After 30 Years of NAFTA, the Working Classes Are Still Losing

The promise of free trade was never fulfilled. Workers are continuing to lose ground.

A demonstration in 1993 against NAFTA in Austin, Tex.

(Robert Daemmrich Photography Inc / Sygma via Getty Images)In 1991, when President Carlos Salinas de Gortari proposed a free trade agreement for Mexico, Canada, and the United States, one of the most pressing questions was whether the deal would bring prosperity to the working classes. In a lecture delivered at the Massachusetts Institute of Technology in May 1993, the Mexican president declared that the North American Free Trade Agreement’s primary goal was to close the gap between the three countries’ standards of living. The problem, critics replied, was that this “convergence” could happen in the wrong direction. Instead of raising the quality of life of Mexican workers closer to those of their American and Canadian counterparts, liberalization of trade could drag down America and Canada closer to Mexico’s.

Thirty years after NAFTA came into effect in 1994, the economic data suggests a somber conclusion: The three countries’ working classes are worse off today than they were before, at least in terms of their power relative to capitalists. While we cannot attribute the condition of North American workers exclusively to NAFTA, the numbers show that the treaty’s promise of prosperity remains unfulfilled.

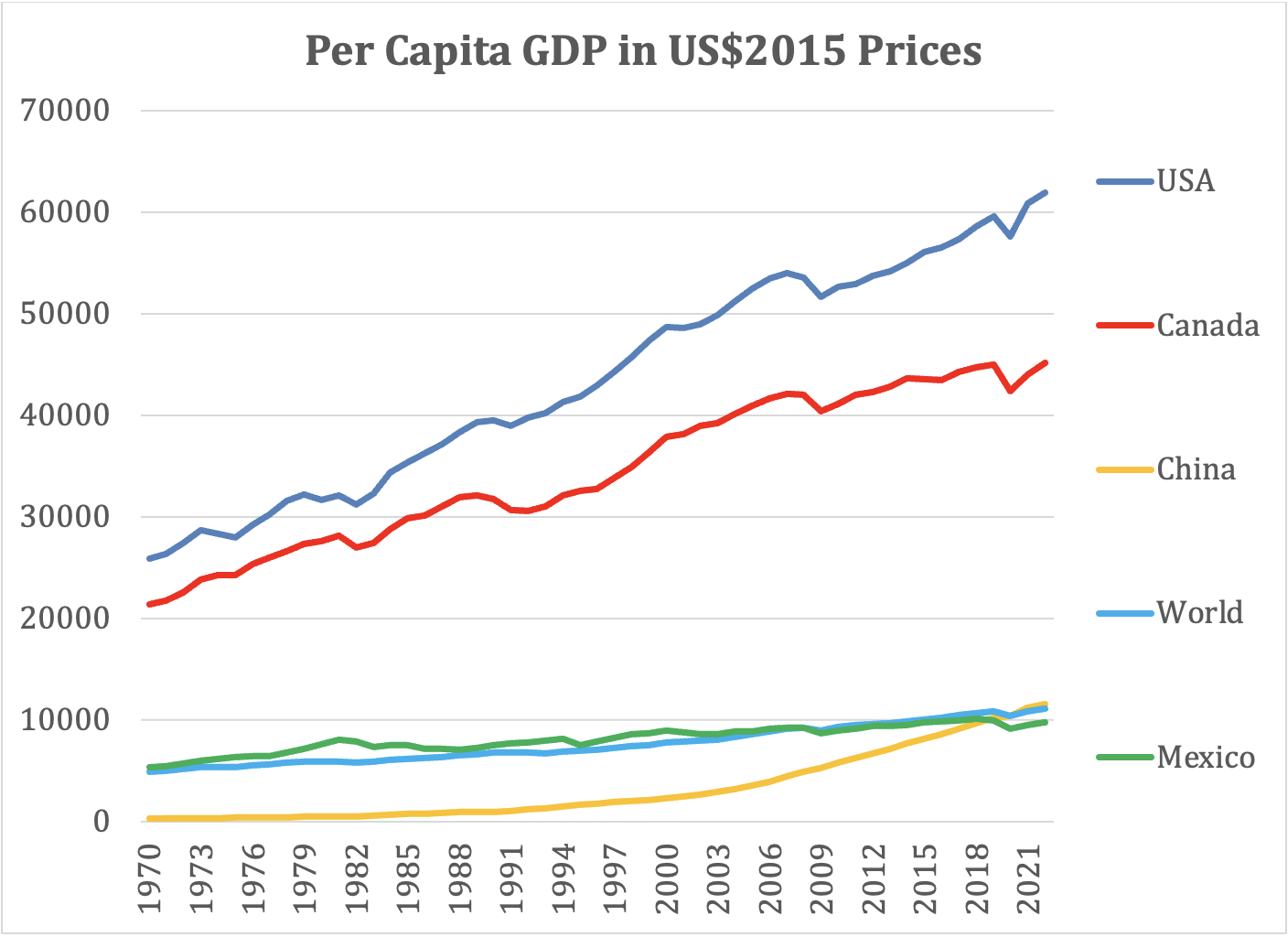

Contrary to what some in the United States seem to think, NAFTA hurt Mexican workers more than their American and Canadian counterparts. To see this, we can look at the rate of economic growth of the three countries since the agreement came into effect. If we compare the US and Canada since 1994, we discover that, while both countries have grown, the gap between them has widened. By contrast, Mexico’s relative stagnation has intensified the divergence between its people’s quality of life and those of its neighbors. These trends are easy to see if we plot the growth rate of the North American nations’ GDP per capita against the equivalent figure for the world average.

In 1970 Mexico’s GDP per capita was slightly higher than the world average. By 2008, that was no longer the case. Mexico grew faster between 1970 and 1993 than in the three decades after NAFTA. This trend isn’t exclusive to Mexico. Between 1970 and 1993, the GDP per capita of the world grew at a slower rate (38 percent) than the average figure for the three North American nations (49.3 percent). After the passage of NAFTA, the trend reversed: Between 1994 and 2022, the three North American countries grew on average 33 percent, while the average per capita GDP worldwide grew 68 percent.

To appreciate the implications of these figures, we must also consider what percentage of each country’s GDP ends up in the pockets of working people. According to the US Federal Reserve Economic Database, the Canadian working class captures the largest percentage of the national GDP in North America. But this figure fell from 72 percent in 1994 to 64 percent in 2019. In contrast, and despite a much lower level of unionization, US workers’ share of their nation’s GDP has remained relatively stable: It peaked at 64 percent in the 1990s and fell to 60 percent in 2019. Finally, there’s Mexico, the North American country where labor compensation amounts to the smallest share of the national GDP: In 1994, it was just 43 percent, and by 2019, it had dropped to 36 percent.

This is political matter more than an economic one. The share of GDP that goes to labor compensation is not the result of immutable economic laws; it is the product of political measures taken by specific classes to protect their interests. NAFTA, which condenses regulations that the ruling classes of the three countries thought would be most advantageous to them, is a weapon of class warfare.

That said, we cannot attribute the current conditions of North American workers solely to NAFTA. Each government must be held accountable for deregulating the private sector and eroding protections for working people. Even if many of the Mexican technocrats who championed the treaty expected the working classes to gain bargaining power against capital, the truth is that the opposite happened. According to the Mexican scholar Armando Bartra, the final outcome of the treaty was that Mexico lost both its food sovereignty (the ability to produce most of the food needed by its population) and its labor sovereignty (the ability to guarantee living-wage jobs for its residents, such that they don’t feel compelled to leave their places of origin in search of opportunities elsewhere).

But the Mexican neoliberal model, which turned the country into an exporter of cheap labor, didn’t just expel migrants. Cheap labor also explains the growing dominance of car exports, which are now Mexico’s most important source of foreign currency. In other words, Mexico exports cheap labor not just through migration but also through the exploitation of workers who produce goods for foreign markets for a fraction of their northern neighbors’ salaries.

Then there’s food sovereignty. The notion doesn’t necessarily mean that a country produces 100 percent of the foods consumed within its borders. Rather, a country is considered sovereign if most of its food supply—especially basic staples, whose fluctuations in price can have the deepest impact on the most vulnerable—is produced locally. Those who advocate for food sovereignty don’t reject international trade; they simply think that countries should prioritize providing for their own population. Once local demand has been met, surplus production can be exported. By the same token, a sovereign country can also import food from abroad, so long as these imports amount to less than 20 percent of local consumption of the product in question.

Mexico almost achieved food sovereignty in the 1970s, but lost it definitively in 1989, after Salinas unilaterally opened the country to international trade. The liberalization of the Mexican economy meant that by the time NAFTA was being negotiated in 1992–93, Salinas had little to offer his American and Canadian partners: Almost all sectors of the Mexican economy were already open. The treaty’s negotiators established a transition period of varying lengths for different sectors and crops, hoping to soften the impact competition with the US’s highly subsidized agribusinesses would have on local producers and consumers. But President Ernesto Zedillo’s administration eliminated these protections in 1998, well before the agreed-upon date.

The result is that, though Mexico has remained self-sufficient in white corn, the kind used for tortillas, by the end of the 1990s, it had been flooded with yellow corn, most of which is genetically modified and used for cattle feed, ethanol production, and as the raw material for high-fructose corn syrup.

Now that we have an idea of the inequalities among the different countries of North America, let’s consider the inequalities between each nation’s social classes. Unlikely as it seems, the economic stratification of Mexico and the United States is not altogether different. In both countries, the poorest 70 percent earn less than the national average income. This striking similarity between two different societies raises some questions: What are the material consequences, especially in terms of food access, of class inequality in Mexico and the United States? And how has that access changed in the years since NAFTA took effect?

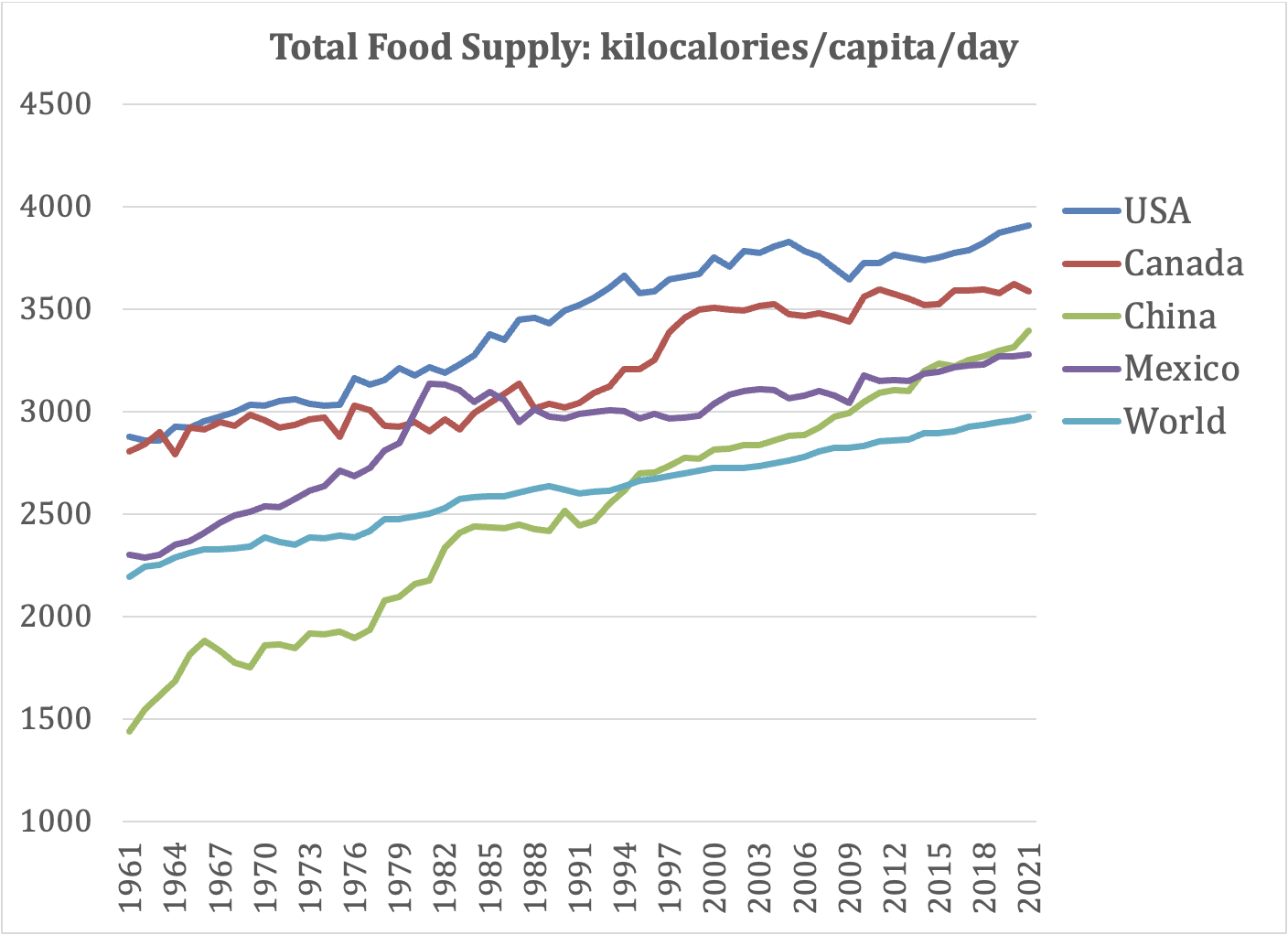

The consumption patterns of the wealthiest North Americans have converged: Across the region, the rich enjoy increasing access to a greater variety of luxury foods. Meanwhile, the working classes of all three countries are increasingly exposed to foods that lack nutritional value—what I have called “the neoliberal diet.” The chief criterion to decide whether a given food counts as a luxury good is whether the product is affordable to those who earn less than the national average. A carton of fresh organic blueberries is a luxury food; a box of sugary cereal with a handful of dried blueberries is not. Even though Mexico produces large amounts of fresh fruits and vegetables, they are inaccessible to many working-class Mexicans, mostly because an ever-larger percentage of the fruits and vegetables grown in Mexico are destined for foreign markets. To better understand the role of NAFTA—and, since 2018, the agreement that succeeded it, the USMCA—let’s compare the number of calories that are available each day to the average person in North America with the equivalent figures for the world as a whole.

Between 1961 and 1981, food access in Mexico grew faster than it did in Canada, even briefly surpassing it and coming close to matching that in the United States. But during the neoliberal turn of the 1980s, Mexico’s access to food declined, and it didn’t return to 1981 levels until 2016. During this period of lower caloric consumption, Mexico became one of the countries with the highest rates of obesity in the world. This apparent contradiction is at least in part a consequence of NAFTA. The treaty reduced the quality of the calories available to most Mexicans: The reorientation of national production toward export markets meant that fruits and vegetables became increasingly unaffordable, pushing people toward less healthy options. This is because, when a country’s economy relies excessively on foreign markets, either as an importer or an exporter, food prices can fluctuate wildly, which harms working people.

Popular

“swipe left below to view more authors”Swipe →Some scholars have argued that the food supplies of the three countries of North America are “mutually dependent,” but the effects of this dependance are not felt equally. While Mexico relies on imports to meet its domestic demand for basic foods such as corn that amount to roughly 40 percent of the average Mexican’s diet, the United States and Canada are externally dependent only when it comes to fruit and vegetables that amount to less than 4 percent of the average person’s daily diet. The result is that Mexicans suffer much more than Americans or Canadians from price fluctuations and often have no choice but embrace an unhealthy diet.

The figures of Mexico’s National Institute of Statistics and Geography show that in an average month in 2018, the poorest 10 percent of the Mexican population spent around $87 on food while the wealthiest 10 percent spent around $388 (both figures are given in 2018 US dollars). Compared to total household income, these figures mean that the poorest Mexican families spent around half of their income on food and the wealthiest around 25 percent.

These differences mean, among other things, that the poorest Mexicans suffer disproportionately from their country’s dependence on foreign markets. According to the UN, a country is considered dependent when its imports and/or exports of a given food item exceed 15 percent of its domestic supply. When a nation’s exports of a locally produced crop exceed that threshold, domestic prices of that product tend to converge with its international market value. For example, if a US company is willing to pay more than a Mexican consumer for a carton of locally produced cranberries, sooner or later that same carton will be sold for its export price in Mexican markets. This dynamic explains why the price of domestic products such as avocados has risen in Mexico. Access to foreign markets is good news for exporting producers, but bad news for domestic consumers.

This situation is largely a consequence of globalization, and more specifically of Mexico’s economic integration with the rest of North America. In 1981, Mexico dependance on food exports was limited to a few products, such as tomatoes. By 2001, however, Mexico had become export-dependent in liquor and beer, and by 2021 Mexican exports exceeded domestic supply in fruits, wheat, and vegetables.

Some economists argue that the dependency I’ve just described is not a problem: The invisible hand of the market has rationally determined that it’s more efficient for Mexico to export these products to markets where the balance of supply and demand results in more attractive prices for producers. In their view, Mexico should make use of its “comparative advantages” and specialize in markets where it can offer better prices than other countries. But this argument stumbles with the fact that economic actors, such as multinational agribusinesses and supermarket chains like Walmart, have “competitive advantages” that allow them to artificially control the market. Before 1992, Walmart didn’t exist in Mexico. By 2022, it controlled more than 64 percent of supermarket food distribution. This near-monopoly on food retail allows Walmart to exert a great deal of power over prices, often to the detriment of consumers as well as producers, but also to push products that could be accurately described as junk food.

This perfect storm of import-and-export dependence and market consolidation has had deadly consequences. As nutritious foods such as fresh fruits become luxury products, many in Mexico have no choice but to embrace the energy-dense and ultra-processed products of the neoliberal diet. The result is that the mortality rate for so-called lifestyle-related diseases has increased dramatically: In 1980, 2.18 out of every 10,000 Mexicans died of diabetes; in 2021, the figure had risen to 11 deaths per 10,000 residents. Such is the paradox of free trade: The reorientation of Mexico’s economy toward foreign markets has increased the domestic production of fruits and vegetables, but it has also condemned many Mexicans to untimely deaths.

In the 30 years since the signing of NAFTA, the quality of life of the working classes of North America—and in particular Mexico’s—has declined. The Mexican farmworkers who grow the organic blueberries sold in luxury supermarkets in New York or Vancouver—and who often cannot afford to eat the fruits they grow except in dehydrated form as part of a bowl of sugary cereal—have enjoyed a much smaller portion of the benefits of economic growth than their wealthier compatriots, whose lifestyles increasingly mirror those of well-off New Yorkers or Vancouverites. That’s neoliberal capitalism for you: A region’s sluggish macroeconomy manifests itself in a more than 500 percent increase in the mortality rate by diabetes.

Who, then, are NAFTA’s losers? Working people, without a doubt. Their relative impoverishment has led to increases in violence, as ever-larger numbers of people are forced to seek employment in organized crime. In that sense, then, everyone who lives in North America lost out on NAFTA. The task for Mexicans is clear: We must demand that whoever wins in this year’s presidential election take decisive steps to combat poverty; confront informality in the labor market, which absorbs 55 percent of the labor force at half the wages of the formal sector; and reduce income inequality in general. The alternative is to continue down the same path that we’ve followed since Salinas—a path littered with unfulfilled promises and working-class suffering.

More from The Nation

Why Bidenomics Was Such a Bust Why Bidenomics Was Such a Bust

A large majority of voters gave the Biden administration a failing grade on the economy. For the sake of future policy battles, it is worthwhile to try to understand their reasons...

Hickey Freeman's Next Chapter Hickey Freeman's Next Chapter

This factory in upstate New York is a testament to the lasting legacy and future of the modern labor movement.

If You Don’t Know Who Ken Griffin Is, You Should If You Don’t Know Who Ken Griffin Is, You Should

How the press keeps us in the dark about the new Gilded Age.

Millions of Workers Are Due More Overtime Pay. Will They Get It? Millions of Workers Are Due More Overtime Pay. Will They Get It?

New regulations are designed to expand the number of employees entitled to overtime. But the conservative courts have other ideas.

Ballet Dancers’ Next Move: Union Organizing Ballet Dancers’ Next Move: Union Organizing

Contract negotiations have brought higher pensions, mandated rest times, and increased wages for a job that requires intense schedules and years of training.

How Can We Wean Ourselves Off Our Country’s Military Dependency? How Can We Wean Ourselves Off Our Country’s Military Dependency?

Moving resources and skills and jobs from the military-industrial complex to civilian sectors is a big project. But it could start in your own community.