Economy

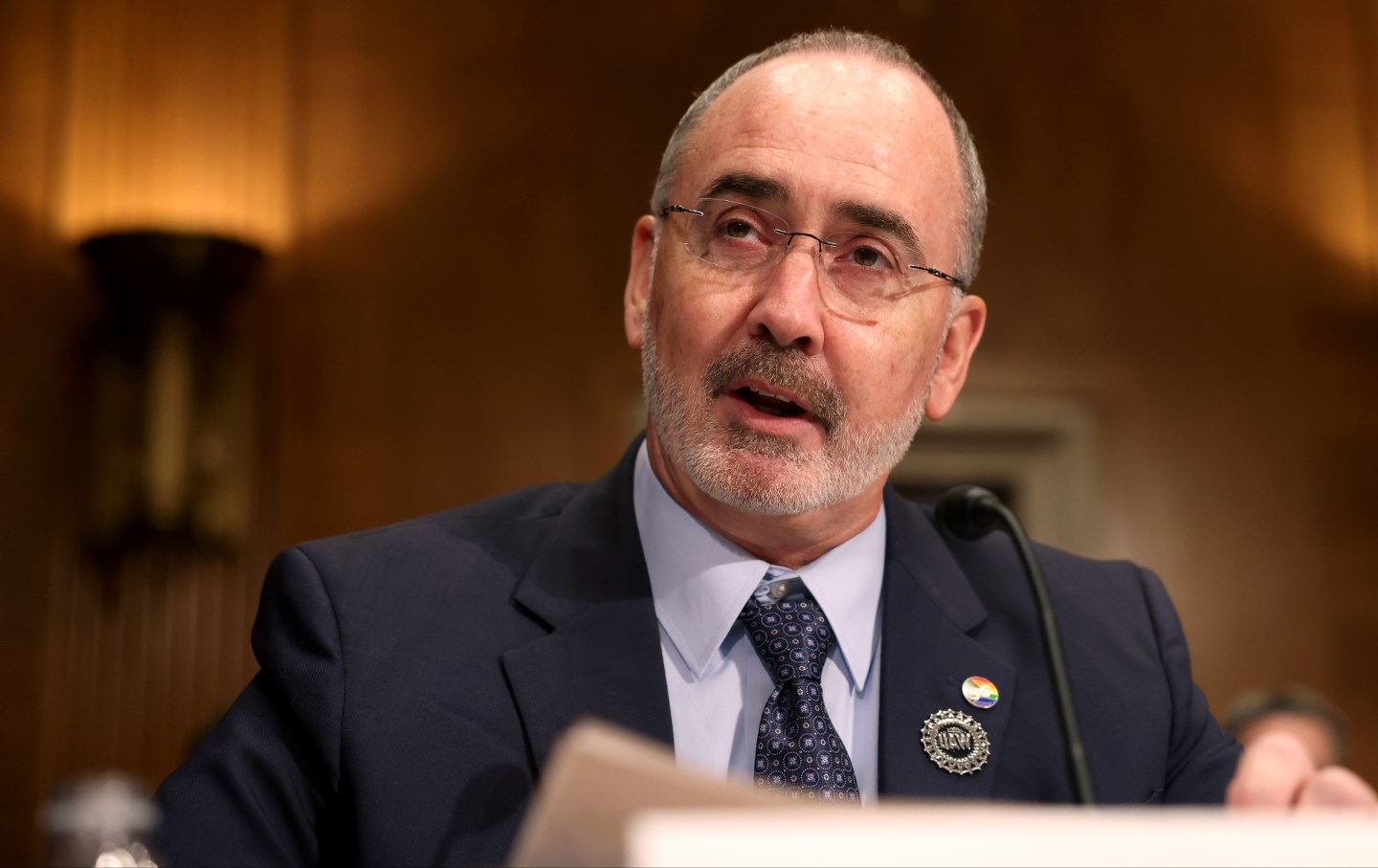

Shawn Fain Triumphed in Detroit. Now He’s Headed South. Shawn Fain Triumphed in Detroit. Now He’s Headed South.

“These companies are more profitable than the Big Three ever dreamed of being, and the workers are paid even less.”

Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter

A unanimous Supreme Court ruling on sex discrimination hides serious ideological differences, beginning with Alito’s long-standing hostility to women’s rights.

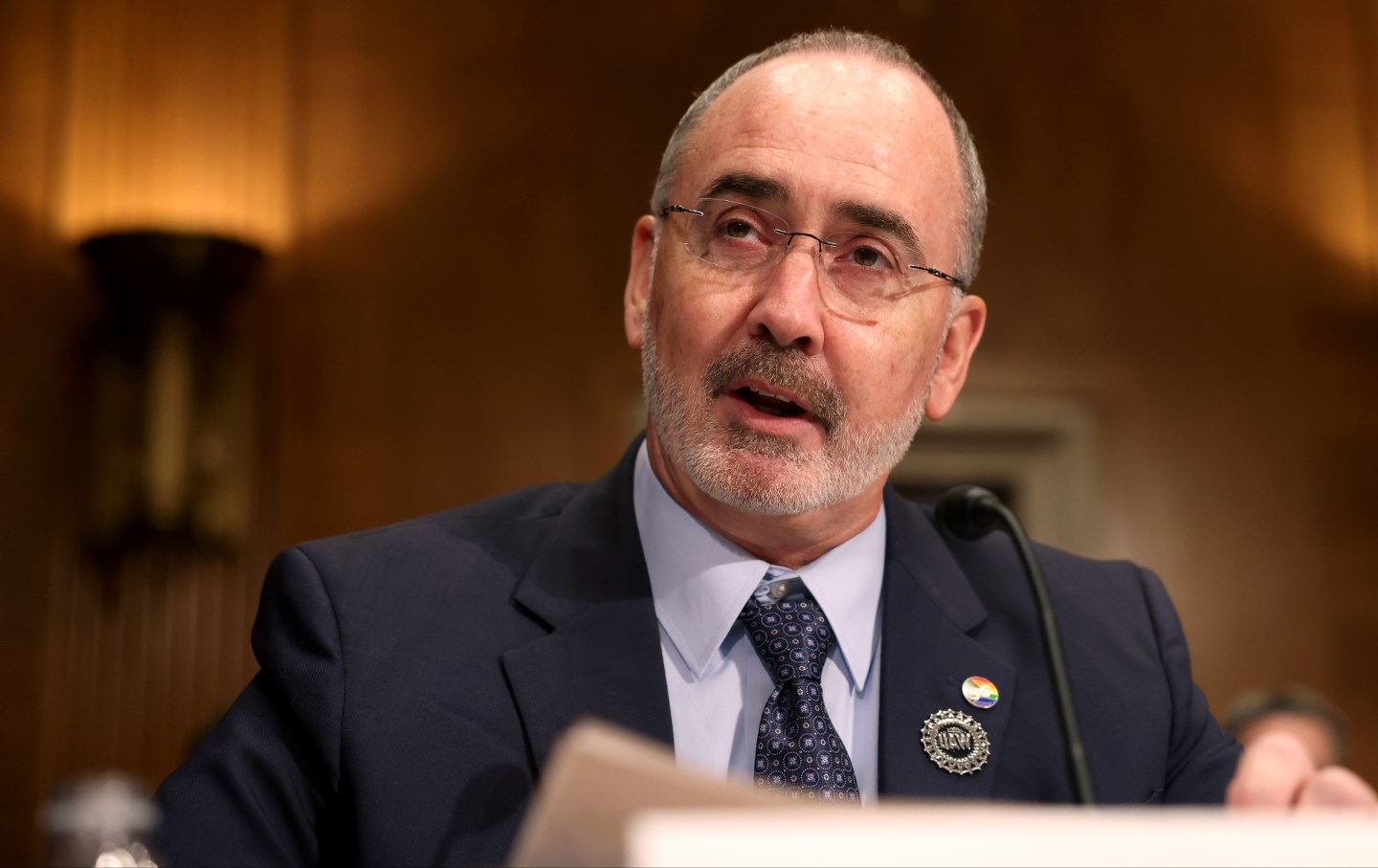

The EEOC Has Released New, Much-Needed Protections for Pregnant Workers The EEOC Has Released New, Much-Needed Protections for Pregnant Workers

The Pregnant Workers Fairness Act obligates employers to enable pregnant people to work safely and to grant them unpaid but job-protected leave for pregnancy-related absences.

The Only Thing Worse Than Taking Rural Voters for Granted The Only Thing Worse Than Taking Rural Voters for Granted

… is dismissing them as out of reach for Democrats.

Policy

Republicans Are No Friends to Working People Republicans Are No Friends to Working People

If you work for a living, or if you know and love people who do, there’s a lot on the line in this year’s election.

Javier Milei’s Amputation Regime for Argentina Javier Milei’s Amputation Regime for Argentina

The country’s new president has imposed a set of brutal austerity measures as part of a so-called “chainsaw plan.” The carnage is already mounting.

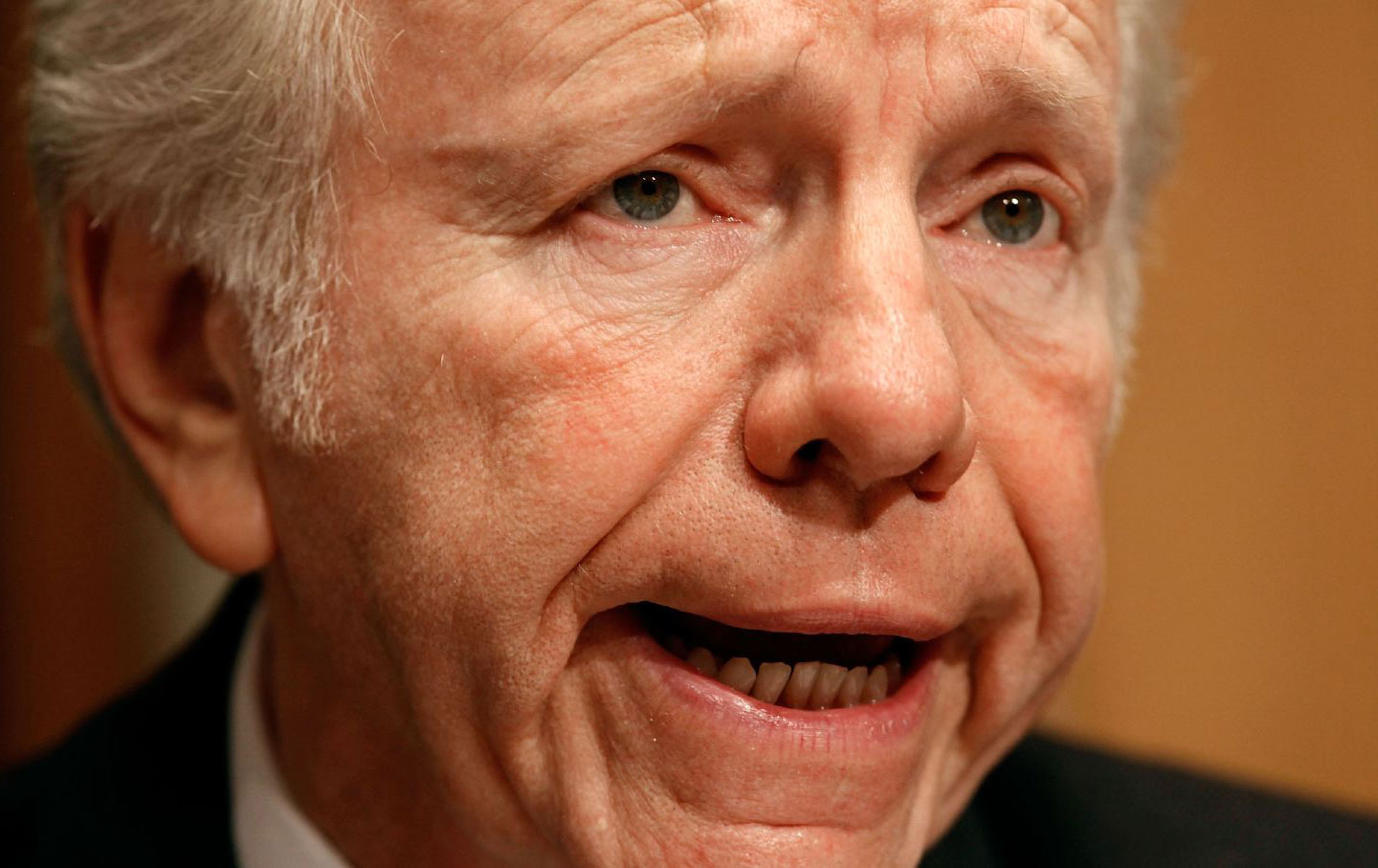

Joe Lieberman and the Venality of Elite Bipartisanship Joe Lieberman and the Venality of Elite Bipartisanship

The late senator embodied a consensus of militarism and plutocracy.

Labor

Shawn Fain Triumphed in Detroit. Now He’s Headed South. Shawn Fain Triumphed in Detroit. Now He’s Headed South.

“These companies are more profitable than the Big Three ever dreamed of being, and the workers are paid even less.”

Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter Samuel Alito Can’t Tell the Difference Between Sex Discrimination and Peanut Butter

A unanimous Supreme Court ruling on sex discrimination hides serious ideological differences, beginning with Alito’s long-standing hostility to women’s rights.

The EEOC Has Released New, Much-Needed Protections for Pregnant Workers The EEOC Has Released New, Much-Needed Protections for Pregnant Workers

The Pregnant Workers Fairness Act obligates employers to enable pregnant people to work safely and to grant them unpaid but job-protected leave for pregnancy-related absences.

Republicans Are No Friends to Working People Republicans Are No Friends to Working People

If you work for a living, or if you know and love people who do, there’s a lot on the line in this year’s election.

Elon Musk Wants to Gut the National Labor Relations Act Elon Musk Wants to Gut the National Labor Relations Act

Elon Musk is challenging the New Deal legislation that established the National Labor Relations Board. Experts warn that this is “a serious threat.”

The Score

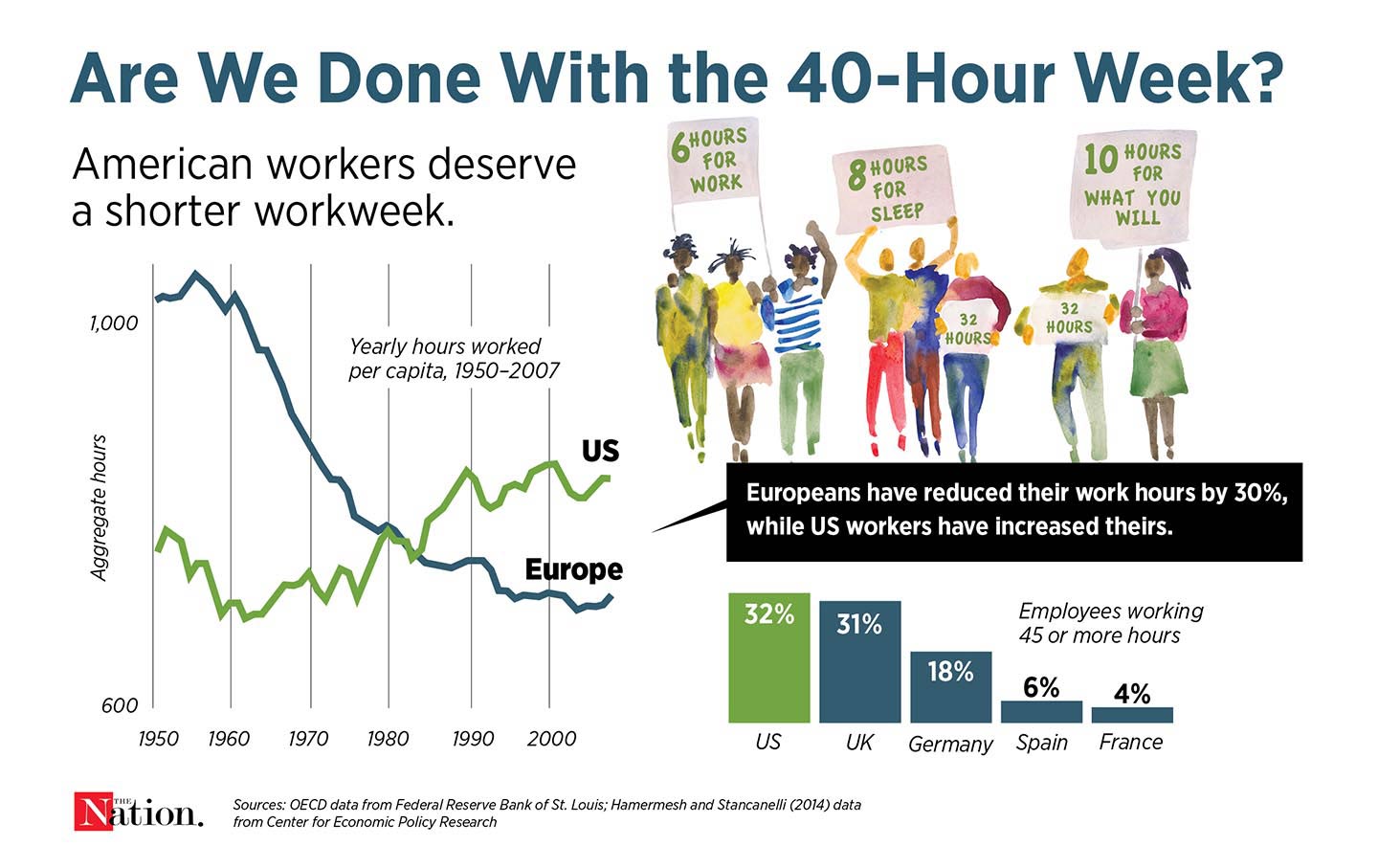

You Deserve a 4-Day Workweek You Deserve a 4-Day Workweek

It’s time for Americans to claw their lives back from work.

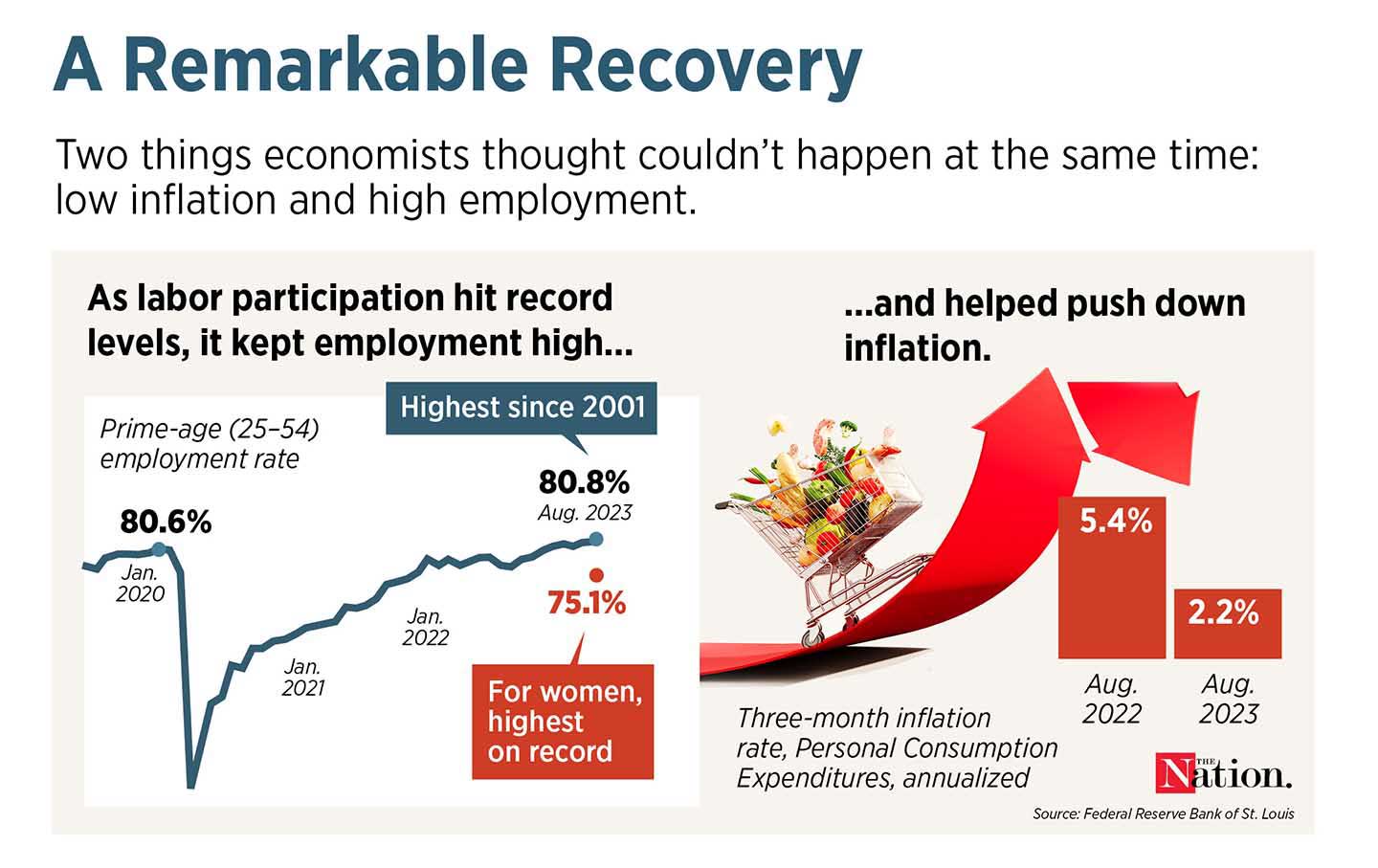

Too Many Economists Thought This Was Impossible Too Many Economists Thought This Was Impossible

The increase in the number of people working has helped tamp down inflation and has shown the importance of aiming for full employment.

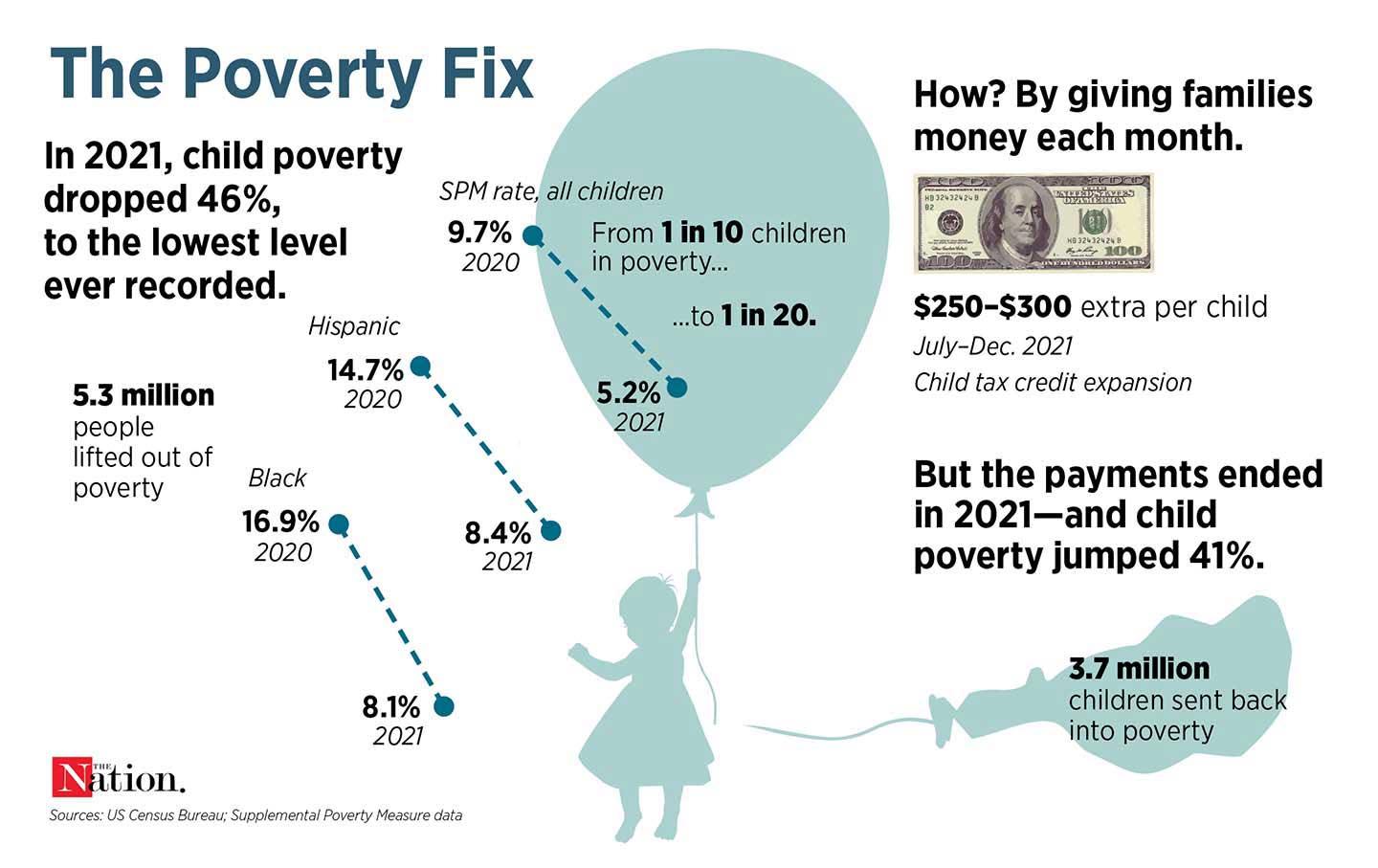

We Have the Solution to Child Poverty. Republicans Are Blocking It. We Have the Solution to Child Poverty. Republicans Are Blocking It.

The expansion of the child tax credits under the American Rescue Plan halved child poverty. When the policy ended, child poverty shot back up.

Latest in Economy

O.J. Simpson Proved That With Enough Money You Can Get Away With Murder O.J. Simpson Proved That With Enough Money You Can Get Away With Murder

The accused killer won and lost in court depending on his bank account.

Apr 12, 2024 / Jeet Heer

These Americans Won’t Pay for the War on Gaza These Americans Won’t Pay for the War on Gaza

As the Biden administration continues to give weapons to Israel, thousands of people across the country are protesting by refusing to pay their taxes.

Apr 12, 2024 / Lucy Dean Stockton

Transatlantic Tragedy: “Grenfell” Moves from Britain’s National Theatre to a Brooklyn Stage Transatlantic Tragedy: “Grenfell” Moves from Britain’s National Theatre to a Brooklyn Stage

An interview with Gillian Slovo, whose new play about the survivors of the Grenfell Tower fire in London just opened in New York.

Apr 12, 2024 / Feature / D.D. Guttenplan

The EU’s Secret to Slashing Emissions The EU’s Secret to Slashing Emissions

Europe proves that putting a price on carbon can dramatically transform fossil fuel–based economies.

Apr 10, 2024 / Paul Hockenos

Fatal Recklessness at Boeing Traces Back to Long-Standing C-Suite Greed Fatal Recklessness at Boeing Traces Back to Long-Standing C-Suite Greed

Why Jack Welch’s philosophy of maximizing short-term shareholder value at all costs is to blame.

Apr 9, 2024 / Katrina vanden Heuvel

His Billionaire Buddies’ Bribery Bails Out Trump, Again and Again His Billionaire Buddies’ Bribery Bails Out Trump, Again and Again

The problem isn’t that the former president is broke but that he’s for sale.

Apr 8, 2024 / Jeet Heer