The Century of Milton Friedman

An interview with Jennifer Burns on her authoritative new biography of the American economist and the personal and intellectual origins of his theories.

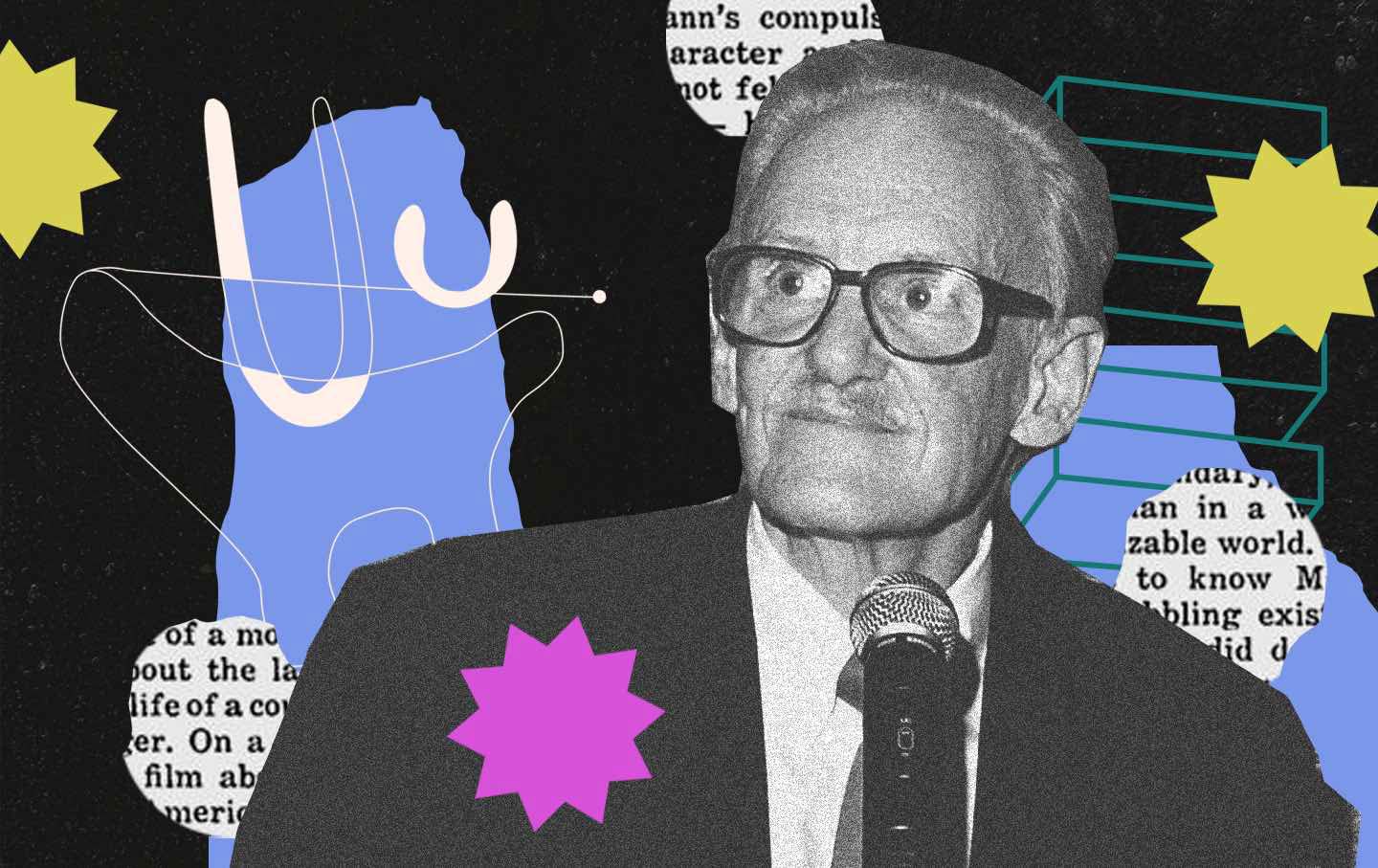

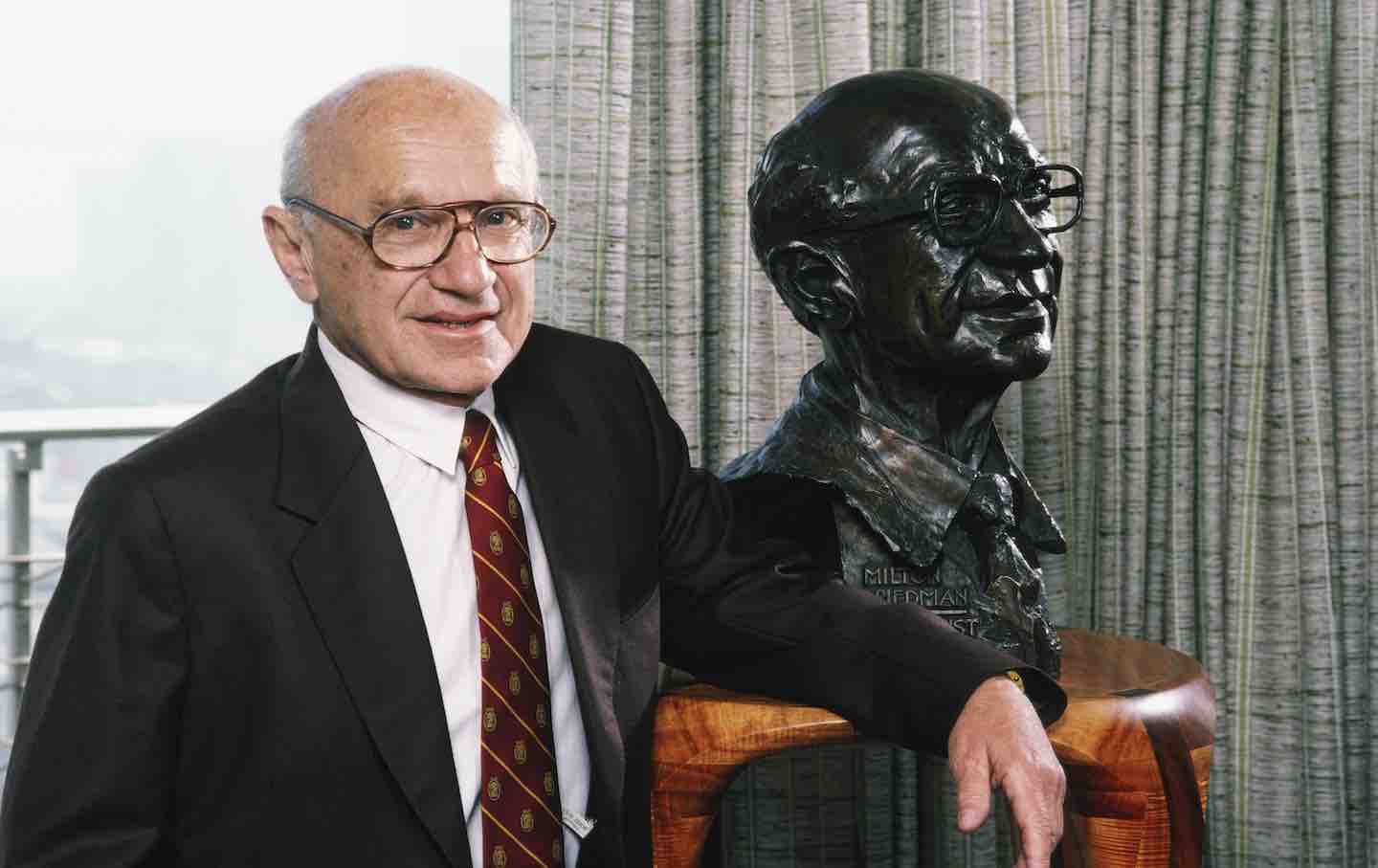

Milton Friedman, 1986.

(Photo by George Rose/Getty Images)Milton Friedman is widely regarded as one of the most influential economists of the 20th century. He is known for his unbending support of free-market capitalism and the role he played in the neoliberal turn of the late 1970s and early ’80s, which culminated in the economic policies of Ronald Reagan and Margaret Thatcher. For much of the late 20th century, Friedman was a celebrity intellectual; prior to this, he made his name based on his work on monetary theory, inflation, the negative income tax (an argument for a universal basic income), and the limits of government planning.

Yet for the first three decades of his career, Friedman was regarded by many of his peers as a retrograde thinker: His conservative politics and thinking on money clashed with the Keynesian sensibilities of the early Cold War era. But why did Friedman, as a young economist, go against the grain of the economic orthodoxies of the day? Plenty, of course, has been written about his training at the University of Chicago in the 1930s, where he came under the influence of the early neoliberal economist Frank Knight, and much work exists on the intellectual inspirations behind Friedman’s key ideas. Yet strangely missing in the literature has been a deeply researched, archivally based biography that spans the entirety of Friedman’s life and work.

That has now changed with the publication of Jennifer Burns’s Milton Friedman: The Last Conservative. Burns, an associate professor of history at Stanford University, has written a panoramic account of the intellectual, political, and cultural origins of Friedman’s economic thought. The Nation spoke with Burns about Friedman’s early life, the cardinal role that women played in shaping his economic views, and the question of whether the term “neoliberal” is the most apt for describing him. This interview has been edited for length and clarity.

—Daniel Steinmetz-Jenkins

Daniel Steinmetz-Jenkins: Many today consider Friedman to be the master neoliberal economic thinker, and yet you argue that “neoliberalism” is basically the parlance of academics. But didn’t Friedman himself use the term to describe his economic project? And why do you think that calling him a “conservative” makes more sense?

Jennifer Burns: There is one instance among all of Friedman’s collected writings, published and unpublished, in which he calls himself a neoliberal—and that was a short article aimed at a European audience, where the term had more currency. That said, it is also true that Friedman didn’t call himself a conservative! However, I argue the term fits him in two senses. The first is that as an economist, he often attempted to conserve older economic ideas and analytic techniques, from the quantity theory of money to the data-gathering methods typical of institutional economics. The second is that throughout his lifetime, Friedman allied himself openly with politicians, intellectuals, and the broader political movement that identified as conservative. One of the things that makes American conservatism unique, in fact, is that it absorbed the economic analysis of Friedman, which in the context of any other nation would be considered liberal, or neoliberal, and profoundly anti-conservative.

DSJ: Let’s talk about Friedman’s early life. You mention that he grew up just outside of New York City in Rahway, N.J., in a town ruled by Anglo-Protestants, and in a family that threw itself into the small but growing Jewish community there. Is there anything about his childhood and/or adolescence that would foreshadow his staunch free-market thinking?

JB: It is noteworthy that Friedman’s family life and childhood were atypical for Jewish immigrants of his era—he had less of the urban, communal experience and more the type of small-town upbringing characteristic of Americans whose families were not recent immigrants. That said, Friedman was firmly attached to his Jewish identity, even as an atheist. I show that Friedman often looked to the experience of Jews in Europe to understand the dangers of state power, which he ranked as more significant than private discrimination. He also believed that economic regulation often served to mask prejudice. One particularly meaningful episode for him involved the American Medical Association’s discrimination against the Jewish émigré doctors fleeing Nazi Germany, seen in the new English-language requirements for medical practice instituted after Kristallnacht. Friedman extended this into a larger critique of occupational licensure, which he believed protected larger economic players against new competition.

DSJ: Friedman arrived at the University of Chicago in 1932, and he quickly came under the influence of Frank Knight as well as other early Chicago School economists who were deeply critical of the New Deal. Yet in 1935, Friedman worked for a New Deal agency, the National Resources Planning Board, and he voted for Franklin Roosevelt in 1936. He has also been perceived by many historians as a Keynesian in the 1940s due to his advocacy of taxation—and it was also during this time that he began to float the idea of a universal basic income. Yet you write that there is no meaningful sense in which Friedman’s thinking on taxation was Keynesian, despite his stating that he was “thoroughly Keynesian” at this time.

JB: I do want to establish that Friedman was not in favor of laissez-faire economics—he definitely saw an important role for the state across many dimensions, and this was an attitude he picked up from the University of Chicago in the 1930s. However, a number of previous writers have extrapolated from this attitude, and his work for the federal government in the 1940s, to argue Friedman was a “New Dealer” or “Keynesian.” Based on my research, I think those arguments are wrong. I go into this in more depth in the book, but his advocacy of taxation while an employee at the Treasury Department in the 1940s should be seen in two contexts: the need to raise funds for a war against the Nazis that he wholeheartedly supported, and his position as a paid expositor of Treasury Department policy positions. Furthermore, Friedman supported taxes as an alternative to price controls, which were supported by the leading Keynesian economists. Additionally, there are a few things at stake here: Casting Friedman as a former Keynesian has the effect of flattening out the many different critiques of the post–New Deal political economy into a stale binary of “monetarist” versus “Keynesian.” It also leads to underestimating the depth and longevity of Friedman’s critique and its grounding in the 1930s.

DSJ: Would it be correct to say that before the publication of Friedman’s A Theory of the Consumption Function (1957), the mainstream of the economic profession considered him as either a retrograde thinker, a political partisan, or both? What was it about this book that moved the profession to grudgingly accept it as a major intervention?

JB: Despite being a tenured professor at the University of Chicago, Friedman was not held in high esteem by the field more generally until 1957 and afterward. There were several reasons for this, including his politics, his fierce personal clashes with the mathematically oriented Cowles Commission, and his interest in money, which seemed completely wrongheaded at a time when fiscal policy was all-important. Friedman was seen as someone who had abandoned his early promise in econometrics to chase an ideological chimera.

However, A Theory of the Consumption Function addressed a central issue in Keynesian analysis, the consumption function, which had immediate ramifications for how to calculate the multiplier, a bedrock of Keynesian policy. Specifically, the idea suggested that fiscal stimulus might not work as expected: Rather than spend money, people might hold on to it or spend it on a different timeline. More long-term, it had the potential to undermine the Keynesian approach to economics altogether. And this wasn’t an obscure problem: Friedman entered a debate that had been simmering for years, as economists attempted to fit Keynes’s theory to the empirical evidence. For all these reasons, A Theory of the Consumption Function captured the profession’s attention. Even Friedman’s biggest detractors now admitted this book needed to be reckoned with.

DSJ: You make it clear that A Theory of the Consumption Function relied heavily on the insights of women economists such as Dorothy Brady, Margaret Reid, and Rose Friedman (née Rose Director, Friedman’s wife). Six years later, A Monetary History of the United States, 1867–1960, a book that Friedman coauthored with the economist Anna Jacobson Schwartz, appeared—a book lauded, you say, in the Nobel Memorial Prize in Economic Sciences that it garnered him, yet without listing her name. Indeed, you go on to write that the success of Friedman’s most popular book, Capitalism and Freedom, as well as his highly watched PBS television show, Freedom to Choose, were in major part due to the initiatives of his wife Rose. Would it be fair to say that Friedman might have remained something of a hack in the profession without their contributions or efforts on his behalf? And do you think Friedman gave them their proper due?

JB: The rise of inflation in the 1970s would have changed Friedman’s reputation no matter what—although I do think that Friedman would have been much diminished as an economist without his female collaborators. If he didn’t know any of these women, I doubt he would have published A Theory of the Consumption Function or Capitalism and Freedom; without Rose, he may never have become a public intellectual. Because A Monetary History of the United States was part of a National Bureau of Economic Research project, that would have been published—but it probably would have looked something like Simon Kuznets’s statistical studies of national income, which, while influential in their day, did not have the foundational impact of Friedman and Schwartz’s book. It was Schwartz’s historical research and narrative, more so than the data she gathered, that made this book accessible to lay readers and increased its impact. In terms of his relationship with Schwartz, Friedman looks much better than almost all of his peers: He really pushed for her to get a doctorate against the opposition of the Columbia University faculty. He was less active when it came to A Theory of the Consumption Function, which was published as a solo work, although the introduction is quite generous.

DSJ: This topic also raises questions concerning Friedman’s thinking about racism. Friedman, of course, was aware of the anti-Semitism in the economics profession, especially given his experiences in graduate school and as he made his way up the career ladder. Yet he seemed not to care about violations of African American freedom. He had little to say against segregated schools, and only when pushed did he opine that, all things being equal, “forced integration” was a “lesser evil” than “forced segregation.” He was a supporter of Barry Goldwater at the time when the Arizona senator voted against the 1964 Civil Rights Act, and Friedman’s work was lauded by some in the John Birch Society. Indeed, you state that even later in life, Friedman never revisited his position on civil rights, even though his work was so concerned with the question of individual freedom.

JB: These positions are hard to explain in light of Friedman’s stated commitments to individual freedom. It is possible these sentiments were insincere and that Friedman had other commitments to racial hierarchy he wasn’t aware of or didn’t publicize. Certainly, he stated openly that he was not egalitarian. I do think his Jewish identity played a role here: Simply put, Friedman saw American Jews succeeding all around him, and he believed the same was possible for other groups in society. That doesn’t explain why he didn’t speak out more forcefully against state-sponsored segregation; he seems to have decided that discrimination stemmed from private preferences, rather than state imposition, and therefore could not be outlawed by the federal government. I find it illuminating to compare his stance to that of George Shultz [a former dean of the University of Chicago Graduate School of Business who served as secretary of labor and secretary of the Treasury under Richard Nixon], for they shared most of the same economic views. Shultz, however, had negotiated labor contracts in the South and came to different conclusions about the durability of racism based on that experience.

Whatever the reason, it was a real loss, because Friedman could have been a significant asset to the moderate Republicans who were trying to keep civil rights as an important cause within the party. Instead, Republican supporters of civil rights were essentially chased out of the party after the Goldwater campaign, and many became Democrats.

DSJ:In this regard, Friedman’s global economic thought also proves relevant. You have a substantive chapter devoted to the Chicago School’s influence on the economic policies of Gen. Augusto Pinochet’s government in Chile, as well as a detailed explanation of Friedman’s visit there in 1975. He advised the Chilean dictator that the country’s economic crisis—marked by high inflation—could be mitigated by reducing the rate of increase of the money supply and by cutting government spending. Friedman was widely criticized, of course, for offering his services to a murderous despot who had violently overthrown the democratically elected socialist government of Salvador Allende, especially as Friedman was awarded the Nobel Memorial Prize around this time. Friedman seemed to think that he hadn’t done much wrong, as evidenced by his view that his policy advice helped rescue the Chilean economy. Yet your narrative in this part of the book might prove counterintuitive to those who see his advice as an instance of economic shock therapy.

JB: My goal in this chapter was both to correct some basic misinformation about Friedman’s role in the country, which is often extremely exaggerated, and to provide some context for the broader clash of economic visions that shaped Chile. The Naomi Klein–style narrative of Friedman as mastermind of the Pinochet regime has proved surprisingly durable even among historians, who are usually interested in more complex narratives. I’m grateful my book is coming out in tandem with Sebastian Edwards’s The Chile Project, which goes into much greater depth than I could about neoliberalism in Chile. There are also a number of other scholars who have probed the many different, non-neoliberal influences at work in Chile during the Pinochet years. The dictatorship was a horrible period in Chile’s history, and Pinochet’s crimes and US support of the regime have been well documented. At the same time, I don’t believe that Friedman’s decision to visit Chile was self-evidently a decision that should be denounced or considered immoral. He never made any public statements in support of the regime; rather, his visit was assumed to mean he supported the government. Today, we’re very influenced by a politics of purity in which denunciation and avoiding engagement is imagined to be the only correct course of action. I think it’s debatable: If you believe your advice would improve the lives of people living under an odious regime, should you offer it, or should you avoid any potential taint of complicity? Friedman was the world’s leading expert on inflation, and when he visited Chile, it had a 300 percent annual inflation rate, down from over 600 percent during the last Allende years. This was the original economic crisis; one could consider hyperinflation as its own form of austerity. Clearly, Friedman’s presence served some sort of legitimating function for the regime. It was a trade-off, because the only way to avoid that would have been not engaging at all. I think it’s better to recognize and explore these dynamics, rather than make the false equation that engagement equals affirmation and to mistakenly cast Friedman as a Pinochet supporter.

DSJ: Friedman’s influence was not just contained to conservatism; his thinking was also embraced by important parts of the Democratic Party. Can you give us a sense of the scale of his influence on the nominally liberal wing of this country’s political system?

JB: It wasn’t Friedman personally who proved so influential, but the broader currents of thought in which he was a prime mover; an excellent account of this is Elizabeth Popp-Berman’s recent book, Thinking Like an Economist. That said, we can identify at least two major episodes where you see Friedman’s impact on the Democratic Party. The first would be after the fall of the Berlin Wall and the dissolution of the USSR: Friedman’s ideas, insofar as they infused the Washington Consensus, rushed in to fill the gap. Key examples here would be Bill Clinton’s championing of China to join the World Trade Organization and his declaration that “the era of big government is over.” This may have been peak Friedman: No one really knew how globalization would unfold, and Friedman had both enormous stature and high confidence in what the right path forward was. Interestingly, he came to have misgivings about his full-throated embrace of privatization in the post-Soviet states, and he clearly worried about the social and economic impacts of globalization within the US.

The second episode I would highlight is happening right now, in the rise of what is sometimes called “supply-side progressivism.” This set of ideas, which incorporates both public-choice economics and Friedman’s insights about occupational licensure and regulatory capture, highlights how government intervention can serve the interests of established private actors, thereby benefiting the powerful and inhibiting growth. Progressives turn these insights to ends of which Friedman would not approve, in terms of hoping to increase the reach and efficacy of federal and state governments. But supply-side progressivism reflects Friedman’s influence insofar as it agrees that government impacts on the private sector can be real and pernicious.

DSJ: Many have argued that Donald Trump’s presidency, the Covid-19 pandemic, Bidenomics, and so forth have signaled the death of the neoliberal order. Another way of putting this is that Milton Friedman’s influence is now in decline. But you don’t see this as a positive thing. You conclude the book by stating: “If we are unlucky, the new order will form itself in blind reaction against all that came before, the good and the bad. If we are unlucky, the future will condemn and dismiss Friedman and all that he built.” The world that Friedman created, however, is in a state of political, economic, and environmental chaos. Isn’t it time to move past him, just as he tried to move past the idols of his own age?

JB: I do agree that it is time to move past Friedman, but we should not do so in an unthinking way that merely reverses everything he stood for or advocated. For one thing, while markets generate inequality, they also generate prosperity, and we can’t wish this away by attacking Friedman. Nor can we dismiss his large body of work on the ingredients of macroeconomic stability, as the return of inflation shows. Finally, I think there is something really valuable in Friedman’s efforts to wrestle with inequality within his commitment to market-friendly policies. I believe we get better outcomes overall when a lot of different minds are focused on the same problem. For a long while, it was chiefly Democrats and progressives who focused on inequality or poverty. Today, we hear a new interest in these questions among at least some who call themselves “national conservatives.” Both sides would benefit from imitating Friedman at his best: someone who tried to substantiate his theories with evidence, enjoyed debating his opponents, and wasn’t afraid to say when he was wrong.