion depository (to serve as a backup currency and as a barrier to any federal expropriation of the sort Franklin Roosevelt ordered in 1933). These moves seem quixotic because the US Constitution bars states from issuing their own currency. They are best understood instead as attempts to create the preconditions for the long-held right-wing dream of returning to the gold standard.

In 2016, Trump cagily tried to harness the GOP’s gold mania by gesturing toward goldbuggery without fully committing to it. “Bringing back the gold standard would be very hard to do, but, boy, would it be wonderful,” Trump enthused. “We’d have a standard on which to base our money.” Like many Trump statements, it displays some cunning ambiguity. But Trump did nominate goldbug Judy Shelton to the Federal Reserve, an appointment that stalled when even some Republican senators balked at her radicalism.

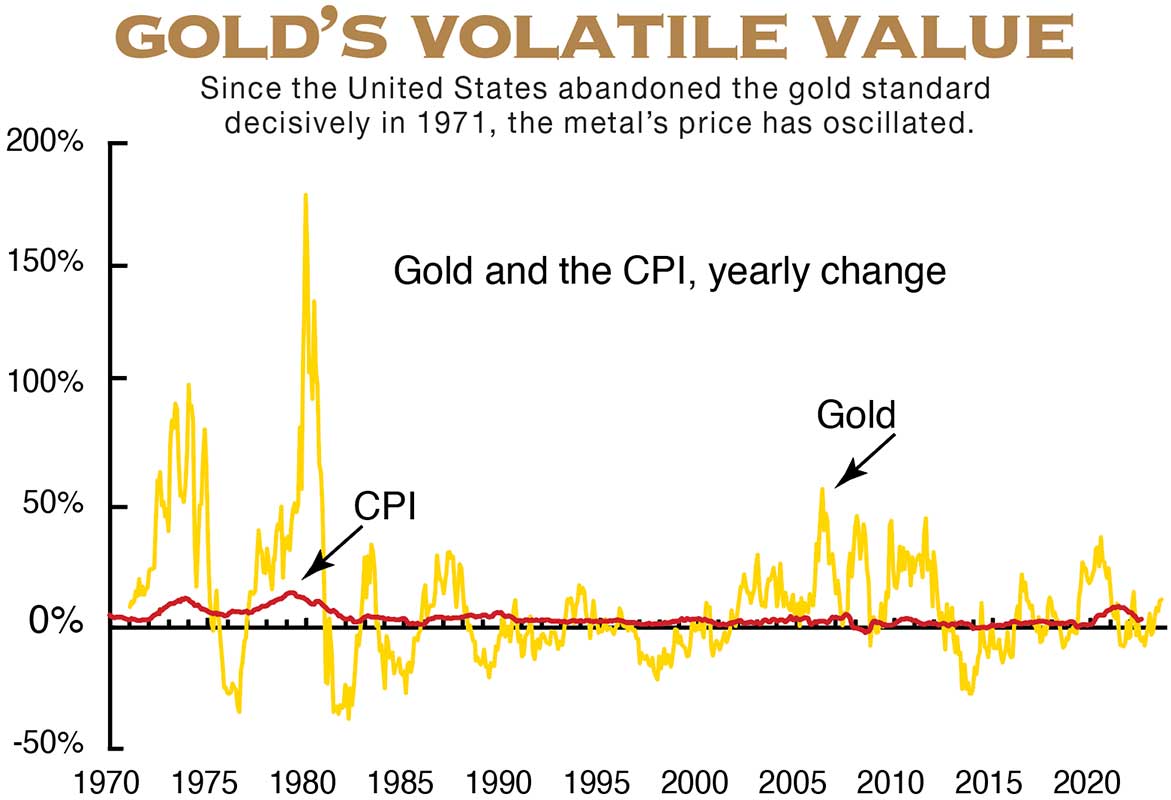

Goldbuggery is on the upswing. The current rebirth of shiny-metal fetishism is strange, though. As a practical matter, the most common financial argument for gold—that it’s a hedge against inflation—doesn’t hold water. Gold peaked in August 2020 at $2,035.55. Three years later, it stands at $1,936.56. Given the post-Covid spike in inflation, anyone who invested in gold on Bannon’s advice has lost ground. Even among the cranky right, gold now has a formidable digital competitor in the form of bitcoin, which promises to do everything that gold allegedly does: act as a store of value beyond the reach of governments or inflation (though the rising price of bitcoin probably has more to do with irrational exuberance than with anything intrinsic to the cryptocurrency). Superficially, gold and bitcoin seem like radically divergent alternative currencies. The whole appeal of gold is that it is solid as can be, hard to destroy, and, with its value as a piece of metal, possesses all sorts of extrinsic uses (from jewelry to dental fillings to transistors). Bitcoin, by contrast, is as intangible as a mathematical formula. What unites the two is that they are both finite—and thus beyond the scope of any government to newly mint, as can be done with fiat money.

Even Ronald Reagan, an earlier and ardent admirer of the gold standard, found it hard to rally the requisite team of economic experts to attempt a hard-metal restoration, since there was no consensus among GOP economists as to whether a gold standard was desirable or even how to implement one. Still, Bannon and Trump shocked the world once by winning the presidency in 2016. Will gold restoration be their second act?

The far right’s love affair with gold is an old story, but it’s a passion that has been rekindled in the Biden era. In his deeply researched book One Nation Under Gold (2017), the journalist James Ledbetter demonstrates that for the first century and a half of American history, gold polarized our politics into hard-money factions (who favored the interests of rich creditors—and states’ rights) and soft-money advocates (who skewed toward the concerns of debtors and believers in a more expansive national government—most famously the perennial populist presidential candidate William Jennings Bryan).

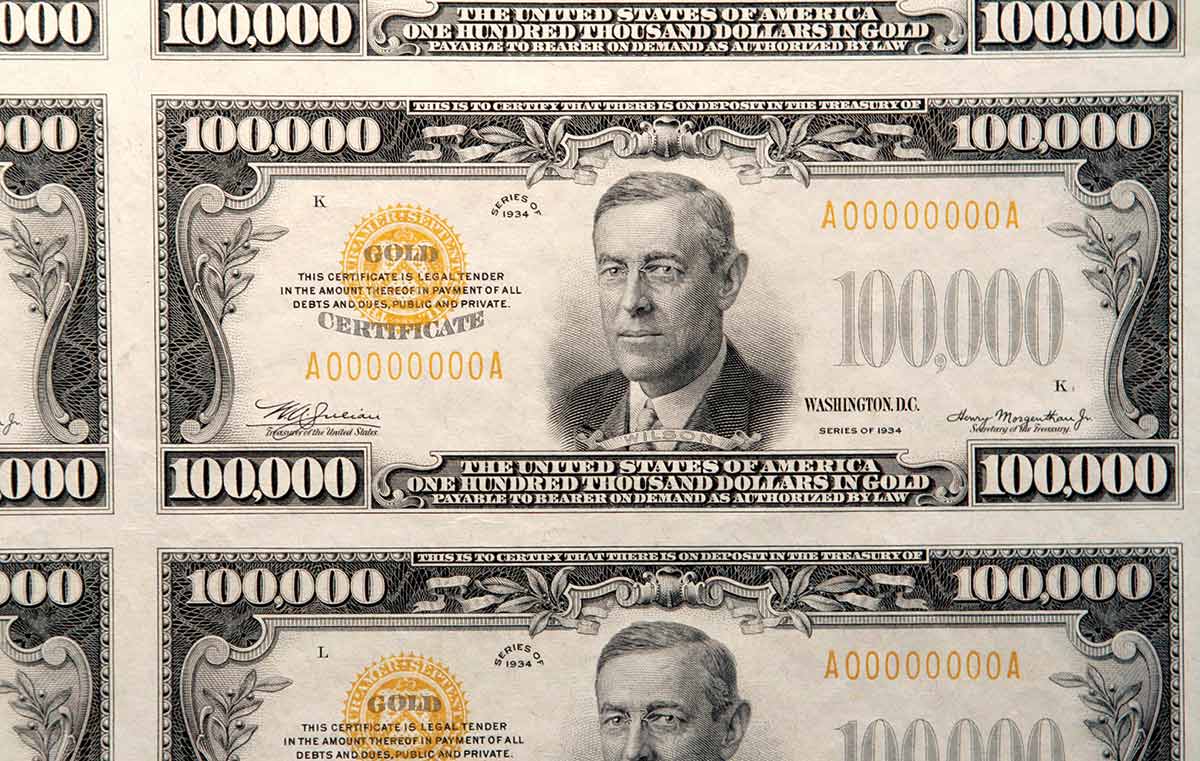

A pivot point came in 1933, when President Franklin D. Roosevelt took the United States off the gold standard and outlawed the private ownership of gold as a way to prevent hoarding during the Great Depression. This generated a backlash, which Ledbetter argues created “a permanent political coalition deeply opposed to [Roosevelt’s] view of the federal government, using gold as its central symbol and occasionally veering into the politics of conspiracy and hate.” Gold bricks are thus part of the very building blocks of the modern American right.

FDR’s move was only temporary: In 1934, the United States returned to a partial gold bullion standard (with the government setting the price of gold). This type of gold management—with some portion of US currency backed by gold—was codified in 1944 at the Bretton Woods conference, which established the International Monetary Fund and the World Bank. The Bretton Woods system was always a hodgepodge, with the promise of partial gold payment for US dollars hedged by backdoor manipulation of the price of gold by central banks in Europe and North America. But the combined financial pressures of Lyndon Johnson’s Great Society programs and Vietnam War military budgets finally led Richard Nixon to formally abandon the gold standard in 1971.

Initially a hobbyhorse of wealthy investors and inveterate FDR haters, the cause of gold-standard restoration slowly gained intellectual clout thanks to the advocacy of libertarian economists such as Murray Rothbard (the author of the influential 1963 tract What Has Government Done to Our Money?) and Alan Greenspan (who in 1966 wrote an essay arguing for the superiority of the gold standard in a newsletter published by his philosophical guru, Ayn Rand). But while Rothbard and Greenspan fought in the abstract realm of theory, the real battle for gold was waged among the right-wing masses by apocalyptic investment advisers who flamed the threat of doomsday to sell metals.

Popular

“swipe left below to view more authors”Swipe →In 1970, Harry Browne, a financial tout who later ran twice as a presidential candidate for the Libertarian Party, wrote the massively successful bestseller How You Can Profit From the Coming Devaluation. Browne was right that inflation was a looming threat at the time (thanks in no small part to the financial shenanigans of Lyndon Johnson and Richard Nixon as they tried to hide the costs of the Vietnam War from the public). And like many other works of that tumultuous era, Browne’s book had the whiff of Armageddon. He advised not just buying gold to protect against inflation but burying it in the ground. Readers were also told to take survivalist measures, buying rural retreats with a year’s supply of goods, in order to have “freedom from the chaos and rioting that would accompany runaway inflation.”

On the plus side, Browne was confident that the complete collapse of the social order would offer the properly prepared “an opportunity to new wealth.” The prepper mentality of antisocial selfishness persists today. In 2017, The New Yorker profiled this breed of über-rich gold obsessives, including the head of an investment firm who had “an underground bunker with an air-filtration system.” He claimed that “a lot of my friends do the guns and the motorcycles and the gold coins.”

Brian Doherty, an editor at the libertarian magazine Reason and the author of Radicals for Capitalism: A Freewheeling History of the Modern Libertarian Movement (2007), notes that “gold in the libertarian imagination was very connected with this sense of crisis and collapse.” He describes the belief that “your money is going to be worthless, everything is going to be worthless. The only thing that matters is the lead in your gun and the gold in your yard.”

Browne was in many ways a precursor to Bannon and his ilk—not least in also taking money from the firms he promoted as investments. He was a strong advocate for Pacific Coast Coin Exchange. A Securities and Exchange Commission investigation revealed that Browne was the director of marketing for PCCE and received $100,000 in commissions in the early 1970s—a fact undisclosed to his many readers. In 1974, the New York State attorney general described PCCE’s actions as a “colossal fraud.” The company sold gold coins that it claimed were in its depository but that in fact never existed. In 1975, the legal scholar James C. Treadway Jr. concluded that “a between-the-lines reading of the allegations indicates that a Ponzi [scheme] probably existed.”

As Ledbetter documents in his book, this type of fraud is all too common in the gold commodity world, which considers loose regulation a feature, not a bug.

There’s a parallel level of intellectual fraud as well, since gold is both an investment opportunity and an ideological cause. But the Republican Party has long played a shell game on this issue, uttering goldbug sentiments to stir the base while keeping policy securely in the hands of Wall Streeters who know there is no plausible path for a return to gold.

The Republican hypocrisy can best be seen in the 1982 Report to the Congress of the Commission on the Role of Gold in the Domestic and International Monetary Systems—a commission convened to placate the goldbug faction. On the stump, at least, President Ronald Reagan often preached the goldbug gospel. Another goldbug, the notorious conspiracy nut and extremist Lyndon Larouche, submitted a statement to the commission. Congressman Ron Paul, for whom gold and opposition to the Federal Reserve were career-long obsessions, was among the commission’s members.

But all this pro-gold sentiment was just for show. Reagan’s chief of staff, Donald Regan, and his secretary of state, George Shultz, were opposed to any return to the gold standard. Reagan adviser Murray Weidenbaum claimed that his role on the commission was a “damage-limitation function or the avoidance of economic harm.” The eminent economist Anna Schwartz, the executive director of the commission, claimed that it was hobbled by the fact that the Reagan administration had no intention to return to the gold standard.

On the gold standard, Republicans say one thing to stir up voters—and do another when holding office. This is true even of their intellectuals. In his 1966 essay, Alan Greenspan insisted that “an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade.” Greenspan also provided a clue as to why the right loves the gold standard, noting that “the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state).” In his ringing conclusion, Greenspan insisted, “Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.”

Yet even in this fervent essay, Greenspan hedges, noting that “a fully free banking system and fully consistent gold standard have not yet been achieved.” In other words, to paraphrase many discussions of socialism, true goldbuggery has never been tried. Among those who would never try it was Greenspan—despite serving as chairman of the Federal Reserve under four presidents.

Rothbard was similarly theoretical in his advocacy, making the axiomatic claim that only privately created coins are true money, with fiat money (currency issued by a government without any exchange value of its own) always a fiction. “Government is powerless to create money for the economy,” Rothbard insisted; “it can only be developed by the processes of the free market.” This flies in the face of the reality that virtually every government on earth uses fiat money—and has done so for many decades—without any sign of the economic apocalypse predicted by the likes of Rothbard.

Greenspan acknowledged the point of this critique during his Senate confirmation hearings in 1987. Disavowing the Randian indiscretions of his youth, Greenspan carefully walked back his position. “Under the conditions of the nineteenth century,” he said, “the gold standard probably worked more effectively than critics assert today, and if the key conditions could be replicated we might be well served by such a standard. However, considering the huge block of currently outstanding dollar claims in world markets, fixing the price of gold by central bank intervention seems out of reach.” Yet Greenspan didn’t completely abandon his support for gold. He once claimed that he was the sole vote for returning to gold on the Federal Open Market Committee—a purely symbolic gesture with no chance of affecting policy.

A similar double-mindedness about gold can be seen in other libertarian advocates. Milton Friedman acknowledged that fiat money was unlikely to be dislodged, so his recommendations were aimed at a monetary policy that suited the free market. But on occasion, he’d make gestures indicating that a return to the gold standard would be desirable.

A parallel battle between theoretical preference and reality can be seen in an interview given in 1984 by Friedrich Hayek, the towering free market advocate. “I sympathize with the people who would like to return to the gold standard,” Hayek wistfully said. “I wish it were possible. I am personally convinced it cannot be done for two reasons: the gold standard presupposes certain dogmatic beliefs which cannot be rationally justified, and our present generation is not prepared to readopt beliefs which were old traditions and have been discredited. But even more serious, I believe that any attempt to return to gold will lead to such fluctuations in the value of gold that it will break down.”

Hayek’s reference to “dogmatic beliefs” is not that far from the view of his ideological foe, John Maynard Keynes, who referred to the gold standard as a “barbarous relic.”

The historian Rick Perlstein, who has written many books about the American right, told me that the roots of goldbuggery lie in the need conservatives have for “something solid.” As he sums up their credo: “There are two genders, the Bible is the way God wrote it, the Constitution is the way the founding fathers wrote it, and gold is the only real money.” In other words, goldbuggery is not just an economic preference but a kind of superstition—the fetishization of a hard and tangible object to ward off the fact that social reality (including the reality of money) inevitably entails fluidity, abstraction, and the creation of consensus-based agreements.

By considering it as a species of superstitious delusion, we can make sense of goldbuggery’s inevitable cognitive dissonance. For example, goldbugs want both a gold standard (which for much of the 20th century meant government regulation, including laws prohibiting private ownership) and a robust speculative market. As James Ledbetter told me, “You cannot have a sustainable system where gold is both a standard for a currency and a speculative investment. These [aims] are completely at odds with one another.” But it doesn’t seem to matter to this audience. The contradiction can only be sustained because “the mere discussion of the idea of gold touches some lizard part of the brain,” Ledbetter said, which thinks: “Both things are good. I want both of those things.”

As a libertarian, Brian Doherty is sympathetic to the goldbug critique of fiat money, which he notes is shared by bitcoin advocates. He sums up this idea as the belief that “if the government can make more of it at will, it’s going to lead to inflation; it’s going to lead to wars.”

“I do detect a real turn in the libertarian community of currency cranks and visionaries, a turn away from hard money towards crypto,” Doherty says. But he adds that as a practical matter, gold makes much more sense than crypto. “It’s easy for a crusty old libertarian to say, ‘Well, my gold coins are buried in my yard in a cannister, and they are safe and I know where they are. The fucking electricity doesn’t have to be on for them to work.’”

But short of such a post-apocalyptic scenario, does using gold as the basis for the monetary system of a nation make any sense? As even Doherty admits, “For now, that question is purely academic because the market has shown that the money that most people prefer is the fucking US dollar, no matter what flaws that libertarians see in it.”

More from

Jeet Heer

No, Kamala Harris Staffers Did Not Run a “Flawless” Campaign No, Kamala Harris Staffers Did Not Run a “Flawless” Campaign

Democratic strategists are still patting themselves on the back for a catastrophic defeat.

Donald Trump’s Government of Gangsters Donald Trump’s Government of Gangsters

Who is being naïve now?

The Democrats Will Keep Losing Until They Solve Their Plutocracy Problem The Democrats Will Keep Losing Until They Solve Their Plutocracy Problem

The party’s habitual deference to big donors makes it impossible to effectively oppose Trumpism.

Only a Working-Class Party Can Challenge Donald Trump’s Corruption Only a Working-Class Party Can Challenge Donald Trump’s Corruption

GOP plutocracy thrives as long as Democrats remain beholden to Wall Street.

Biden’s Mindless Escalation Is a Final Betrayal of Ukraine Biden’s Mindless Escalation Is a Final Betrayal of Ukraine

Instead of preparing for inevitable negotiations, the outgoing president adds fuel to the fire.

Donald Trump’s Foreign Policy Will Be Chaos First, Not America First Donald Trump’s Foreign Policy Will Be Chaos First, Not America First

His team of cronies includes establishment hawks and cranky outsiders who are more likely to deliver global anarchy than world peace.