The NSA Wants Carte Blanche for Warrantless Surveillance The NSA Wants Carte Blanche for Warrantless Surveillance

If the Senate passes an expansion of the Foreign Intelligence Surveillance Act, any American’s international communications could become an open book.

NPR’s Problems Won’t Be Solved by “Viewpoint Diversity” NPR’s Problems Won’t Be Solved by “Viewpoint Diversity”

An embattled NPR editor denouncing the network’s practices fails to understand them—or the practice of journalism.

Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter

A unanimous Supreme Court ruling on sex discrimination hides serious ideological differences, beginning with Alito’s long-standing hostility to women’s rights.

Pacita Abad Wove the Women of the World Together Pacita Abad Wove the Women of the World Together

Her art integrated painting, quilting, and the assemblage of Indigenous practices from around the globe to forge solidarity.

Latest

Shawn Fain Triumphed in Detroit. Now He’s Headed South. Shawn Fain Triumphed in Detroit. Now He’s Headed South.

Apr 18, 2024 / Q&A / John Nichols

A Toxic Legacy of Mining In Peru A Toxic Legacy of Mining In Peru

Apr 18, 2024 / Multimedia / Tania Wamani

How Sports Betting Is Fueling Gambling Addiction How Sports Betting Is Fueling Gambling Addiction

Apr 18, 2024 / Audio / Paris Marx

As the Threat of War Looms, Some Students Regret Joining ROTC As the Threat of War Looms, Some Students Regret Joining ROTC

Apr 18, 2024 / StudentNation / Gabe Levin

The Cop City Defendants Are Done Being Silent The Cop City Defendants Are Done Being Silent

Apr 18, 2024 / Oliver Haug

Bob Graham Knew Iraq Would Be a Quagmire Even as Most Democrats Fell for Cheney’s Lies Bob Graham Knew Iraq Would Be a Quagmire Even as Most Democrats Fell for Cheney’s Lies

Apr 17, 2024 / John Nichols

Nation Voices

“swipe left below to view more authors”Swipe →Israel-Gaza War

Israel’s Genocide in Gaza Is a World Historical Crime Israel’s Genocide in Gaza Is a World Historical Crime

When Jews were being slaughtered by the Nazis, the world turned away. Now, the world has awakened to Israel’s crimes.

Will Benjamin Netanyahu Drag America Into a Big Middle Eastern War? Will Benjamin Netanyahu Drag America Into a Big Middle Eastern War?

Biden is for pushing de-escalation—but Israel could still go rogue.

Where Is the Leftist Critique of Hamas? Where Is the Leftist Critique of Hamas?

What is the view of most of the organizations and activists in the Palestinian solidarity movement about Hamas? The answer remains unclear—and rarely talked about.

Popular

“swipe left below to view more authors”Swipe →-

Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter

-

Columbia Is Waging War on Dissent Columbia Is Waging War on Dissent

-

Israel’s Genocide in Gaza Is a World Historical Crime Israel’s Genocide in Gaza Is a World Historical Crime

-

NPR’s Problems Won’t Be Solved by “Viewpoint Diversity” NPR’s Problems Won’t Be Solved by “Viewpoint Diversity”

From the Archive

January 4, 2014: This Week in ‘Nation’ History: How We Helped Start the ‘Melville Revival’ of the 1920s This Week in ‘Nation’ History: How We Helped Start the ‘Melville Revival’ of the 1920s

An article in our pages in 1919 helped rescue the long-deceased scribe from obscurity and secured him a prominent place in the American canon.

Politics

Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter

A unanimous Supreme Court ruling on sex discrimination hides serious ideological differences, beginning with Alito’s long-standing hostility to women’s rights.

Bob Graham Knew Iraq Would Be a Quagmire Even as Most Democrats Fell for Cheney’s Lies Bob Graham Knew Iraq Would Be a Quagmire Even as Most Democrats Fell for Cheney’s Lies

The former Senate Intelligence Committee chair saw through Republican efforts to manipulate Congress into authorizing a war that should never have been fought.

The Only Thing Worse Than Taking Rural Voters for Granted The Only Thing Worse Than Taking Rural Voters for Granted

… is dismissing them as out of reach for Democrats.

Books & the Arts

Pacita Abad Wove the Women of the World Together Pacita Abad Wove the Women of the World Together

Her art integrated painting, quilting, and the assemblage of Indigenous practices from around the globe to forge solidarity.

The Many Evolutions of Kid Cudi The Many Evolutions of Kid Cudi

In Insano, the rapper and hip-hop artist comes back down to earth.

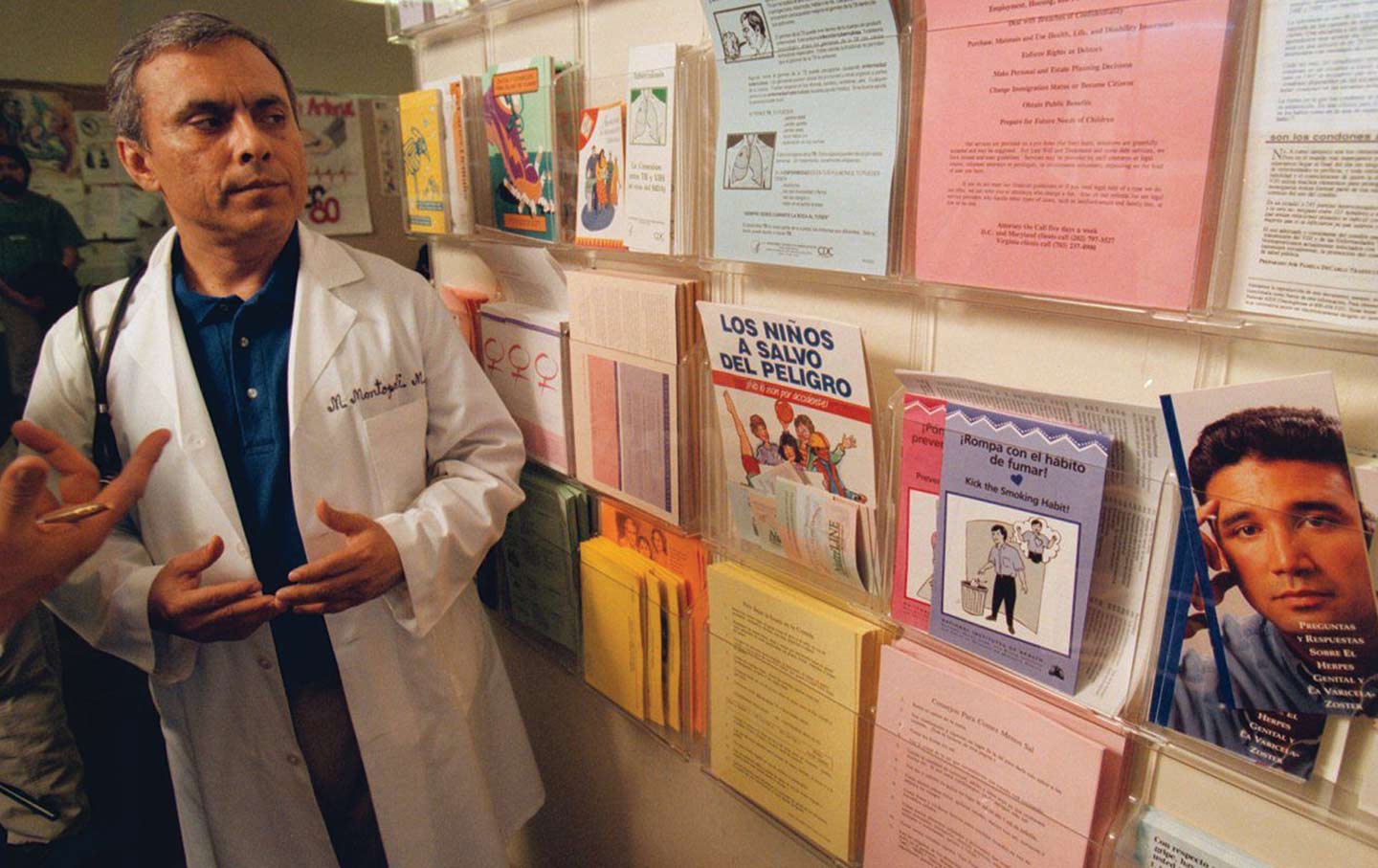

The Brutal Cycle of US Immigration Policy The Brutal Cycle of US Immigration Policy

In Everyone Who Is Gone Is Here, Jonathan Blitzer examines how North and Central American migration moves in two directions.

Features

“swipe left below to view more features”Swipe →Latest Podcasts

The Nation produces various podcasts, including Contempt of Court with Elie Mystal, Start Making Sense with Jon Wiener, Time of Monsters with Jeet Heer, and Edge of Sports with Dave Zirin.

SubscribeHow Sports Betting Is Fueling Gambling Addiction How Sports Betting Is Fueling Gambling Addiction

Podcast / Tech Won’t Save Us

Trump’s Very Bad Week— Plus, Prestige TV, From “The Sympathizer” to “Shogun” Trump’s Very Bad Week— Plus, Prestige TV, From “The Sympathizer” to “Shogun”

Podcast / Start Making Sense

“Patriots” on Broadway “Patriots” on Broadway

Podcast / American Prestige