“In Techno Parentis”: Who Should Regulate the Online Lives of Teenagers? “In Techno Parentis”: Who Should Regulate the Online Lives of Teenagers?

With TikTok, Instagram, and other platforms using algorithms to send teen viewers addictive, dangerous content—and reaping immense profits—self-regulation has clearly failed.

Apr 2, 2024 / Zephyr Teachout

The Big Unfriendly Tech Giants The Big Unfriendly Tech Giants

We must ensure that corporations aren’t able to pick and choose winners and losers in journalism.

Dec 11, 2023 / Feature / Zephyr Teachout

When Big Brother Is Your Boss: The Rise of Surveillance Wages When Big Brother Is Your Boss: The Rise of Surveillance Wages

Everything the Internet knows about you may end up being used against you by your employer.

Jan 5, 2022 / Zephyr Teachout

It’s Time to End Murder by Spreadsheet It’s Time to End Murder by Spreadsheet

The other side of criminal justice reform is focusing on white-collar prosecutions.

Oct 29, 2021 / Column / Alvin Bragg and Zephyr Teachout

The Real Question Is Why Andrew Cuomo Took So Long to Fall The Real Question Is Why Andrew Cuomo Took So Long to Fall

New York hasn’t had a governor leave in dignity in years—and that is not a fluke.

Aug 11, 2021 / Editorial / Zephyr Teachout

Joe Biden Just Threw Down the Anti-Monopoly Gauntlet—but One Big Question Remains Joe Biden Just Threw Down the Anti-Monopoly Gauntlet—but One Big Question Remains

This president’s executive order on Friday afternoon forcefully rejected the pro-monopoly worldview of the last 50 years.

Jul 9, 2021 / Zephyr Teachout

Appointing Lina Khan May Be the Best Thing Joe Biden Has Done Appointing Lina Khan May Be the Best Thing Joe Biden Has Done

Massive corporations have wielded extraordinary power over our economy for the past 40 years. That’s about to end. Why? Because there’s a new sheriff in town.

Jun 22, 2021 / Morgan Harper and Zephyr Teachout

Alvin Bragg Is the Right Choice to Be Manhattan’s District Attorney Alvin Bragg Is the Right Choice to Be Manhattan’s District Attorney

He’s spent his career holding powerful people and interests accountable, and he’s the progressive with a real shot to win the race.

May 27, 2021 / Zephyr Teachout

Why Andrew Cuomo Must Resign Why Andrew Cuomo Must Resign

There is no investigation that can give New Yorkers a governor we can trust not to abuse power and lie.

Mar 16, 2021 / Editorial / Zephyr Teachout for The Nation

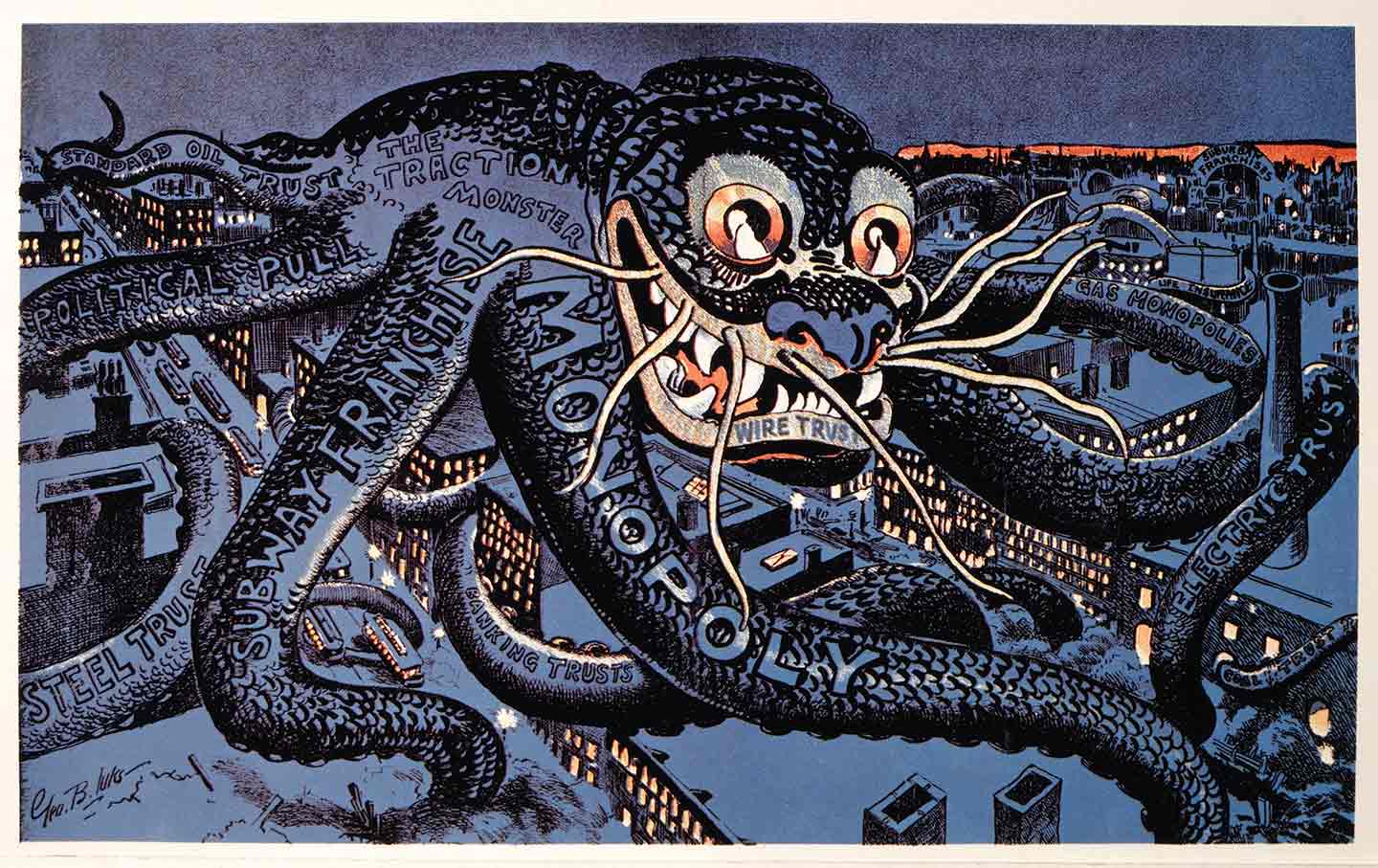

How Biden Can Break the Stranglehold of Amazon and Other Monopolies How Biden Can Break the Stranglehold of Amazon and Other Monopolies

The incoming president can take numerous steps to trim the tentacles of today’s monopolistic companies, which reach into every corner of American life.

Jan 4, 2021 / Biden's First 100 Days / Zephyr Teachout