In fifty years, when historians look back upon the current era of unbridled financial sector influence on American government—unless all historians are by then employed at CitiBankofAmericaChaseOne Institutions of Higher Learning™—Wednesday’s hearing of the Senate Banking Committee will be an instructive example of our perverse power structure.

Jamie Dimon, CEO of the JPMorgan Chase, the country’s largest bank, appeared before the committee after a clear screw-up: traders at JPMorgan placed a series of complex bets that resulted in $2 billion in losses and counting.

This should be of great concern to the Senate. Since deposits at JPMorgan Chase are backed by the federal government, risky market gambling could create the need for another massive public bailout of a normally profitable private bank.

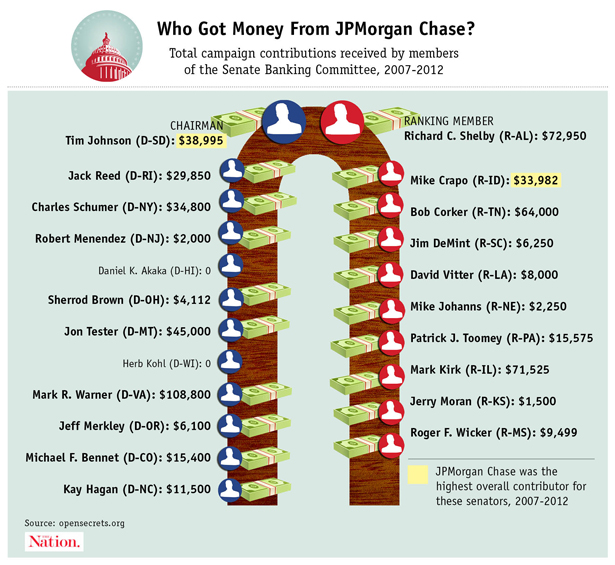

But instead, a vast majority of the Senators at Wednesday’s hearing repeatedly praised Dimon’s wisdom and executive acuity while politely soliciting his opinion on how he thought his own bank should be regulated. That shouldn’t be too surprising if one examines the bank’s political giving–members of the committee received $522,088 of the bank’s cash in recent years, with $296,557 going to Democrats and $285,531 to Republicans. (See the graphic above).

And Dimon happily played the part. To underscore who is the boss, he first demanded and received a one-week delay in the hearing after being summoned by the chairman, Senator Tim Johnson, and then showed up on the appointed day wearing cufflinks with the presidential seal to take questions from his underlings.

“We’re here quizzing you,” Senator Bob Corker (R-TN) explained to Dimon in a typical exchange. “If you were sitting on this side of the dais, what would you do to make our system safer than it is, and still meet the needs of a global economy like we have?”

Rather than focusing on the clear and present danger presented by JPMorgan’s risky financial maneuvers, Corker then invited Dimon to opine on the “societal good” of his bank, and asked, “What would society be like without these institutions?” (Dimon eagerly expounded on the value JPMorgan chase provides to the public, particularly “mothers and veterans.”)

Popular

"swipe left below to view more authors"Swipe →

Instead of pressing for tougher controls, Senator Mike Crapo (R-ID) asked Dimon, “What should the function of the regulators be?”

Some Senators even asked Dimon what regulations he’d like to dismantle. “I would like to come away from the hearing today with some ideas on what you think we need to do, what we maybe need to take apart that we’ve already done, to allow the industry to operate better,” said Senator Jim DeMint (R-SC).

At one point, after being overloaded with invitations to help out, Dimon offered that “me and lots of other folks, we’ll do whatever you want, we’ll even get apartments down here. Let’s go through [the regulations] in detail.”

But in a different world, Dimon should have had to navigate some tough terrain. His bank’s error makes a strong case for tough regulation of high-stakes financial gambling at commercial banks, and he had to pretend it didn’t.

The important context is that two years ago, the financial industry lost a legislative fight over the Volcker Rule, which would prohibit risky, proprietary trading by federally insured banks. But the rule is still being written by regulators who are trying to navigate a complicated question: How do you permit simple hedging—where a bank makes financial bets against some assets to protect itself in the event of a downturn—but disallow larger-scale, profit-driven betting?

JPMorgan’s position was that the massive losses they incurred were a simple hedge against existing bank positions, which somehow went bad through incompetence by lower-level executives. In Dimon’s telling, the bank originally took out credit default swaps—that is, financial instruments similar to insurance that would pay off if a certain company or index went sour—in order to safeguard the bank’s assets.

“If you look at the position, what it was meant to do is—in benign environs, maybe make a little money, but if there was a crisis, like Lehman, like Eurozone, it would reduce risk dramatically by making money,” Dimon said.

Perhaps that was the original intent, but JPMorgan traders in London began layering very complex bets on top of it, and even began selling insurance on a large index, the IG9, instead of buying insurance. (Hedge funds caught wind of this position, bought a lot of JPMorgan insurance on the IG9, and proceeded to pummel its value, thus incurring massive losses at the bank.)

Dimon needed to pretend that what happened was simple incompetence, a hedge gone wrong, and not a desire to make profit through trading—that would be a direct violation of the spirit of the Volcker Rule and might cause regulators to beef it up. (Financial investigator William Black calls this overly broad definition “hedginess,” a tribute to Stephen Colbert’s characterization of the Bush administration’s “truthiness.”)

Here’s Senator Jack Reed (D-RI) trying to pin Dimon down on this point—an unfortunately rare moment during the hearing:

REED: In 2011 or ’12 at some point, the bet was switched. And now you started rather than protecting your credit exposures, taking the other side of things—selling credit protection. Which seems to me to be a bet on the direction of the market unrelated to your actual credit exposure in Europe, which looks a lot like proprietary trading designed to generate as much profit as you could generate. [This] seems to be inconsistent, again, if this is simply a risk operation and you’re hedging a portfolio. How can you be on both sides of the transaction and claim that you’re hedging?

DIMON: I think I’ve been clear, which is—the original intent was good. What it morphed into I’m not going to try to defend. Under any name, whatever you call it, I will not defend it. It violated common sense in my opinion.

This was Dimon’s refrain throughout the hearing—that a good idea somehow “morphed” into a bad one, almost as if it was a cancer that nobody could predict nor control. “The way it was contrived between January, February and March, it changed into something I cannot publically defend,” he said at another point.

Would a strong Volcker Rule have prevented this evolution towards risky proprietary bets? Of course it would have, but Dimon has been the lead proponent to make sure it doesn’t, personally visiting the Treasury Department several times this year and spending over $10 million on behind-the-scenes lobbying in the past two years.

When asked directly if a strong Volcker Rule would have prevented the losses, Dimon gave a response that harkened an image of Sylvester the Cat professing innocence as yellow feathers dangle on the edge of his lips. “I don’t know what the Volcker rule is, it hasn’t been written yet. It’s very complicated,” Dimon said. “It may very well have stopped parts of what this portfolio morphed into.… I just don’t know.”

His bank’s influence runs deeper than even the donations given to a majority of the committee and visits to the Treasury. JPMorgan also employs at least eight lobbyists that used to work on the Senate Banking Committee, and one current committee staffer used to work for the bank.

This aggressive lobbying and donation strategy was, as yesterday’s hearing demonstrated, a successful hedge of a different kind—one that seems to be protecting the bank’s backside after steep losses in both the balance sheet and public perception. Several protesters erupted into chants of “Stop foreclosures now” and “This man is a crook,” but were quickly escorted out by US Capitol Police and arrested so the hearing could begin.