Seniors and disabled veterans are planning today to crash a “Fix the Debt” party in New Hampshire hosted by Honeywell CEO David Cote. Fix the Debt, an organization comprised of many of the country’s richest and most powerful CEOs, pushes the case for cutting Social Security and Medicare as well as lowering the corporate income tax rate.

As such, the organization—and subsequent party—caught the eye of the anti–corporate tax-dodging group US Uncut and the new group Flip the Debt.

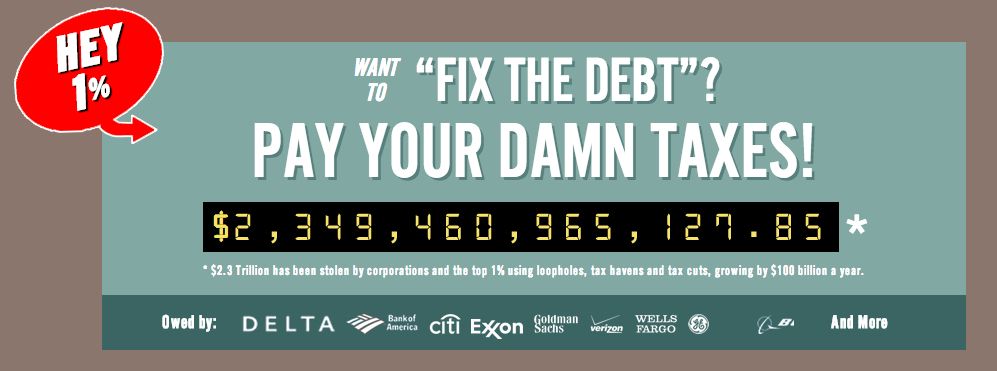

“We wouldn’t have to make these cuts, and we could invest in putting America back to work, if only [corporations] pay their fair share. So we say, rather than ‘fix the debt,’ let’s ‘flip the debt’ and put responsibility where it belongs. Hey 1%! Pay your damn taxes,” Flip the Debt states on its website.

The two tax accountability groups have organized the protest, which will include seniors and disabled vets sharing their stories about how they survive on programs like Social Security, Medicare and Medicaid, then handing over their Social Security checks to Cote. They will demand that Cote, a spokesperson for Fix the Debt, answer the question: Why are you demanding that we reduce the deficit by cutting critical social programs, when your own company practices tax-dodging that has contributed millions to the national debt?

Despite reporting substantial pretax US profits to shareholders, Honeywell paid no federal income taxes in 2009 or 2010 (or more precisely, paid less than zero), according to Citizens for Tax Justice, a nonprofit advocacy think tank.

Cote and Honeywell have a history of making lavish profits while taking advantage of a tax system that permits corporations to bleed the country dry of revenue.

Over the last three years, Honeywell received more than $2.7 billion in federal defense contracts and reported more than $2.5 billion in U.S. pre-tax profits. And yet thanks to corporate deductions, tax subsidies, and loopholes, Honeywell has claimed $377 million in federal tax refunds during this period.

Honeywell CEO David Cote has been a fixture at Congressional hearings calling for a territorial tax system for corporations. He is also Vice-Chair of the Business Roundtable, a club for big business CEOs that has called for an extension of all the Bush tax cuts, including those for millionaires and billionaires, as well as the tax cuts on unearned income from capital gains and dividends. These combined measures would add $1.5 trillion to the debt over the next ten years.

This isn’t about “fixing the debt.” This is about rigging the game so big business and CEOs can still make oodles of cash while the 99 percent shoulder the burden of corporate welfare.

“The ‘Fix the Debt’ Campaign is the latest incarnation of a multi-decade effort by wealthy Wall Street investors to slash social support programs under the pretense of cutting the deficit,” the groups state in a press release. “Meanwhile, many of the very same corporations and their CEOs have contributes mightily to the national debt.

“Honeywell has paid an average effective tax rate of negative 14.8 percent from 2009–11, even as they receive taxpayer money as the thirty-fifth largest federal contractor. Now CEO David Cote is demanding we sacrifice our nation’s most popular and effective anti-poverty programs. The average Social Security check is under $1,400 per month. By comparison, when CEO David Cote retires, he is expected to receive a monthly mention of nearly $500,000.”

The groups go on to claim that the Bush tax cuts for the wealthy tax-dodging global corporations—many of them members of Fix the Debt—have cost the US Treasury $2.3 trillion, an amount that exceeds the $1.6 trillion Congress now seeks to cut from the deficit.

Check out this week’s issue of The Nation for more on the US’s regressive tax system.