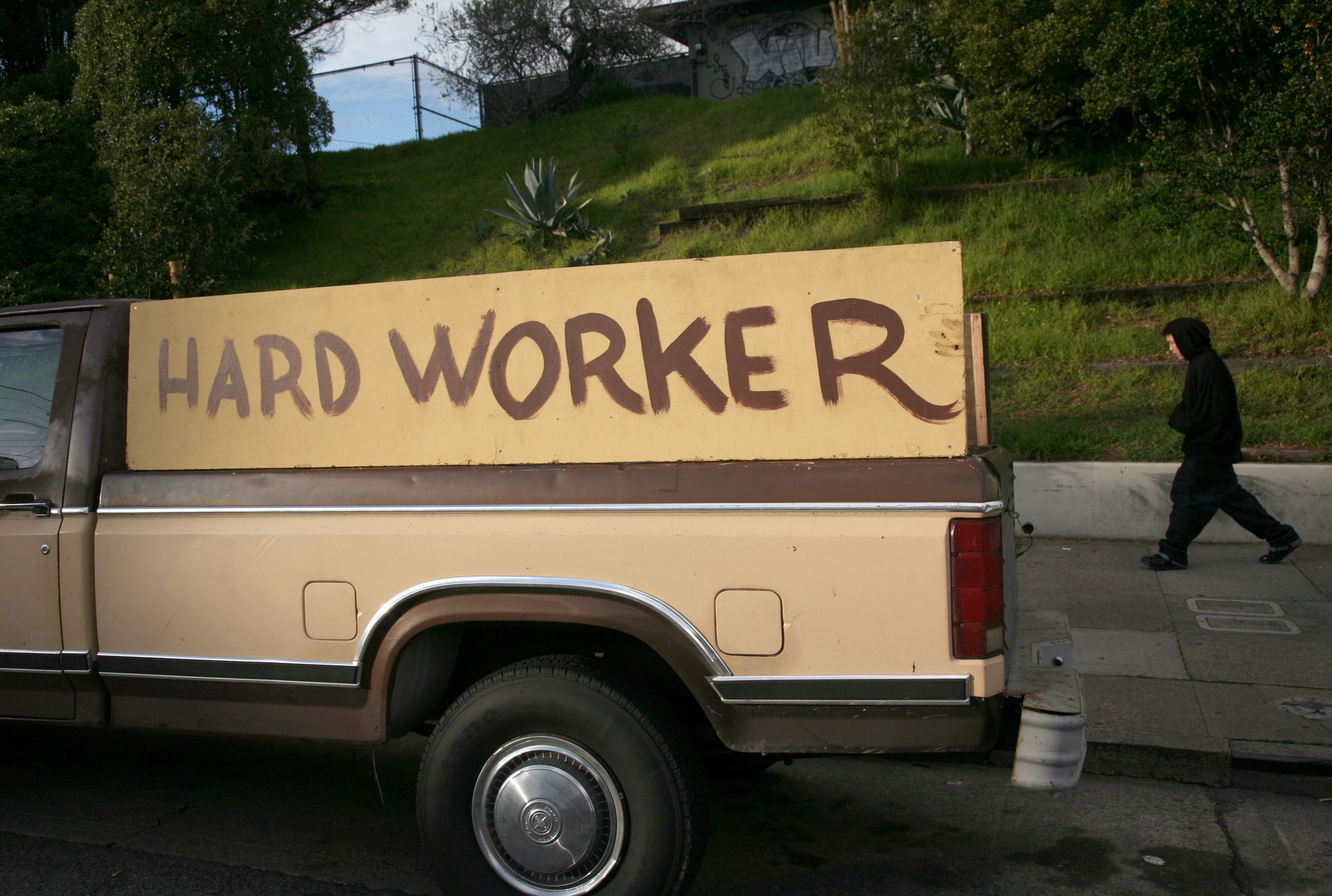

Reuters Pictures Lost your job? Tell your story.

Reuters Pictures Lost your job? Tell your story.

Last week, Nation columnist Nicholas von Hoffman asked people who had lost their jobs to tell us their stories. Response has been strong from people around the country who have lost blue-collar and white-collar jobs at major employers, as well as from the self-employed. Here’s the best of what we received in the last twenty-four hours. Send your employment-related stories and reflections to [email protected]. We will update this report daily as letters are received.

SUCCESS STORY

I was laid off from my job on December 8, just before the holidays. I hit the ground running hard! I am a 51-year-old human resources professional, and there is intense competition for jobs in Sonoma County. I tailored my résumé for each specific job I applied for, crafted a well- written cover letter, and was invited for five interviews in December and January.

I was offered a terrific job last Friday, and started yesterday. It pays a little less than what I am used to making, but I feel fortunate to have landed a job in my field and for a fair salary, with a company that is growing! My non-stop job search was a seven-day-a-week, morning to night, online and active networking. It’s not all doom and gloom.

Please share your success stories too! We all need them in these trying times.

Karen Boudrie

Petaluma, CA

A TEACHER’S DILEMMA

As a teacher in the state university system, this time last year I was carrying a full load of classes, which was enough to live comfortably on. This spring, because enrollment is down, some of my courses were cut at the last moment, leaving me to scramble to pick up the pieces. I’m told next fall won’t be any better. I was able to find a temporary low-wage job through friends, but even that business appears to be in serious trouble and I don’t expect it to last through June. Unless something turns around, I am going to have to move back in with my family at the age of 28, to avoid ruining my credit.

Katie Lynn

Northern California

WE WANT TO WORK

My husband and I were both laid off in November from our jobs as steelworkers. He has since been called back at huge pay cut and I am still waiting, even though I make more on unemployment than he now does working. But we both want to work, it is what we have always done.

Popular

"swipe left below to view more authors"Swipe →

With four children, things have been rough and we can only hope to hold on and cross our fingers that President Obama can work a modern-day FDR miracle. When the first half of the bank bailout was allotted, I wondered why they didn’t just use that money to pay of the mortgages of people making less than a certain amount? That way the banks would get their money and people would have more disposable cash in which to stimulate the economy. If our house were paid off, we could afford to buy a much-needed new vehicle. The middle class spending money is the only way to effectively and quickly jump start this economy.

Larita Thomas

Raceland, KY

RISE TO THE CHALLENGE

I was recently let go from my position as controller of a local natural foods manufacturer.

I had worked for the company for nine years, and had navigated the company financially through difficult times resulting from two less-than-effective product line introductions.

The consequence for me was that there are MANY competent unemployed in my field, each competing for scarce jobs.

Our department was understaffed, not considered a value-adding department, but only a cost to be minimized. At 54, I was not able to work fifty to sixty hours/week like I used to, and manage at the level of detail that my employer insisted on (but without clearly informing me.)

I did receive two months severance, and am not desparate financially. But, there are very few jobs out there in my region (a relatively small town in western Massachusetts).

I’m learning a great deal about simplicity. I find that I and my family can live far more frugally than we had, and that working together with neighbors and others in our community, we can live well frugally.

If I can eat, stay warm, stay healthy, then I throroughly enjoy having hours to read, discuss, play music, hug, and volunteer and mentor.

To get there takes individuals thinking and working to create good alternatives. It takes me doing it.

Richard Witty

Greenfield, MA

CAN’T CATCH A BREAK

The peak for me was July 2006. After years of hard work I was making $150K+ as a medical sales rep, just bought a house with 20 percent down and a fixed-rate mortgage(!) and started getting ready for the arrival of my second kid. Shortly after escrow closed, I was told that my company had been bought by an Icelandic company that was running around buying up a bunch of medium-sized orthopedic manufacturers. Over the next eighteen months and despite record sales and repeated assurances, salaries and benefits were cut drastically. Ironically, employees located in Iceland have stock options and sixty days a year or so of medical and vacation leave as mandated by their government.

In January 2008 I was given a choice: take a 50 percent reduction in salary or be let go with three months severance pay. I chose severance, mostly due to the fact that I could not survive on the new salary. For the last year I’ve worked as a sales rep at another company for considerably less, trying to build a client base that took me years to get previously. I’ve burned through my savings just to get by and I’m unable to sell my house for what I owe on it even despite doing things the “right” way when I bought it. I have to stop paying the mortgage so I can pay for doctor visits for the kids and groceries. I can’t afford the minor surgery and physical therapy to get a back problem fixed completely so I get by at the price of a dependency on pain meds, but hey–at least THOSE are generic and cheap. Despite a BA and management experience my attempts to find another position have been unsuccessful.

I did have a ray of hope last year. I started a side business with some colleagues from my military days and we bid on a government contract with the the DOJ for about $5 million a year. We were selected as the best-priced, most-qualified vendor. However, we were eventually disqualified by the Small Business Administration because we were unable to secure a credit line. A credit line wasn’t needed to perform the contract nor was it required on the bid notice, but someone at the SBA decided that any company without a credit line of some sort was too big a risk for a government contract. Sadly, six months later and the contract still has not been awarded.

John Crumrine

NOT A GOOD TIME TO BE YOUNG

I graduated from a Seven Sisters school in 2007. After nine months of job searching, I finally landed a job at a small planning company. The didn’t really have much time to train an entry level employee and the workload was falling as the economy worsened. I was only there for six weeks before the ax fell. I hadn’t been there long enough to qualify for unemployment and the company wouldn’t give me a letter explaining the situation.

I’m now trapped in the catch-22 of needing more experience to get even an entry-level job, but being unable to get that experience without getting a job. So now I’m stuck slinging groceries for eight dollars an hour and being thankful I have a job at all.

Kim Cadena

BANKRUPTED DREAM

I started as a temp data processor in October of 1994. After working my way into management, I followed the American dream and left in 2004 to start my own business. A year later, I was bankrupt, and lost the business, my wife, and my home.

I went back to my old company, where I was a gratefully employed computer programmer. On October 28, 2008 I was summoned into a conference room and told that after a fourteen-year relationship, I and 109 of my colleagues would be laid off in order to save $15 million annually. I’m nearly out of money and facing the loss of my second home in three years. I find it disgusting that our CEO makes $25 million a year, but 110 of us had to lose our livelihood to save 60 percent of his salary.

Ron Smith

Parker, CO

I’M TERRIFIED

I’ve worked high-end retail sales since 2001, furniture and related. I earned about $50,000 in 2001, which has consistently decreased since due to the increasingly bad economic sitation of the middle class: people have just stopped spending. I made half that income the last two years, even with working longer and longer hours, and last October I lost my job, since the company I worked for is about out of business due to lack of sales and the crash in September guaranteed another bad, even worse, holiday season.

In the almost four months since I lost my job, I have applied everywhere for any kind of sales or customer service job opening, willing to take as little as $9 or $10 an hour–anything. I’ve sent out four to eight résumés every week, but most companies don’t even acknowledge. For every job opening there are hundreds of applications–something I’ve been told by everyone I’ve managed to get an interview with.

I know I interview very well, having–before now–received a job offer for every single job I’ve ever interviewed for. With my experience, I should have had a job within a week–in fact, my pick of jobs. I’m very good at what I do, but there simply is no market now at all.

I’m 55 years old, widowed, sole support. I don’t know what I’m going to do when my unemployment benefits run out in two months if something doesn’t open up. I’m facing homelessness–forget health care–I haven’t been able to afford that for three years. I’m terrified.

Pat Spence

Houston TX

I DID EVERYTHING RIGHT

I lost my job to a layoff at the end of December. Fortunately, I had tucked away some money so I can get by for a while. Overall, I feel fairly well-off compared to most of the other layoff stories I have read and heard about.

But it is still difficult personally and it has been a roller-coaster ride, emotionally. I have days were I am fairly calm and go the task of building my contact network to find work. Other days are not so much fun. One of the things that makes this hard is the more than obvious age discrimination. I am in my late 50s, but am finding it tough to even get interviewed for positions I am more than qualified to fill.

I get angry at times because I did everything right according to the conservative mantra. I have been very conservative in my finances. I have substantial equity in my home with a conservative mortgage. I put money aside for retirement diligently. And for what? I’ve seen my house equity decline and my retirement portfolio deteriorate. And all because of the reckless laissez-faire policies of the past eight years where the few were enriched to the detriment of the common good.

It is galling so see the financial masters of the universe and their political enablers get away with this debacle and hurt so many people. I hope the American people learn something from this and force our political leaders to put in place policies to keep this from ever happening again.

Carl Mitchell-Smoot

WHY TAX THE UNEMPLOYED?

I’ve been out of work for six months. My unemployment benefits, now reaching the final days of their last twelve-week extension, barely cover my basic monthly living expenses. While I am most grateful to receive them, I don’t understand why the government taxes unemployment benefits. I’m facing a tax bill against benefits received in 2008 and I have no idea how I’m going to pay it. Worrying about this–on top of worrying about what I’ll do if I become sick (since I have no health insurance), on top of searching for a job everyday–is almost too much. Thank you for providing a forum for the people most in need of economic help to have their voices heard.

Kathryn Vanskiloff

Manitowoc, WI

TOUGH CLIMATE FOR SALES

Three years ago when my husband began as a sales specialist with for a building company, he had a promising career ahead of him. After a year of selling pre-engineered structures such as barns and out buildings, he was the second most successful first-year salesperson across the company. But then the economy started to change. In 2007, his sales plummeted, as did his base salary, from $335 per week to $250 per week. In 2008, his base salary dropped to less than minimum wage, $200 per week–a total on which he was trying to support our family of four. Finally, in October of 2008, he was let go.

The company then tried to deny his unemployment and withheld his last paycheck. They wanted him to sign a statement saying he had not met his sales quota after being repeatedly told to do so, even though no customer is going to build a barn or out building when they cannot get a loan and in the current economy. We had to solicit the assistance of our state representative, Diana Fessler. The corporation appealed the decision once his unemployment was granted.

The worst part of this layoff is that my husband carried our family’s health insurance. With my two part time jobs I make just over the amount allowable to put my children on Medicaid. Luckily, Ohio makes children eligible for a buy-in plan if one’s children are uninsured for over six months. But what about those six months?

On New Year’s Day I went to a party with some old college friends. I discovered that one of my friends had been laid off from a job he had worked for over twenty years. He was the sole provider for his family of five. I remind myself that at least we are better off than his family–better off than a lot of people.

Gail Ruhkamp

Laura, OH

SMALL BUSINESS BLUES

I have been developing a business for over ten years and now have no access to capital. I have a great product, great market and real demand, but I cannot afford to bootstrap the expansion of my company. The credit crunch my business is facing was caused by greedy financial services executives in urban centers who have essentially siphoned off all of the discretionary capital that makes a national economy function. When small businesses in the heartland of America cannot access operating capital EVERYONE loses.

Tom Simon

Mount Vernon, IA

DIFFICULT ADJUSTMENT

Last July, with no advance notice, I was laid off from my job of ten years at a trade publication. (I am contractually forbidden from giving specify details about the firm or my job.) I had been working almost without interruption since the age of seventeen, when I landed my first full-time job on a clothing assembly line. Since then, except for two years of attending college during the day, and one year of unemployment, I have earned a salary.

Compared with the dire accounts of other newly jobless–no health insurance, facing eviction, barely enough money for food–my situation is tolerable. My wife is still working, I collect Social Security and unemployment benefits (which stop with each freelance assignment I land), and I belong to a strong tenant organization that has secured rent concessions after a four-year battle. Still, at nearly 67, with two children in college and the accompanying mountain of debt, I am in trouble. I cannot afford to retire and, even if I could, my IRA savings are dissolving at lightning speed. I look for work every day. Here and there I land a freelance project, but the compensation is far below what I had been earning.

Beyond my financial troubles, one of the biggest difficulties I am facing is psychological. Call it macho if you will, but I have always felt good being the main supporter for my family. That was a major part of my self-definition. That sense of pride was taken away from me. I’m not sure when, or if, the emptiness in me will ever be filled.

Nathan Weber

New York City

OUTSOURCED

For more than fifteen years I worked as a proofreader of textbooks, from college chemistry on down. The company was at first family-owned, then it was bought by a national firm, and then that was bought by an international corporation based in New Delhi. Can you guess where this is going? The Los Angeles office was closed effective last month, December.

Because I was an independent contractor, I received no severance, will get no unemployment compensation and forget about COBRA health insurance, which is not affordable anyway to the unemployed. I have little hope of finding such specialized work at all, much less at the hourly rate I was paid. Here in California, the official unemployment rate is now 9.3 percent, but that doesn’t include people like me, and there are a lot of us.

W.K. Grady

Los Angeles, CA

UNDEREMPLOYED OUT WEST

Both my younger brother and I are trying to get back on our feet after the local economy crashed during the 1980’s and 90’s. While Wyoming has a low unemployment rate (and has been recruiting from Michigan and elsewhere), the job market mostly consists of low-wage, dead-end positions. My brother was cut loose from his job as a mudlogger in the once-booming local oil industry; now the hospital and Home Depot seem to be the only employers still hiring for mid-level positions.

Thomas O’Brien

Casper, WY

BURNED BY THE FIRE DEPARTMENT

In July of 2007, I suffered a ruptured appendix while working for the Valley Center Fire District and underwent emergency surgery. The fire district’s administrator told me that, since there was no medical leave policy, he would not be able to hold the job open until I returned to work. I went on extended unemployment that October and, although I have a college degree, I have been unable to find work since. My husband is also unemployed at the moment. We need health insurance and extensions on unemployment, but most of all we need decent paying jobs. What has happened to this country?

Janet McGarrigle

Valley Center, CA

THE JOBS HAVE LEFT THE DEPOT

I worked at a Home Depot EXPO Design Center for six years and was very disappointed to learn that they were closing my division. I have been a top-performing employee and have been awarded and promoted time and again. I thought that if I was doing a great job–in the top 5 percent to 10 percent, performance-wise–I would be able to stick it out. I guess I was wrong. In my quest to find a new job, I have found that positions I am qualified for pay half of what I made and positions that pay what I made are asking for qualifications I don’t have. Many people have told me to use this setback as an opportunity to further my education or start out fresh in an industry that makes me happy but I cannot afford to do that, either.

I understand that layoffs happen, really I do. However, at what point will our corporate leaders realize that putting more people out of jobs to cut short-term operating losses is not going to build their consumer base in the long term? If people have no job, they can’t spend any money. If they can’t spend any money, then the businesses won’t make any income. How and when will this downward spiral end? Like all things, I know it will end eventually, but it’s the timing of it that worries me most.

Rochelle Cooper

Costa Mesa, CA

WAITING FOR THE REVOLUTION

A year and a half ago I was working as a carpenter in Boston making over $30 per hour with a reasonable benefit package. Now I, like nearly everyone I used to work with, am laid off. I can’t even find a job without benefits for half of my old hourly wage. I have exhausted my unemployment insurance and will probably end up landscaping for $12 per hour in the spring.

I thank all the politicians in Washington, DC and the Wall Street lobbyists who conspired to deregulated banks so that they could more efficiently swindle the workers of America. Let the markets run free–well, until there is no money left, then the government can step in and pick up the tab. Unless there is a revolution soon I am moving to Europe. I’m embarrassed to be a foolish American.

James M. Rich

Peabody, MA

MAD IN MICHIGAN

For over 20 years, I worked for BBDO, an advertising agency, whose primary customer in the Detroit area is Chrysler. I had a good salary, good health care for my family, benefits like a 401K and paid time off. That’s all gone now and my family and I are struggling with the realities of this new situation we find ourselves in. I was an excellent worker and was very good at what I did, but in the end, it didn’t matter one bit. Ultimately, I was–or rather my salary and associated benefits were–only numbers on a spreadsheet that someone, somewhere deemed expendable. Another worker to “shed,” to use the current vernacular, in service of the bottom line.

The managers and politicians are only focused on their next quarterly earnings or their next re-election bid and don’t seem to understand that the loss of my job doesn’t only affect me and the ones I love–it affects every business my family and I come into contact with. The job losses are rippling through our economy and soon, because of the sheer numbers of unemployed workers, that ripple will turn into a tsunami which could rip this country apart. How and where will the millions of unemployed workers others find jobs like the ones that have been lost? With no job, how can I afford to buy a new American vehicle or TV or shoes for my son or food for our next meal?

The people that we’ve entrusted with this nation’s corporate and financial assets better get it together fast because soon those questions will be resonating a million times over and the noise from the masses may well topple the walls surrounding of their gated communities and country clubs and rattle their gilded cages. We were told, “work hard, play by the rules, and pay your taxes and you will get ahead–you will have the so-called American Dream.” That’s a damn lie and I for one am mad as hell about it. I don’t know what to do with this newfound realization, but God help those in charge if the millions of unemployed people like me (and our numbers seem to be growing exponentially by the day) reach a point of desperation and no return. There will be a revolution and no redemption for the people that caused this mess. Just because they haven’t felt any of the pain yet, doesn’t mean they ultimately won’t.

Joris B. Rapelje

Clinton Township, MI

FINANCIAL FALLOUT

I worked as for an asset management company for over ten years until I was laid off in October on the day of the third-quarter earnings conference call. I suspect the layoffs were timed to reassure the shareholders–my former employer lowered its headcount by 11.7 percent in the fourth quarter of 2008.

Before I became an asset manager, I did temp work but none of the agencies to which I’ve applied have had any work for me. I try to keep to a normal schedule during the workweek: I keep the alarm set and spend my days improving my software skills, checking the e-mails I get from job sites and trying to network. Fortunately, I have a severance package and some savings. I’ll start collecting unemployment when I’m eligible and could bleed out my IRA, as a last resort.

To revive the economy, I think that both smart infrastructure programs and a bottom-up stimulus package are what is most needed. I’m also in favor of allowing bankruptcy judges to do cram-downs on mortgages–the contention that mortgage payment relief would result in too much uncertainty in the value of the attendant credit default obligations is ridiculous, because their constant repackaging has done that already.

Bill Bruno

Astoria, NY

NO HELP FOR THE SELF-EMPLOYED

I am an Ivy League graduate with a masters in architecture who has been self-employed for nineteen years. I am in an increasingly precarious position without any safety net. Architecture work has dried up since September 2008 and there is no government help for the self-employed. At fifty-eight years old, I cannot find affordable health insurance. I am a renter with no family and, due to a health problem four years ago, no savings. I can possibly keep this up for eight more weeks. After that, I have no idea what is going to happen. (Actually, I do, but it’s unthinkable.) I have a beautiful two-year-old pup who I dearly love. I know I should make plans to re-home her but I just can’t bring myself to do it, yet. I could stay in my current circumstances on only 2.2K a month, yet there is nothing coming in.

Where are other people’s stories? I have been looking online and, beyond this forum, they are nowhere to be found. Perhaps without an Internet connection, the worst stories will never be heard. Is that the reason for the silence? Is it pride–or shame? I despise the greedy bastards who got us here, and they are still being rewarded for their malfeasance. It’s sickening beyond belief. And you think the best solution is to suspend the payroll tax? You’ve got to be kidding.

Anonymous

Miami, FL

SAVING SEEDS

Because of a couple of chronic illnesses, I’ve ended up cleaning houses to get by. As my customers lose their jobs or have salaries slashed, my income is also being whittled away. Because my husband has a job that still has health insurance, I am not a good candidate for disability. Because he is a well-skilled carpenter, my husband’s employer is able to get him jobs a couple days a week if we’re lucky. This week, there is no work.

Because my husband has work at all, he can’t qualify for unemployment. The unemployment office doesn’t even take calls every day. The answering machine at the local office said to call back in a few days just to get information. So we both look for work, hoping to find something that will get us over the next hump, something that will enable us to pay our household expenses.

I have been putting off treatments for my health conditions that could possibly make me more functional–even with health insurance, the treatments are too expensive for me to afford at this time. We also have four pets and I am terrified whenever their health needs attended to. Our dog needed surgeries so my husband had to use the money he had saved to get those done. Now, there is no money to fall back on. We live paycheck to ever-tinier paycheck.

I’ve organized a documentary movie night so my friends have something cheap that they can do on the weekend and a place where we can gather together as a progressive community. Next movie night, I’m showing a film on the healthcare delivery crisis. At this time in history, we all have to strive to be one another’s teachers and be there to support each other in kindness and emotional support. I put on a potluck spread so that those in our group can have a decent meal while feeling the emotional support from friends who care. My friends read my fliers and my husband’s résumés and give us pointers on how to make them more effective.

Even though I’ve never been a churchgoer, I know what it is like to pray everyday for the simple necessities. I have a victory garden now. I save seeds. I hope that our struggles will soon pay off. I pray that my health doesn’t worsen and that I can continue to work, when work becomes available.

Paulette Kenyon

Pleasanton, CA

PAYING FOR CHILDREN’S COLLEGE WITHOUT A JOB

After the telecom bubble burst, I was unemployed for three years. It wasn’t until 2005 that I found a job in New Jersey. I commuted to the job from New England for approximately three years. The economic and personal costs of the commute began outweighing my income so I sought employment closer to home. I took a poorly paid position with a marginal company closer to home; however, in late September the company was in trouble and I was LIFO (last in, first out). In my field of work (sales and marketing of complex instrumentation), there are no opportunities out there. And yet my costs, and two children in college, still remain. Any savings that we had managed to accumulate have disappeared, primarily due to education expenses.

The stimulus package could best help me in the short term by enabling some type of tax deduction for the costs of college–an amount equivalent to all the tuition and books, not the costs of living at the college. This would put a LARGE amount of money back into my family’s hands relatively quickly that would help us to survive through the coming summer. That said, I am doubtful that any stimulus package is going to help me to find new employment within the next 12 months. If the stimulus does include significant new expenditures for the US government’s national laboratories and research centers at qualified universities it might have an indirect effect on my future employment prospects.

Paul Tivin

North Kingstown, RI

THE MORE THINGS CHANGE…

I was laid off from my job at a very high-end cabinetry company with one week’s notice and no severance, two weeks after buying the house and three weeks before Christmas. Before the layoff meeting was over I realized I had to move out of my hometown. The Naples/Fort Myers area is ground zero for the foreclosure debacle and even if the economy were to recover fully, it will be years before the existing housing inventory is sold.

I am grateful that I have found several companies that are hiring and interested in my services; however, none of these businesses are ready to commit to hiring (and understandably so). Employers that were ready to fly me up for an interview in December reconsidered after the holidays in light of the continued deterioration of the economy. The job offers that remain are short term with ninety-day probationary periods and lodging covered instead of relocation assistance.

I haven’t been out of work since I was 23 years old during the last extended recession in 1991. I notice the irony that at that time, George Bush was president, we were at war with Iraq, and the government was bailing out insolvent banks as a result of ill-advised deregulation.

Sean Reardon

Naples, FL