The “Troublemakers” of the Labor Movement Gather in Chicago The “Troublemakers” of the Labor Movement Gather in Chicago

The Labor Notes conference explodes, with growing ranks of unionists, new organizers taking on goliaths like Amazon and Starbucks, and veterans invigorated by reform victories.

Pecker Exposes Lengths Taken to Please Trump Pecker Exposes Lengths Taken to Please Trump

Testimony by the former National Enquirer publisher detailed the Trump campaign’s involvement in directing the tabloid’s coverage of the 2016 election.

As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off

Human Rights Watch just let go of 39 staffers. Workers are demanding executives take pay cuts instead

“The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza “The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza

The extraordinary story of a 14-year-old, her mother, and what happened when the Israeli military came to destroy their house.

Latest

Summer Lee Proves That “Opposing Genocide Is Good Politics and Good Policy” Summer Lee Proves That “Opposing Genocide Is Good Politics and Good Policy”

Apr 24, 2024 / John Nichols

On Sex Ed, “Our Side” Is Finally Fighting Back On Sex Ed, “Our Side” Is Finally Fighting Back

Apr 24, 2024 / Joan Walsh

A Better Two-State Solution—Plus, the UAW’s Victory A Better Two-State Solution—Plus, the UAW’s Victory

Apr 24, 2024 / Audio

Data, Desire, and Where Fiction Goes Next Data, Desire, and Where Fiction Goes Next

Apr 24, 2024 / Q&A / Rose D’Amora

Without Expanded DACA Protections, Undocumented Students Are Being Left Behind Without Expanded DACA Protections, Undocumented Students Are Being Left Behind

Apr 24, 2024 / StudentNation / Lajward Zahra

Is Comedy Really an Art? Is Comedy Really an Art?

Apr 24, 2024 / Books & the Arts / Ginny Hogan

Nation Voices

“swipe left below to view more authors”Swipe →Israel-Gaza War

Israel’s Attacks on Gaza Are Not “Mistakes.” They’re Crimes. Israel’s Attacks on Gaza Are Not “Mistakes.” They’re Crimes.

The political and media class is doing what it always does with the US and its allies: trying to frame deliberate atrocities as tragic mishaps.

Inside the Gaza Solidarity Encampment at Columbia University Inside the Gaza Solidarity Encampment at Columbia University

Hundreds of peaceful protesters began occupying the campus on Wednesday to demand that the university divest from Israel. The next day, the school sent in the NYPD to arrest them….

Will Benjamin Netanyahu Drag America Into a Big Middle Eastern War? Will Benjamin Netanyahu Drag America Into a Big Middle Eastern War?

Biden is for pushing de-escalation—but Israel could still go rogue.

Popular

“swipe left below to view more authors”Swipe →-

“The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza “The Bulldozer Kept Coming”: A Girl Stares Down Death in Gaza

-

Pecker Exposes Lengths Taken to Please Trump Pecker Exposes Lengths Taken to Please Trump

-

As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off As Atrocities Unfold, Those Documenting Rights Violations Are Getting Laid Off

-

The Rotten Roots of the IMF and the World Bank The Rotten Roots of the IMF and the World Bank

From the Archive

July 1, 2014: ‘The Nation’ Welcomes Canada Into Existence… With a Shrug ‘The Nation’ Welcomes Canada Into Existence… With a Shrug

The politicians were happy, if nobody else.

Politics

On Sex Ed, “Our Side” Is Finally Fighting Back On Sex Ed, “Our Side” Is Finally Fighting Back

The new group EducateUS is creating a counter-movement to the conservative groups stoking a culture war over sexuality education.

Is Donald Trump on Drugs? If Not, He Should Be. Is Donald Trump on Drugs? If Not, He Should Be.

His true addiction explains the president’s doziness.

The House Foreign Aid Bills Have Put a Target on Mike Johnson’s Back The House Foreign Aid Bills Have Put a Target on Mike Johnson’s Back

After a vote in favor of sending $95 billion to Ukraine, Israel, and Taiwan passed, far right Republicans are threatening a motion to vacate the speaker of the house.

Books & the Arts

Is Comedy Really an Art? Is Comedy Really an Art?

A history of comedy’s last three decades of pop culture dominance argues that it is among the consequential American art forms.

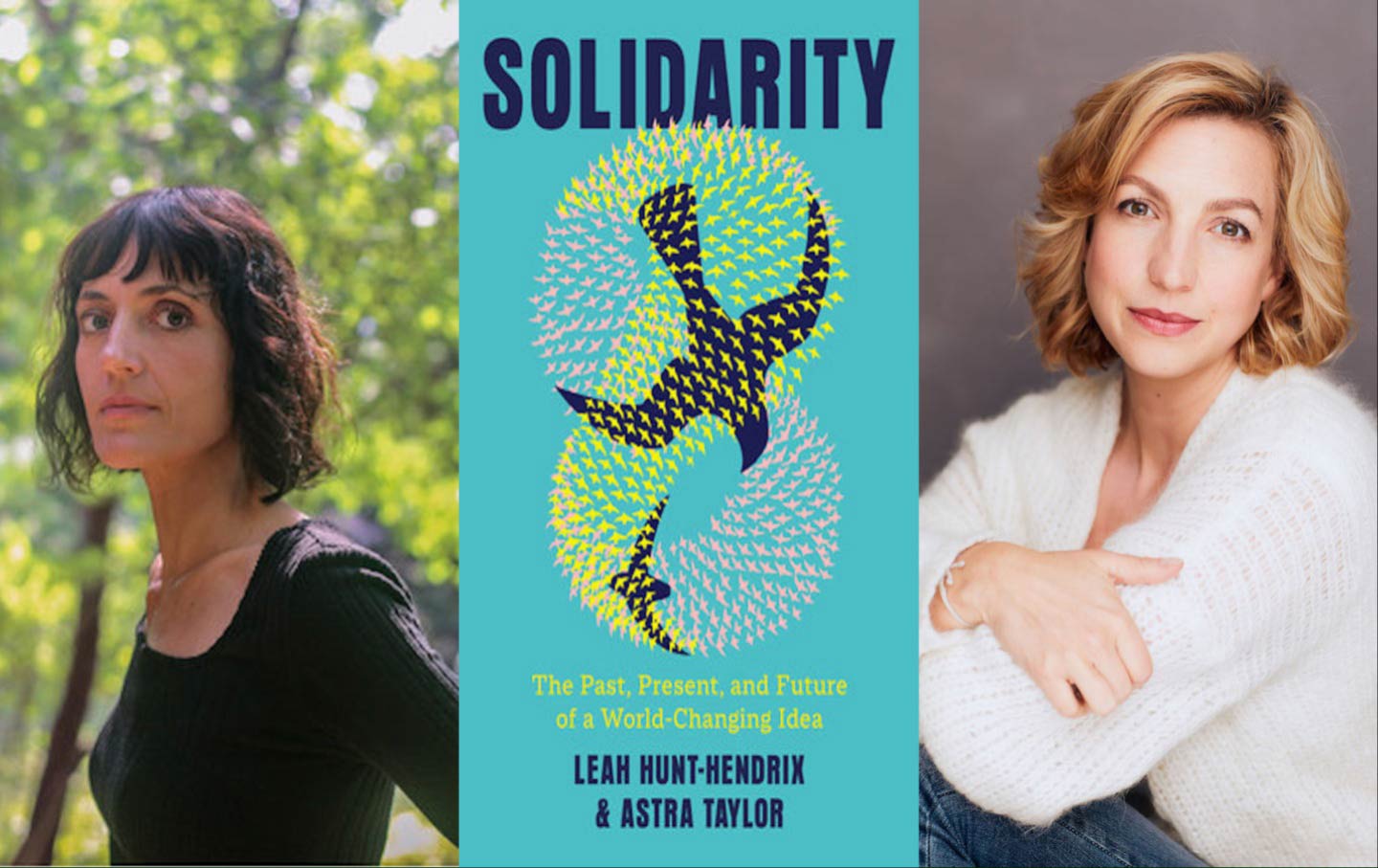

Talking “Solidarity” With Astra Taylor and Leah Hunt-Hendrix Talking “Solidarity” With Astra Taylor and Leah Hunt-Hendrix

A conversation with the activists and writers about their wide-ranging history of the politics of the common good and togetherness.

The Education Factory The Education Factory

By looking at the labor history of academia, you can see the roots of a crisis in higher education that has been decades in the making.

Features

“swipe left below to view more features”Swipe →Latest Podcasts

The Nation produces various podcasts, including Contempt of Court with Elie Mystal, Start Making Sense with Jon Wiener, Time of Monsters with Jeet Heer, and Edge of Sports with Dave Zirin.

SubscribeA Better Two-State Solution—Plus, the UAW’s Victory A Better Two-State Solution—Plus, the UAW’s Victory

Podcast / Start Making Sense

Did Fascism Happen Here? Did Fascism Happen Here?

Podcast / American Prestige

The Meaning of Jalen Brunson and the 2024 Playoffs The Meaning of Jalen Brunson and the 2024 Playoffs

Podcast / Edge of Sports