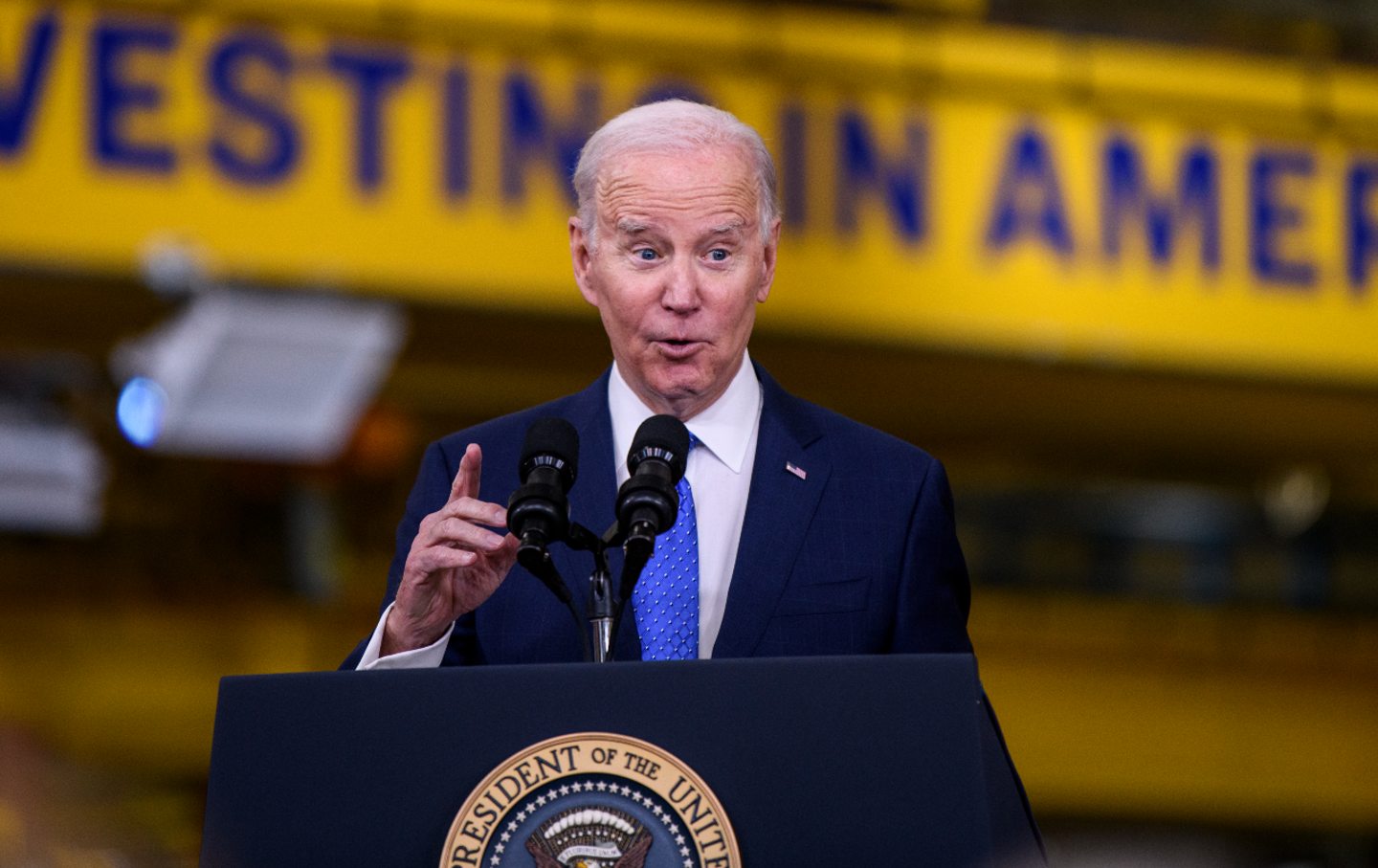

Bidenomics and Its Discontents

The White House believes American workers have seldom had it so good. And lots of prestigious economists agree. But the voters aren’t buying. Maybe they know something?

Unemployment is low. Inflation has fallen. Real earnings are rising. GDP growth has held up—so far. The economists are happy, but for some reason the voters are not! It must be their own ignorance and obtuseness—so says Paul Krugman, house economist of The New York Times.

The other possibility—however horrible to contemplate—is that perhaps the voters are sensible and the economists are obtuse. And perhaps the indicators on which economists rely no longer mean what economists suppose them to mean.

Take the unemployment rate. It is a ratio of those seeking work to the whole active labor force. In past times, most households depended on a single earner, for whom holding a job was a make-or-break proposition. If unemployment was rising or high—say 7 percent, typical in recessions—then, even though 93 percent of the labor force was still working, fear of unemployment amplified the woes of those actually out of work. Conversely, if unemployment was low or falling, most workers felt reasonably secure. The unemployment rate, back then, was a reasonable indicator of distress or well-being.

Those days are long gone. Today’s typical American working household has several earners, sometimes in multiple jobs. If one earner loses a job while the others keep theirs, she may leave the workforce for a time; there is the option of making do with less, and for some there is early retirement. She will not, in that case, count as unemployed—however difficult her life. A low jobless rate can mask a great deal of stress in such households. The employment-to-population ratio is still a bit below where it was in 2020, and far below where it was in 2000; average weekly hours are still falling.

Next, consider inflation, which is the rate of price change measured month-to-month or year-to-year. But what matters to consumers is prices in relation to household incomes over several years. In 1980 Ronald Reagan famously asked, “Are you better off than you were four years ago?” Today, millions of American households are worse off than they were in 2020. Basic living costs, such as gasoline, utilities, food, and housing, have risen more than their incomes have. Real median household income peaked in 2019 and fell at least through 2022.

Yes, but didn’t real wages go up sharply in 2023? According to the Biden-friendly Center for American Progress, real wages (for those continuously employed) have indeed now recovered roughly to where they would have been had no pandemic occurred. But there is a great distinction between steady progress and a sawtooth down-and-up. The former breeds confidence; the latter does not.

Then there is the ending of Covid-19 relief. Pandemic programs gave millions of Americans a financial cushion for a time; early on, the payments were often larger than previous paychecks and, while they lasted, poverty and food insecurity went down. (By 2021 Covid tax credits and relief payments brought child poverty down to a record low of 5.2 percent.) Most Americans were prudent with the support, but they often used it, not unwisely, to achieve a touch of independence from dreary jobs. With that support gone, the cushions erode, savings decline, debt rises–and families feel the pressure to go back to work on whatever terms that employers offer. They don’t like that very much.

As people return to work, how secure are their jobs? In the golden years during which today’s older generation of economists learned their textbook tools, a worker’s job was often a lifetime affair. Autoworkers (and their associates in rubber and glass) might suffer periodic layoffs, but they could expect to be called back; their skills and experience remained useful. That was all over by the 1980s.

Since then, factories close and do not return, and practically all new jobs have been in routine services, with mediocre wages and high turnover. The pandemic drove home the fragility of these jobs to everyone—even those who had never lost a job before.

Interest rates are another problem. Long ago, Joe Biden kicked the can of “fighting inflation” over to the Federal Reserve. The Federal Reserve then did the only thing it knows how to do: It hiked interest rates. Mortgage rates were around 3 percent in 2021; today they are at least twice that. High interest rates hit young families looking for their first house, and they hit established households, often older, looking to sell their homes. And high interest on consumer debt eats away at disposable incomes. The capital wealth of the middle class falls, to the benefit of those with cash to spare. The second group is much smaller and far richer than the first.

For the politically and economically alert, high interest rates bring other anxieties. They hit construction, and long-term investment projects—including in renewable energy. Although conditions may have changed, the “inverted yield curve” is a traditional harbinger of financial crisis and recession. For banks with heavy exposure to commercial real estate, they foretell trouble when existing loans come due.

The Federal Reserve knows that the inflation it supposedly set out to fight was already fading almost two years ago. It knows that the economy is in at least the early stages of stagnation. Yet it cannot bring itself to bring rates back down. And in the peculiar world of budget projections, high interest rates blow up forecasts of future federal budget deficits and debt, provoking scare stories and stoking campaigns to cut Social Security, Medicare, and Medicaid—the bulwarks of middle-American social insurance.

The growth of GDP, another once-reliable icon of prosperity, has also lost much of its meaning. The concentration of gains in the small, ultra-rich sectors of finance and technology is one reason. Another has to do with the nature of government-supported investments in chips, in renewable energy and in military hardware, all of which have been contributing to growth and to massive corporate profits. Such investments do create jobs. But they add nothing visible to living standards.

Also, the politics of electricity are asymmetric: Consumers expect the grid to work, and they react only when the power goes off or the bills go up. Although there were good things in it, even Biden’s infrastructure bill was largely a conventional roads program, notoriously likely to foster suburban sprawl and to enrich developers, rather than to visibly repair the decaying core of most American cities and towns.

Popular

“swipe left below to view more authors”Swipe →Finally, what are Biden’s priorities these days? They are to get money for Ukraine, Israel, and Taiwan—that is, for (respectively) distant, dishonorable, and prospective wars. The belligerence with which he opened his State of the Union address was astonishing. Yet looming failure in Ukraine and mass murders committed with American bombs in Gaza add to the war-weariness that many Americans feel, after 23 years of brutal and fruitless fighting. The notion that the United States could fight and win a war against China over Taiwan—150 miles from the mainland but more than 5,000 from Hawaii—is too ludicrous for words. When foreign policy is delusional, it’s not unreasonable to lose confidence in economic policy as well.

In short, Biden’s economists and their acolytes in the press appear locked into a statistical and cognitive paradigm that is old and irrelevant—a metaphor, if you like, for our political class. The voters appear to know this. Dire consequences may follow, come November.

More from James K. Galbraith

Why Bidenomics Was Such a Bust Why Bidenomics Was Such a Bust

A large majority of voters gave the Biden administration a failing grade on the economy. For the sake of future policy battles, it is worthwhile to try to understand their reasons...

In Defense of the 30-Year Mortgage In Defense of the 30-Year Mortgage

A recent New York Times column argued that the long term fixed-rate loan popular with US homebuyers is unfair to banks. In fact the arrangement—a fruit of the New Deal—is somethin...

The Debt Deal Is a Tragedy The Debt Deal Is a Tragedy

The debt-limit agreement entrenches long-term austerity. It was a huge GOP win.

More “Dangerous Nonsense” From “The New York Times” on the Debt Ceiling More “Dangerous Nonsense” From “The New York Times” on the Debt Ceiling

There are multiple legal pathways to resolve the current debt “crisis.” Having the president and House speaker agree on spending cuts to programs already approved by Congress is no...

The Debt Ceiling Explained. Once More, With Feeling… The Debt Ceiling Explained. Once More, With Feeling…

What The New York Times doesn’t know might hit you in the wallet.

The Mobilization That Must Start Now The Mobilization That Must Start Now

With the coronavirus bearing down on our economy, we must deploy all our resources now to survive—so that one day we may thrive.