Trump’s Crackpot Crypto Scheme to Reduce Inflation Would Be a Financial Catastrophe

A federal crypto reserve would only benefit the scoundrels and scammers who helped fund Trump’s presidential campaign.

Donald Trump speaks at the Bitcoin 2024 Conference on July 27, 2024, in Nashville, Tennessee.

(Mark Humphrey / AP Photo)

President-elect Donald Trump’s pledge to create a federal crypto reserve is a terrible idea. The most vivid proof was supplied by the crypto markets themselves, which saw Bitcoin prices rocket into six figures after Trump nominated a raft of crypto-boosters for the incoming administration and amid speculation that the federal government would soon hoard the data-mined tokens.

The theory behind a currency reserve is that it serves as a hedge against inflation. In this view of things, gains in the crypto market can help release pressure on prices in the real economy, since the government’s reserves would appreciate at rates faster than inflation. But to have the prices of an asset rally to unprecedented heights on the mere possibility that it may form part of the US Treasury’s holdings is a sign that it’s less a storehouse of durable value than a volatile plaything for speculators and scammers. Indeed, the extreme volatility of crypto is why it’s subject to persistent market manipulation of the sort made infamous by the now-jailed crypto baron Sam Bankman-Fried: When an asset creates no economic worth of its own, the volume traders who build markets around it must commandeer a vast infrastructure of smoke and mirrors to disguise the dirty secret of its complete inutility. This is also why, amid the pre-holiday fever of crypto-speculation, news broke that North Korean hackers had engineered a $308 million theft of holdings from crypto broker DMM Bitcoin this spring—a heist that forced the company to shut down earlier this month.

For all the crypto sector’s ritualized pledges to bring greater transparency and integrity to its currency exchanges, these sorts of shakedowns remain a feature of crypto trading. As Jacob Silverman and James Block reported for The Nation earlier this year, fly-by-night scams are endemic in the crypto market—so that when Colorado Governor Jared Polis declared that his state would serve as a model of lightly regulated crypto trading, the state was promptly overrun with crypto brokers who sported nameplate incorporations in foreign countries, and who then vanished altogether when the deals they set up turned out to be bot-led pump-and-dump schemes.

These shady and predatory sides of crypto trading were a key reason the Biden administration’s head of the Security and Exchange Commission, Gary Gensler, aggressively prosecuted crypto abuses and tightened regulatory scrutiny of the sector. (The initial run on crypto prices during the past financial quarter kicked off with Gensler’s announcement after the election that he’d be stepping down in January—again showing that it’s a poor candidate for a safe-harbor currency that goes into speculative overdrive the moment that regulatory oversight is poised to be loosened.) Indeed, crypto’s track record in staving off financial fraud was so miserable that even Trump denounced it as a scam in 2021.

So how did this fraud-prone, value-free asset move into the vanguard of the incoming Trump administration’s financial agenda? The answer is, of course, money—namely, the traditional, transactional mobilization of dollars to attract political support from on high. This transformation got under way with Trump’s forays into crypto-promotion; as a serial scammer himself, the GOP presidential standard-bearer joined forces with World Liberty Financial, a crypto clearing house promoted by his sons0 Eric and Donald Jr. (Earlier this month, the company received a $30 million investment from crypto billionaire Justin Sun, who is facing fraud charges before the SEC, and who has lately been in the news for his $6.2 million purchase of a banana as a conceptual art piece; Sun’s investment could trigger an eight-figure return for a Trump-controlled company under the deal’s term sheet.)

With a growing stake in the crypto market, Trump set about touting plans in his second term to make the United States the center of the global crypto economy. And crypto backers responded enthusiastically; crypto was the leading source of election funding during the 2024 cycle, kicking in more than $230 million to all campaigns, with Trump’s campaign reeling in some $22 million. Crypto-aligned super PACs successfully targeted industry critics in Congress, such as Ohio Senator Sherrod Brown, California Representative Katie Porter, and New York Representative Jamaal Bowman, all Democrats. Not surprisingly, Trump’s incoming cabinet is festooned with crypto allies. His pick for commerce secretary, Howard Lutnick, has long promoted crypto concerns on Wall Street; his investment bank, Cantor Fitzgerald, owns a 5 percent stake in the crypto platform Tether, which has attracted a loyal fan base of scammers and money launderers, according to a recent UN report. Trump has also announced that he plans to replace departing SEC head Gensler with Paul Atkins, a finance consultant who’s called for the regulator to be “more accommodating” to crypto interests. (And yes, it was news of the Atkins pick that propelled Bitcoin past the $100,000 mark.) Trump’s nominee to captain the Council of Economic Advisers, Stephen Miran, is likewise gung-ho on crypto and a critic of regulatory curbs on the industry. Trump also has named David Sacks, the terminally credulous right-wing venture capitalist, to be his “crypto and AI czar.”

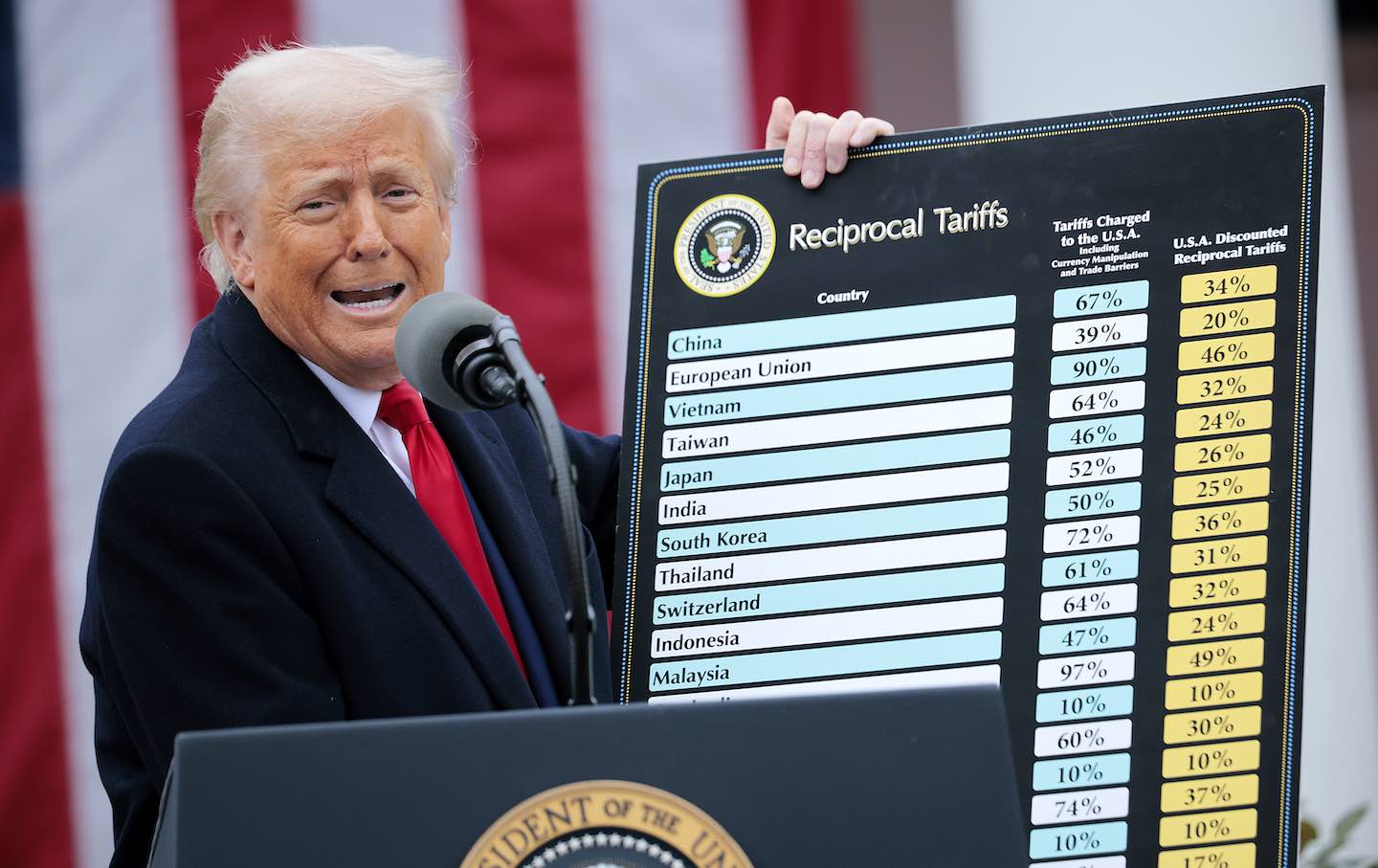

Trump’s plan for a national crypto reserve, then, is less a study in considered economic policymaking than a garden-variety brand of backsheesh, of a piece with his pledge to oil-and-gas billionaires to let them tender their own deregulatory wish list in exchange for their campaign contributions. Of course, with other elements of Trump’s economic agenda—from tariff-driven trade policy to occasionless tax cuts for the rich—sure to create inflationary effects, the incoming president has reasons beyond his own crypto stake to hope against hope that crypto will continually gain in value and give the US Treasury a windfall to cover a battery of new debt obligations. Yet, like virtually all the other Trump-branded assets in the president’s portfolio, crypto can’t deliver on this comically outsize demand, for the simple reason that it produces nothing useful in the first place.

Still, maybe the new class of investors poised to be fleeced in a federal-backed crypto boom can find some consolation by looking up Ecclesiastes 5:14 in their Trump Bibles, where the author asks what benefit accrues to the owners of “meaningless” objects of gain “except to feast their eyes on them.”